Bitcoin Thoughts: Somewhat Extensive Thoughts on Bitcoin and Blockchain and Cryptocurrencies Generally

Bitcoin Thoughts

I saw this recently:

Bitcoin is the most stable store of value in history

It’s a provocative title, and spawned a bit of an interesting thread.

It made me realize I had a few things to say about bitcoin and blockchains generally. I’m not particularly for or against them, but I had a few things to say.

First the good things. I was totally caught off-guard when it came out in 2010. It’s an amazing bit of technology, lots of interrelated ideas hooked together in many neat ways. It’s going up in value. It sort of promises something we haven’t had before, but in many cases, the more you look at it, the more you think we had it before, or we don’t actually want it.

Key Features

A lot has been written about bitcoin and blockchain, and I found this (somewhat dated?) article particularly good: On the Dangers of a Bitcoin Monoculture

One of his points is that the blockchain has several properties that make it interesting:

- Replicated log

- Merkle tree

- Decentralized “consensus by lottery” using a proof-of-work

- “Transactions” authenticated with public-key cryptography

- Public decentralized transaction ledger

- Broadcast protocol

- Scripting language / “Smart contracts”

Replicated Log

Don’t know what to say about this yet – basically it has a replicated, append-only data structure.

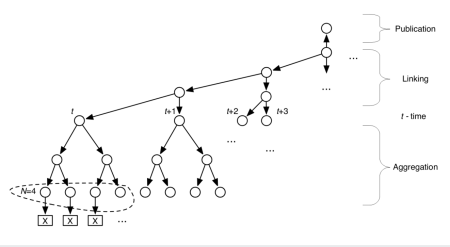

Merkle Trees

Hash Chains – a degenerate form of hash trees – aka Merkle Trees – are not a fundamentally new idea. This isn’t really anything for or against the blockchain (which are just blocks strung together by hashing), but I feel like there’s enough people describing it as revolutionary that I wanted to point out prior art. The concept of merkle trees is named after Ralph Merkle who patented it in 1979.

The Internet also already had linked timestamping services by the 90s – they were a kind of trusted timestamping service, as formalized in RFC 3161 and they are clearly visible as “PGP timestamping servers” available by 1995:

Every signature made by Stamper will have a unique serial number. This number automatically increments by one every time a document is signed. Stamper also stamps summaries of its own signatures from the previous day.

Bruce Schneier re-described the fundamental idea – the hash chain – and some improvements on it, like asynchronously-coupled hash lattices, in 1998 in a paper called Cryptographic Support for Secure Logs on Untrusted Machines

Decentralized “consensus by lottery” using a proof-of-work

Proof of Work is a relatively well-known thing among cryptographers.

Computer scientist Hal Finney built on the proof-of-work idea, yielding a system that exploited reusable proof of work (“RPOW”).[18] The idea of making proofs-of-work reusable for some practical purpose had already been established in 1999.[2] Finney’s purpose for RPOW was as token money. Just as a gold coin’s value is thought to be underpinned by the value of the raw gold needed to make it, the value of an RPOW token is guaranteed by the value of the real-world resources required to ‘mint’ a POW token. In Finney’s version of RPOW, the POW token is a piece of Hashcash.

It was proposed as a solution to spam, and found to be wanting. I can’t recall much about this, but I think it was because the POW was supposed to be on CPUs, and it was far too easy to get unsuspecting web users to do some of the POW in their browser.

In fact, that actually happened. A competitive gaming league that secretly installed Bitcoin-mining software on its members’ computers has agreed to a $1 million settlement with the state of New Jersey to avoid criminal prosecution.

It reminds me a bit of Ross Anderson’s book “Security Engineering”, where he suggests that organized crime could bypass CAPTCHAs simply by requiring porn site viewers to solve them in order to see more free porn. They simply pass the CAPTCHA through to the user, and he solves it, and they send it back.

Things are a little different for bitcoin now since a browser isn’t enough computational power to move the needle, with most miners using ASICs.

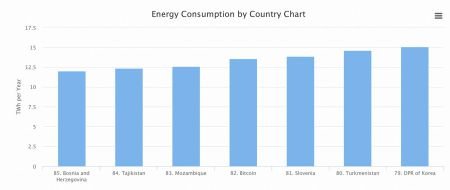

At the moment, bitcoin mining is arguably the largest compute cluster in the world, and each miner is racing to solve a puzzle faster than everyone else (a hash partial preimage problem). That means they are attempting to burn as much electricity as they need to, to hash as many times as they can, to win the race.

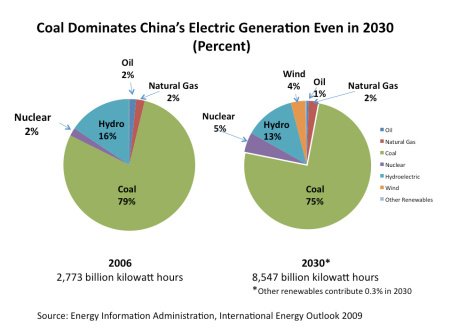

This is energy consumption by country… or cryptocurrency:

This is the world we are creating. Beijing, modern day:

From an environmental perspective, this is unsustainable.

Computer cooling firm Allied Control estimates the total power consumption of the Bitcoin network at 250 to 500 Megawatts. Looking at the total hashrate, which is the number of calculations the network can perform per second, and applying a generous miner efficiency of 0.6 watts per gigahash, we can estimate our own back-of-the-envelope Bitcoin network constant power draw at just under 215 MW, although this figure is always in flux (it’s important to note that many of the variables in my calculation are constantly changing slightly). That’s around enough zap to power 173,000 average American households‘ daily electricity usage.

With about 110,000 transactions per day, that works out to 1.57 households daily usage of electricity per Bitcoin transaction. Yes, every time you buy something in Bitcoin, you could be using as much electricity as 1.57 American families do in a day.

“The actual figure is likely worse, given that a large number of transactions are exchanges and miners moving bitcoins around and other low-value ‘dust’ transactions,” said Matthew Green, a cryptography expert at Johns Hopkins University. “So each transaction where there’s an exchange of goods or services happening is really representing even more electricity.”

And the weird thing about this is, the proof of work problem (brute forcing partial hash preimages) is a fundamentally useless problem. It’s basically solving (“satisfying”) a number of simultaneous linear boolean equations in 256 variables (the exact number varies depending on the difficulty level). They are essentially random equations – random in the sense of “fixed but arbitrary, and uniformly distributed” as in “random oracle“.

There are plenty of problems it could be solving of use to the world. But bitcoin solves almost none of them. It’s a great example of the paradox of value. It’s like something out of a Douglas Adams novel.

The world’s largest supercomputer, you see, was actually a cluster of computers, working on an entirely useless problem; a problem whose only redeeming characteristic was that it was very difficult to do, which allowed one to measure very precisely how conspicuously consumptive one was being. For every unit of uselessness you completed, you got a ticket to a lottery, and if you won, you got something that was different than, but not entirely unlike, money. This process, inasmuch mirrored society, was either entirely accidental, or the product of a much deeper motive to create in one’s own image than anyone was willing to admit. Man has voluntarily created a system consisting entirely of futile, Sisyphean toil with gluttonous consumption of resources for personal enrichment for his computer prodigies. The idea that might lead to deeper insights into the nature of either society or man was a relatively uncomfortable topic and not brought up in polite company. And even though the “proof of work” problem was widely believed to be a bad idea, it was still an incredibly popular thing to do, which is where Microways got its famous slogan, “if you’ve done four billion useless things today, why not finish it up with a virtual breakfast at Microways, the restaurant at the end of the darknet?”

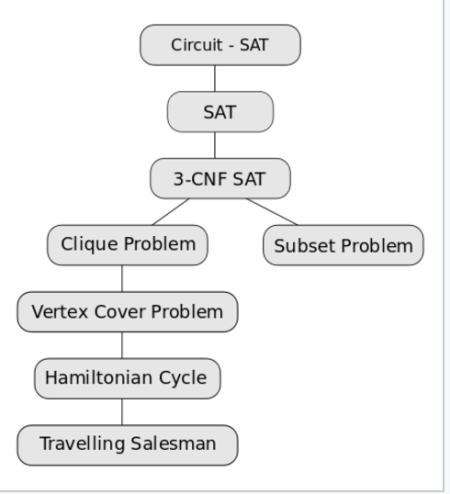

POW Idea 1: Solving Every NP Problem, Ever

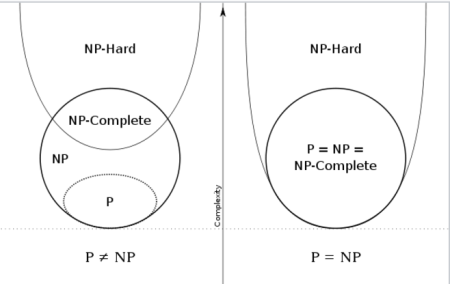

But it could be solving real problems. For example, partial hash pre-images are special cases of the SAT problem (SAT basically short for “satisfiability”). In short, the SAT problem is basically, given a set of simultaneous boolean equations, give me the truth values for the input variables that make the output variables all true. For example, the formula “a AND NOT b” is satisfiable because one can find the values a = TRUE and b = FALSE, which make (a AND NOT b) = TRUE. In this case, the value that satisfies the equations is known as a “witness“, and if you have it, you can easily show it makes the equations true. The SAT problem is NP complete, which means two things that are fairly technical – see the italicised parts if you want to get the gist of it.

- It exists in the NP class of problems. If a problem is known to be NP, and a solution to the problem is somehow known, then demonstrating the correctness of the solution can always be reduced to a single P (polynomial time) verification.

A consequence of this is that it’s (at least theoretically) hard to solve all of the SAT problems without exhaustive search. You can think of this like the current POW function, in that everyone is trying different input values to the hash, and a successful lottery winner has the first N bits set to zero. It’s hard to find the input that gives a particular output, but it’s easy for the network to validate the block – you just have to hash it once. - A solution for any SAT problem is a solution for an isomorphic problem in every NP complete class of problems. In fact, the Cook-Levin theorem says that any problem in NP can be reduced in polynomial time by a deterministic Turing machine to the problem of determining whether a Boolean formula is satisfiable. And that in turn means that, if you used SAT problems as the POW function, you the blockchain would be a list of solutions to the SAT problem. Assuming that you walk the input space in some reasonable order, you will hit every instance along the way. And that means it should be fast to convert any NP problem into a blockchain query, and get an answer, and convert it back to your problem.

- the mining software and/or FPGA layouts, so you acquire more NP-complete problem solutions, faster

- the compiler binary (maybe?)

- mobile device software (because power is limited in mobile devices)

- Unix kernels

Via this method, you’d be doing computational geoarbitrage, by precomputing solutions where energy is essentially free, memoizing them, and creating some as-yet-undefined incentive to provide them to other problem domains as an essentially free byproduct, and reaping the work product n times over. That might even lead to a net energy decrease in the world compared to one without bitcoin; although I wouldn’t count on it, it would at least offset the energy we are spending on POW.

As I understand it, many compiler optimizations are NP or NP-hard problems. I would imagine many EDA problems are, as well.

Double Duty as Space Heaters

By making e.g. electric space heaters which do the work, you’ve also created a sort of interesting incentive to participate in situations where none would have existed.

POW Idea 2: A Market for Computation

Proof of Stake

Other Resources

- ASIC FAQ page 7

- A Treatise on Altcoins section 6.2 page 12

- On Stake and Consensus

Unanswered Questions

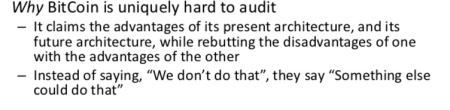

It turns out that Bitcoin is surprisingly well balanced in its interlocking assumptions. Although it looks like a grab-bag of tricks, it is actually carefully interconnected. The key assumption(s) is that all are equivalently anonymous. Therefore anyone can pretend to be as many as one likes. Hence the vote on control is required to isolate over some unforgeable differentiating thing, which ends up being energy (PoW) in Bitcoin’s case (proof of stake is also popular). Energy costs money so it has to be paid for somehow, so we need the money creation to empower the mining, and we need to provide a payment system so as to encourage people to demand the money to incentivise the miners to produce otherwise worthless leading-zero hash numbers.

One of the problems in markets is that it is terrifically hard to get specialisations up and going by planning, because you need to coordinate multiple groups at the same time. In this sense, bitcoin started out as “everyone was a node” and then it bifurcated to miners and payments nodes and then again to full nodes and SPV nodes. Evolution worked, but if you planned it to bootstrap like that you’d likely fail because of chicken & egg mechanics.

The doctrinal argument is that if there is another purpose to the mining, then the security is weakened because it comes for less money. This goes back to Gresham’s observation that money with multiple purposes has strange artifacts. Popularly “bad money beats out the good” although that is only a popular saying, it’s different in the analysis. So in the bitcoin world of today there are multiple issues going on with the money source – i.e. the power costs vary which causes those artifacts to kick in and impact back into the ecosystem.

“Transactions” authenticated with public-key cryptography

This is interesting. The progenitor of elliptic curve cryptography, the NSA, having spent 20 years promoting it, has publicly told its contractors to not bother implementing ECC if they haven’t already. The speculation is running wild.

Public decentralized transaction ledger

Plenty of prior art in this one, but look at the stats for this database:

- Uses approximately the same amount of electricity as could power an average American household for a day per transaction

- Supports 3 transactions / second across a global network with millions of CPUs/purpose-built ASICs

- Takes over 10 minutes to “commit” a transaction

- Doesn’t acknowledge accepted writes: requires you read your writes, but at any given time you may be on a blockchain fork, meaning your write might not actually make it into the “winning” fork of the blockchain (and no, just making it into the mempool doesn’t count). In other words: “blockchain technology” cannot by definition tell you if a given write is ever accepted/committed except by reading it out of the blockchain itself (and even then)

- Can only be used as a transaction ledger denominated in a single currency, or to store/timestamp a maximum of 80 bytes per transaction

Broadcast protocol

Don’t know what to say about bitcoin’s network protocol. Certainly we had flood-model propogation networks starting back with Usenet.

Scripting language / “Smart contracts”

First attempt: security failure. The DAO was the largest crowdfunded project ever, and thanks to a bug in its smart contract system, it was hacked to the tune of $50 million.

Bitcoin: "What if my wallet was as reliable as my computer?"

Ethereum: "What if the legal system was as bug-free as SOFTWARE?"

— Matt Brubeck (@mbrubeck) May 21, 2017

So, basically, I don’t know. I have a high regard for Tezos, which has some formal proofs, and describes its language for smart contracts fairly well. It also cleverly uses the OCaml compiler. That they even know what Ocaml is, is a good sign.

Other Comments

But Electronic Money is Novel!

This is not the first E-Cash. Chaum, 1983. In 1990, he formed a company around the idea. Sadly, it didn’t work out.

Technically, all of this stuff dates back a long long time. The form has mutated a little from the letter of credit to a credit card. Then it mutated a lot to Bitcoin. But the roots go deep.

Not Scalable

Because of its massive resource requirements, as you scale up, it seems to converge on the current banking system – only at much greater cost.

Slideshare Illustration: https://www.slideshare.net/slideshow/embed_code/key/tkAjN8cVkz14jq

I am not up enough on all things bitcoin to know if segwit does everything they need it to.

“Trust the Math”

Except when it’s wrong, like in transaction malleability.

Math Isn’t Usually the Problem

The math isn’t usually the problem.

Please note that in most of these sorts of things, someone either “left the keys in the door”, or the attacker went around the door. Your reinforced door is fine. It’s the stuff around it that’s easy.

Hacker Redirects Traffic from 19 Internet Providers to Hijack Bitcoin

Evil ISPs could disrupt bitcoin (note: evil ISP could include any hacker of any ISP)

It’s a Deflationary Currency

We can predict it’s going up in the medium term. It’s a deflationary currency. And as long as it continues to go up nobody will ever spend it to invest, which is why it is not a good reserve currency for a country. It’s a great vehicle for making money fast via quasi gambling, because hoarding ensures that it’ll continue to go up and up.. until it doesn’t.

The Economist: Bitcoin’s Deflationary Problem

Flash Crashing – Unstable Store of Volatility

GDAX:

Bitcoin and Ethereum crash… for a few minutes

Market Watch: Opinion: Stay away from bitcoin — it’s complete garbage

Are they really protections against the ravages of “inflation” and “monetary debasement” imposed by wicked governments? If so, how come people who keep their money in bitcoin and ethereum and the like have experienced Weimar Republic levels of consumer-price inflation just this week?

That is, after all, what it means when the price of your “currency” plunges. Bitcoins aren’t just down 30% against the dollar in the past week. They’re down 30% against the potato, the sack of rice, the gallon of gasoline and the new car.

There seems to be a “whale dive” every morning, about 1000-1230 EST.

I wonder what the sharpe ratio of bitcoin is?

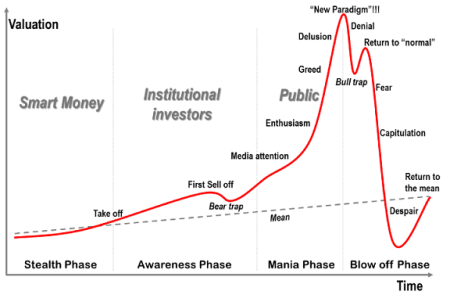

Speculation and Bubbles

In his seminal book Margin of Safety, hedge fund manager Seth Klarman tells an old story about the market craze in sardine trading. One day, the sardines disappear from their traditional habitat off the Monterey, Calif., shores, the commodity traders bid the price of sardines up, and prices soar. Then, along comes a buyer who decides that he wants to treat himself to an expensive meal and actually opens up a can and starts eating. He immediately gets ill and tells the seller that the sardines were no good. The seller quickly responds, “You don’t understand. These are not eating sardines; they are trading sardines!“

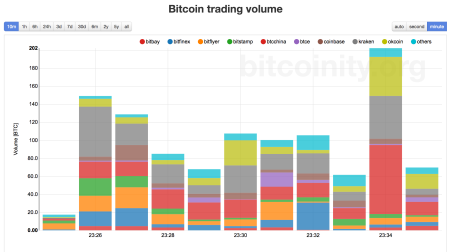

What you will see, is that, when your grandmother asks if she should invest in it, that’s the time to get out. That means it’s way beyond fundamentals and into speculation – speculation driven by the deflationary hoarding, which inflates the marginal price. That inflated price is not the average value, but the value of the “free” bitcoins – bitcoins that people are selling off at the moment because they need cash. The volumes are so low you could probably move the market selling just a few hundred bitcoins. Here is a volume chart from today, showing minute-totaled volumes of under 200 BTC.

And you can’t really know when a sell off happens – anything could shake confidence unpredictably – and thats when the marginal price will fall quickly due to sell offs increasing the supply, which can cascade quickly. It might or might not stop sliding at any point it depends on confidence. So you won’t know a flash crash and rebound from a longer term crash, except maybe that a crash will probably have some reason underlying it. But not always. There was no reason for 2000. It just happened.

During the 2001 bubble pop the Nasdaq lost about 12%. Compare that to the 30%+ losses in Bitcoin and Ethereum. Such a move would be disastrous for a country reserve currency.

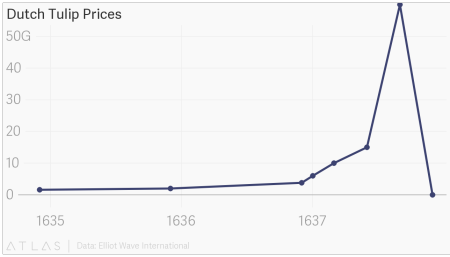

And it happened a long time ago with tulips:

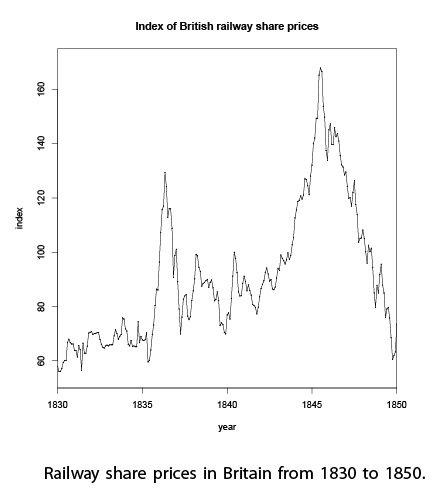

And again with railway shares:

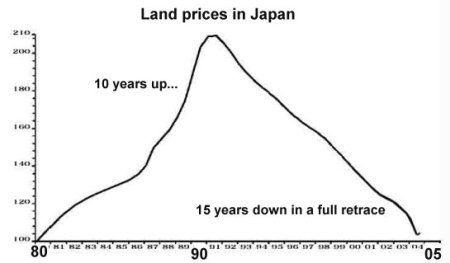

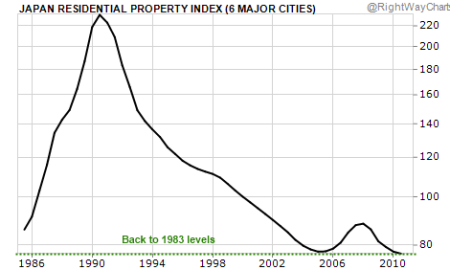

And again with Tokyo real estate:

In the pump and dump world, a chart like that is called “the middle finger”.

In fact, the entire history of the stock market has some pretty weird stuff.

But certainly we’d never have another crash, right?

Right?

Kennard & Hanne: Boom & Bust – A Look at Economic Bubbles

Regulatory Risk

If somebody commits a terrorist attack and it is funded by bitcoin you can bet that many countries will ban. And that will dissuade enough people to drop the price.

Technology Risk

Bitcoin is now less than 50% of the crypto currency market. If another one takes over as the primary crypto current say you could see bitcoin lose value very very rapidly.

Limited Historical Information

Invented in 2009, you currently have a grand total of 8 years of information? That’s a drop in the bucket. Nobody knows about its long-term stability.

The Block Split

A plan to save blockchain democracy from bitcoin’s civil war is an interesting read.

The current process meltdown is an argument between people who want to make what they see as a simple and overdue change to increase the number of transactions, and people who want to stop it for various reasons ranging from algorithmic purity to protecting their transaction fees that their racks of mining hardware is collecting. In other words, the investment has caused calcification that resists change. And that complaint is something that bitcoin afficionados were quick to point out as a flaw with the mainstream economic system.

Non-Professionalism in the Industry

The blockchain conferences are full of people who seem to be very interested in network (Sybil) attacks, game theory – and to a lesser extent, crypto – and not terribly interested in endpoint protection. Admittedly, that’s a substantially less sexy problem, but it’s probably the most important one for real financial institutions.

For a long time the biggest Bitcoin Exchange was “Magic The Gathering Online eXchange” (MTGOX), a website for trading collectible playing cards. It had admin consoles written in PHP.

The problem with the blockchain conferences are, the presenters are thinking like academics, not like APTs. And I don’t intend to go into detail on that, but if you’re doing computer security in the financial industry, you already know. Stuff goes undetected for years.

And that’s just the tip of the iceberg. I don’t even want to get into what happens when billionaires start playing games with the market, when hedge funds start exchanges for the sole purpose of front-running, when you get low-latency high-frequency algorithmic trading platforms involved. That’s a whole other league of attacks to be ported from a mature industry that I’m not sure Bitcoin is ready for.

51% Attack: Basically Already Happened

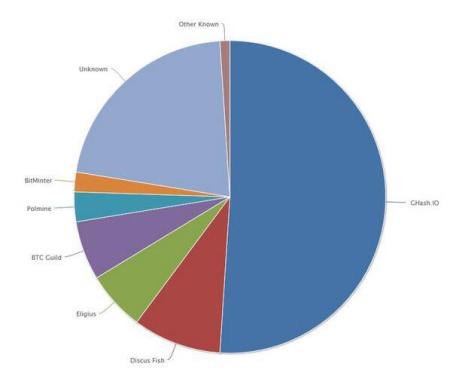

There’s something called the 51% attack, and it basically already happened:

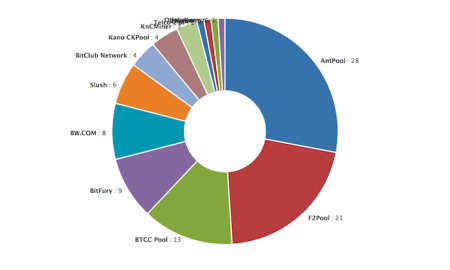

Now maybe that isn’t true any more, because I see pie charts like this:

But my point is this; if you think the current financial system is an oligarchy, what do you think this is?

Not Controlled By Anyone? Not So Fast

One of the selling points for cryptocurrency is that it’s not under anyone’s control. But that denies the reality of supply and demand. Major (but temporary) shocks have occurred because of semi-official pronouncements by large countries, which should tell you something.

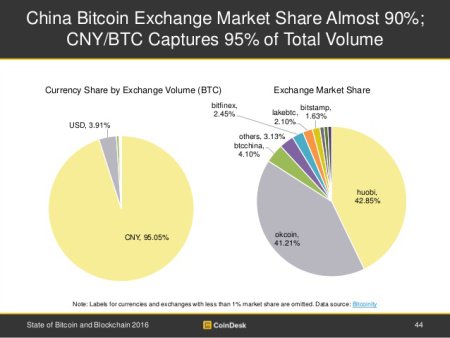

Let’s look at exchange power:

Now let’s look at mining power:

Chinese mining pools control more than 60% of the Bitcoin network’s collective hashrate.

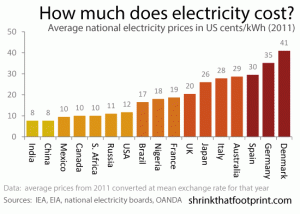

Electricity in China is extremely cheap compared to most other countries. Chinese electricity in industrial regions is either supplied by hydro-electric facilities or subsidized by the state – and it’s still mostly coal, which leads to smog like the picture above.

#Bitcoin enables Chinese entrepreneurs to export coal by burning it and using the energy to mine.

— Emin Gün Sirer (@el33th4xor) July 20, 2015

Majority of mining power in China, where electricity costs are 3x less than USA. My marginal rates are $0.45/kWHr so it’s a completely pointless exercise for me.

So essentially, because of 51% attack, this is now a PRC-controlled currency.

Isn’t It Great As Transmission of Value?

Maybe. From a bank point of view, adding all the cryptography is a bit like strapping a jet engine to a horse; it doesn’t actually solve the problems they have. Jet engines are supposed to replace horses, not augment them. Putting a jet engine (fancy cryptography) on thousands of transactions per second is simply going to make it cost a lot more, and with no added benefit to the bank.

From the legal customer point of view, there’s some hurdles getting money into and out of the system, because it’s essentially a non-reversible payment system, and mixing reversible and non-reversible causes problems.

There are many immediate, real-time payment options now:

And from traditional financial institutions:

Zelle by Wells Fargo

A lot of these came out because of the Federal Reserve Faster Payments Task Force.

So, when you already have a mobile banking application on your phone, and you already have a bank account (or email address), there’s little reason for a person to learn about bitcoin in order to receive payment. The established networks are already much larger in the payments world.

But What About What It Could Do?

I don’t know, we can’t keep moving the goal posts. I admit, sometimes this article is about cryptocurrency, sometimes it’s about blockchain, and sometimes it’s about bitcoin. But that’s because I’m disorganized and throwing this together after midnight.

Misleading Anonymity Claims or Assumptions

Public decentralized ledger makes it great for deanonymizing bitcoin or tracing money flows.

It’s easy to deanonymize a dataset where identities have been converted to psuedonymous quasi-identifiers. All you need is some external linkage information -even though neither gender, birth dates nor postal codes uniquely identify an individual, the combination of all three is sufficient to identify 87% of individuals in the United States. In other words, the financial transactions are public, and identities are a separate, disjoint set, but you can treat it like a topology of covert conflict problem to re-identify the transactions.

It turns out that differential privacy is hard.

Bad guys, Sandia National Labs is paying attention.

What About Ethical Considerations?

I saved this for the last because I think it’s been fairly played out.

Market Watch: Opinion: Stay away from bitcoin — it’s complete garbage

What are its real-life uses? Online gambling and money laundering

On the one hand, you have people who are genuinely nice, productive citizens who might like to (for example) buy controlled substances for recreational or other uses. They might be exposed to violence, fraud, or other risks if they meet in person without a reputational system, and bitcoin prevents that. At least in theory; there are still exit scams. And then there’s clearly violence being solicited, if not perpetrated. We all heard about this possibility when Jim Bell promoted his idea of “Assassination Politics“, which is summarized in “Assassination Markets“. If there are millions of people turning to criminal enterprise for unmet needs, we might need to address the broken political system so we can deal with this as social policy rather than criminal markets.

On the other hand, as I said in my essay on my former libertarianism, I think that not all choices which seem desirable actually are good social policy. Sometimes people want what isn’t good for their neighbors, and for society, and that isn’t necessarily obvious except in hindsight. For example, an 80-year Harvard study shows that the most detrimental behavior in life is alcohol abuse. Presumably this extends to recreational drugs as well.

“Alcoholism is a disorder of great destructive power.” Alcoholism was the main cause of divorce between the Grant Study men and their wives; it was strongly correlated with neurosis and depression (which tended to follow alcohol abuse, rather than precede it); and—together with associated cigarette smoking—it was the single greatest contributor to their early morbidity and death.

Conversely, things that people would not voluntarily do, like take microdoses of lithium, might actually decrease risk of depression and suicide. Can you imagine the reaction if the government was reported to be adding it to the water supply? Even if it were within the range of naturally-occuring levels (like fluoridation, which led to the famously cavity-free “Texas teeth“), people would have a fit.

Thus, the balance between what specialists determine is good public policy and what people think they want is an important and complex one.

Tax Evasion

Only 802 people told the IRS about their coinbase profits.

The IRS is going after them, and they might go to jail.

Money Laundering

How can bitcoin be used for money laundering?

What is the Threat of Money Laundering Associated with Bitcoin?

Currency Controls and Sanctions Evasion

While there are many reasons to believe that government should not be able to control the wealth you earned honestly and legally, and we can point to many cases where what they do during financial crises is immoral, there are also cases where international sanctions and embargoes are effective in limiting the ability of a rogue nation to adversely affect other countries.

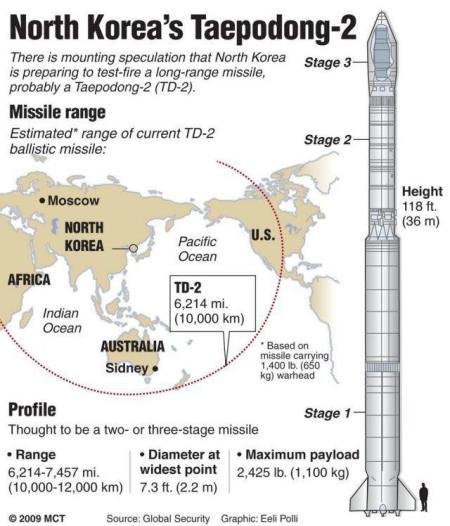

For example, no modern democracy really supports the atrocities of the North Korean regime, from its terrorism to kidnapping of Japanese to kidnapping of South Koreans and it is prepared to do the same with Americans and employs organized crime for state purposes. There are many stories of North Korean defectors that are heart-wrenching and should be watched. It has demonstrated a ballistic missile capable of reaching the US, which is also capable of carrying a nuclear warhead and has threatened Australia and the United States with it.

Also, North Korea is probably behind the WannaCry malware, which used the exploits leaked by the Russian-linked Shadow Brokers. Gathering all that bitcoin will allow it to buy prohibited items and generally bypass international sanctions.

So when countries as diverse as South Korea, Japan, the EU, and the United States all agree that North Korea is a rogue state – yes, facilitating the evasion of sanctions and export controls truly does put lives at risk.

What’s The Deal with Russia and Cryptocurrencies

Speculation: money laundering, facilitating online cybercrime, insufficient banking system, looking to get in front of the parade, looking to control cryptocurrency domestically by proposing RuCoin and then outlawing/downregulating others.

Russia Caves In on Bitcoin to Open Front on Money Laundering

Why Russia Legalized Cryptocurrencies

The Bottom Line

It’s not clear what the fundamental driver is for valuation other than speculation. I don’t know what the metrics are on the size of the market for goods denominated in bitcoin, but that seems like a good metric to start with to determine whether it is overvalued or not. Presumably most goods in bitcoin are also available in another currency, so we’re really want to express the preference for goods available in bitcoin over other currencies – and the compelling advantages appear to be in things like kratom, drugs, and things you want to buy that you don’t want traced to you.

For the moment the deflationary aspects are driving a lot of hoarding behavior and speculation.

My suspicion is that this will continue until:

- an altcoin takes over the black market as a medium of exchange

- big countries suddenly decide to outlaw it perhaps because someone uses it to fund a terrorist attack

- a major attack (cyber, crypto, or otherwise) causes “investors” to lose confidence

- general investor sentiment changes with respect to cryptocurrencies

Copied from https://disorthodox.wordpress.com/2017/06/22/bitcoin-thoughts/ with permission of the author.

Ethereum: "What if the legal system was as bug-free as SOFTWARE?"

Disclaimer: I am just a bot trying to be helpful.

very informative post - much appreciated - Upvoted and following!

good information.