Finding the Monopoly: Bitcoin, Ethereum, and Nothing Else…

1000+ internet money tokens to invest in. Which one is the winner? Use network effects to identify internet money protocols that can achieve a high return (100–1000x) and avoid losing money on internet money BS.

Network Effects

Bitcoin and ethereum have by far the largest network effects of all of the internet money protocols at the time of this writing. Identifying protocols with the strongest network effects is the main factor to look for in finding protocols that can achieve perhaps 100–1000x in upside. The protocol that achieves superdominant network effects will effectively secure the monopoly, and any other competing protocols(altcoins) will fall further and further behind into obscurity. Because bitcoin and ethereum are the only protocols that look like they have a chance at achieving superdominant network effects, it is my opinion that they are the only two tokens that have a chance at 100–1000x returns. Note that I assume that bitcoin and ethereum are protocols for two separate uses; therefore they are not competing and may both reach a monopoly position for their intended use.

Superdominance and Critical Mass Crossover

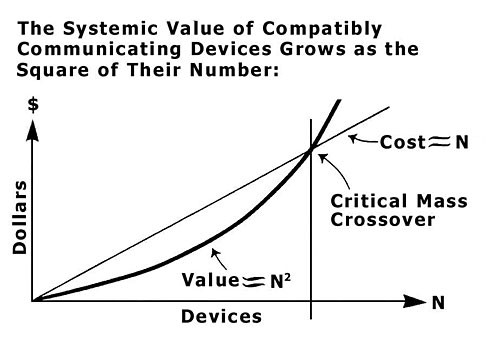

With the network effects, each new user of the network adds value to the network. The network is considered to be superdominant when each new user(person, device, company, node) to the network increases the value of the network the more than the cost of acquiring the next new user. This is the “critical mass crossover” as identified by Metcalfe below. Any protocol that reaches this critical mass crossover will presumably become superdominant and achieve a monopoly.

A historical analogy of protocols achieving superdominance are the TCP/IP networking protocols; the foundational protocols for internet data transmission. It was not clear that TCP/IP would be the winner because on paper other protocols were superior. TCP/IP however won the monopoly because it had the the strongest network effects despite not being the most technologically advanced protocol set. It reached the critical mass crossover point before the competing protocols and secured a monopoly position. Most other transfer protocols have fallen into obscurity as a result of this.

Assessing Internet Money Protocols

At this time it appears that only bitcoin and ethereum will become superdominant and secure a monopoly and most other protocols(altcoins) will fall increasingly behind.

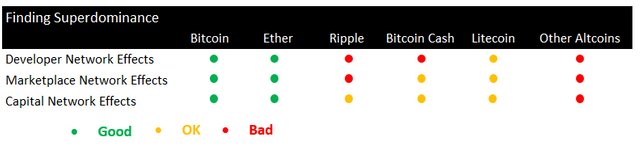

In identifying protocol tokens that will achieve high return, we can compare protocols based on (3) types of network effects; developer, marketplace, and capital network effects. My (biased?) assessment of the network effects of the major internet money protocols is shown below.

Developer network effects — how much of a development community of smart software engineers are developing code for the protocol?

Bitcoin and ethereum both possess strong developer network effects. They have smart and enthusiastic development communities building applications and protocol upgrades on them for the real world. For internet money protocols, having a strong development team is the most important factor for growing into a monopoly.

Marketplace network effects — how far is the adoption of the protocol? How much is the token being used in the real world? Is this protocol actually improving on a real world problem?

Compared to the other protocols, bitcoin and ethereum have the most usage in transactions, token holders, nodes, exchanges, wallets, and miners, and others with a vested interest. This makes them a clear front runner in marketplace network effects.

Capital network effects — How much value is currently captured in the protocol in terms of market cap? Is smart money invested in the protocol or just uneducated speculators?

Bitcoin and ethereum are the largest protocols by market capitalization. The market capitalization is a pool of people that want the token price to continue to increase. They fund this by hiring developers to further develop applications and upgrades for the protocol. Developers are also most often passionate token holders that want the price to increase. Developers possess the power to make the token price increase by writing code for new applications and protocol upgrades.

*I am not a financial adviser and this is not financial advice.