When does a token become a security ?

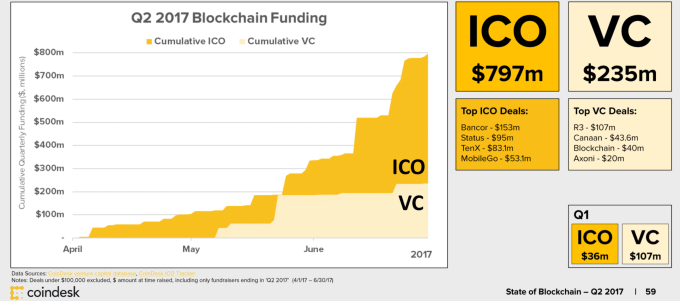

Initial Coin offerings (ICOs) hit a frenzy recently with $1.7 billion raised from the beginning of this year till early September (Russell, 2017). There have been calls by legal professionals in the crypto space for the SEC to come in and start regulating the market as they believe that blockchain tokens should be classified as an investment product and should be regulated as such (Higgins, 2017). However is this case?

Image from Coindesk

A blockchain is classified as a database that maintains a continuously expanding list of data records. Satoshi Nakomoto in 2008 came up with the first distributed blockchain for Bitcoin and implemented it a year later. So where do blockchain tokens come from? A blockchain token is a digital token which is created on a blockchain as part of its decentralized software protocol. There are a large variety of blockchain tokens, each which has a different function and utility. Bitcoin, which is a blockchain token, for example functions as a digital currency whereas other tokens can represent a right to tangible assets.

So is the blockchain token considered a security? Well, it depends if certain conditions are fulfilled. The United States Supreme Court case of SEC vs Howey has established a test for whether an arrangement can be classified as an investment contract (COMMISSION, Report of Investigation Pursuant to Section 21(a) of the Securities Exchange Act of 1934: The DAO, 2017). When looking at the situation of blockchain tokens, the Howey test can be described through four main factors.

- An investment of money

- In a common enterprise

- With an expectation of profits

- Solely from the efforts of others

For it be considered a security, an investment of money is required. What is meant by investment of money? It means an investment that includes the provision of assets, cash, goods, services or a promissory note. All blockchain tokens will fulfil this test as any sale of the tokens from issuer to the buyer fulfils this factor.

Looking at the second factor, for a blockchain token to be considered as a common enterprise, the reward for work (mining) has to be correlated with the reward attained by the other participants. However whether a common enterprise exists is dependent on how much control the issuer has over the protocol. This means that if the issuer has less control over the protocol, a common enterprise looks less likely due to the decentralised nature of the blockchain framework. What this means is that there is no central authority overlooking the system. Instead the system runs on a peer to peer basis where the functioning of the system is reliant on all the users rather than a centralized authority (CryptoCompare, 2017). How the presale is structured has a big effect on if the common enterprise factor is met. What this means is that if the money used from the presale creates a common established system that is used by all the participants it lends credence to the belief that this is a common enterprise. This is as it can only be a common enterprise if every participant has the common goal of creating the same type of system.

Now comes the expectation of profits, the key to any investment contract is the expectation of profits right? Not really. It is only classified as a security if there is an expectation of profits from the efforts of others. What does this mean exactly? This means that if the profits are dependent on the managerial or operational expertise of other parties( i.e. issuer) then the token can be classified as a security. The main distinction is if the holder of the blockchain token is a passive or active participant. Being an active participant means that the profits from holding the token are solely dependent on your own efforts. Also if you promote and market the token as an ‘investment’ then the chances of the token being classified as an investment are much higher. Say for example you issue a token promising annualised returns and with words such as ‘high-yield’, ‘investment’ and other similar language , then there is a strong possibility that the token will be classified as a security.

The DAO was created by Slock.it and it’s co-founders, with the objective of operating as a for-profit entity that would create and hold a group of assets through the sale of DAO Tokens to investors, which assets would then be used to fund “projects”. The holders of DAO Tokens stood to share in the anticipated earnings from these projects as a return on their investment in DAO Tokens. After the SEC’s analysis, they concluded that DAO tokens are an investment contract as the use of Ether to purchase DAO Tokens was a form of contribution of value sufficient to create an investment contract. Investors that purchased DAO with Ether were anticipating profits from the effort of others. (COMMISSION, Report of Investigation Pursuant to Section 21(a) of the Securities Exchange Act of 1934: The DAO, 2017)

However there is a way in which you are exempt from going through the process of being classified by the Howey test as a security or non-security token. The JOBS Act added a new exemption to the Securities Act, Section 4(a)(6), to permit securities crowdfunding without registration. The total amount sold to all investors in a 12 month period may not exceed $1 million. Also any investor taking part in the crowdfunding securities is limited by how much he can invest based upon his annual income and net worth. Any securities crowdfunding will have to pass through certain compliance stipulations; if these are not fulfilled then SEC laws are violated (COMMISSION, Crowdfunding Final Rule, 2016).

In conclusion, the token is only classified as a security if the issuer portrays it as an investment. One major factor that influences the decision is if the investor is ‘passive’ or ‘active’. Also as it has been illustrated above, there are ways to be exempt from the SEC securities law under Section 4(a)(6). As it has been pointed out above the decision to call a token a security is full of nuances and cannot be a snapshot decision.

Works Cited

COMMISSION, S. A. (2016, May 16). https://www.sec.gov/rules/final/2015/33-9974.pdf

COMMISSION, S. A. (2017, July 25). https://www.sec.gov/litigation/investreport/34-81207.pdf

CryptoCompare. (2017, April 13). https://www.cryptocompare.com/exchanges/guides/what-is-a-decentralized-exchange/

Higgins, S. (2017, July 26). https://www.coindesk.com/not-surprise-blockchain-industry-saw-sec-ico-action-coming/

Russell, J. (2017, September 7). https://techcrunch.com/2017/09/07/ico-report-q2-coindesk/