On this trajectory it won't be long before one Bitcoin is worth $1 million a pop

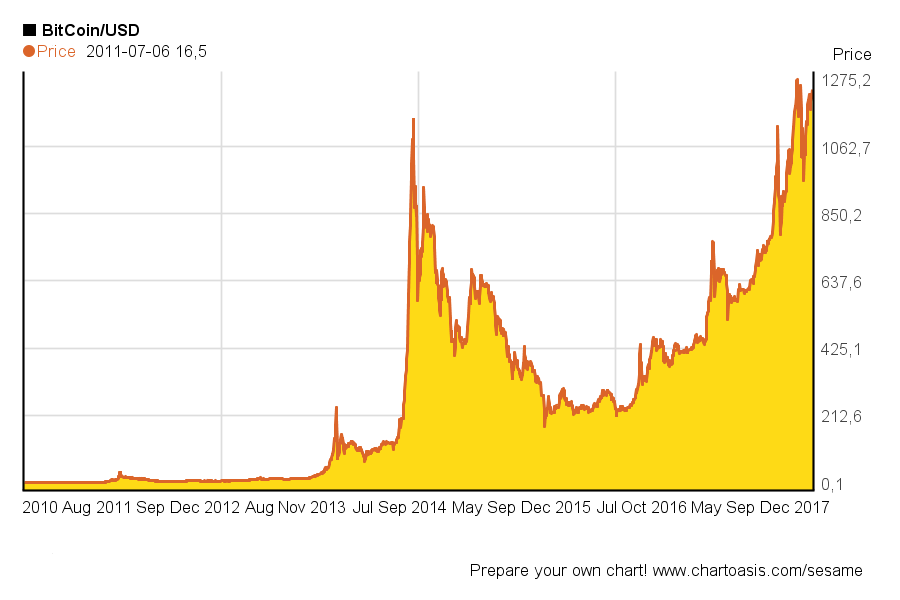

Eight years ago, if I told you you'd be a millionaire today if you invested in Bitcoin, would you buy it? Back then, Bitcoin was one of the first cryptocurrencies to hit the market and had a price tag of $0.08 ($US0.06) per coin, as recorded in 2010. This month, it hit a record of $10,417 per coin. You would have only needed to buy 95 coins at a total cost of $7.68 to be worth $1 million today.

Based on this trajectory, it won't be long (perhaps a few years) before one Bitcoin will be worth $1 million a pop.

The wild swings in cryptocurrency investments

Bitcoin and Ethereum are just some of the digital currencies that have been on a tear this year. But it hasn't been smooth-sailing in the cryptocurrency world.

It's no surprise that this highly valuable commodity has started to infiltrate our lives. There are now hundreds of currencies, including Bitcoin, Dash, Ether, Litecoin and more. If we're not prepared, businesses will suffer the most.

Much like 10 years ago, as Azimo co-founder Marta Krupinska puts it, every business realised the necessity for a web strategy. Five years ago, every business understood the need for a mobile strategy. Fast forward to now: 2018 will be the year that businesses will need to plan for a cryptocurrency strategy.

When the internet took the world by storm, it caused huge anxiety for businesses everywhere. Companies had to learn and master e-commerce, e-business, e-marketing and e-everything to survive in the digital age. It was a totally new ballpark then, and it was anyone's game.

And this anxiety still exists. We recently commissioned a survey of 500 small business owners in Australia and found that over two in five small businesses (42 per cent) are off the grid and don't do any business on the internet. These guys are miles behind the eight ball.

Which industries need a cryptocurrency strategy now?

Finance

The finance sector is the obvious starting point here. It can be used in a variety of ways, the most common of which falls under banking and international money transfers.

The demand for this new service can be shown by up-and-coming Bitcoin ATMs across Australia and internationally. People will be able to walk into any convenience store and transfer cash into cryptocurrency and vice-versa. This is a key opportunity for banks to offer this service in their own ATM networks of which they have more than 32,000 ATM terminals combined.

With over 500,000 transactions on major blockchain networks per day, cryptocurrency will take a bigger piece of the money transfer pie. Crypto will need to be incorporated into money transfer providers' business models if they want to survive. Adapt or die.

Retail

Next in line is the retail industry. You may have already seen this payment method, with a number of retailers, online and in-store, already accepting cryptocurrency. Although scaling remains an issue, the more stores that accept digital payments and treat cryptocurrencies as a valid source of payment will likely redress this.

The interest is there, too. There have been numerous petitions encouraging retail giants like Amazon to accept this new payment method.

Marketing

Marketing is another field where cryptocurrency is shaking things up. When it comes to digital advertising, the middleman has become part of the process (at least for now). In marketing, these central authorities, like Google or Facebook, make sure of the reliability and dependability of your ad campaigns.

However, due to the intermediaries involved, companies investing in advertising campaigns are only receiving half the value. Cryptocurrencies could see the introduction of much better value for ad campaigns. Instead of communicating indirectly with site owners when you want to publish an ad, you could communicate directly.

Music

The music industry is yet another field seeing the benefits of cryptocurrency, with new platforms like dotBlockchain, UJO and Mycelia seeking to improve the way artists are paid and help to determine who owns a particular work. These new platforms may force the current players to adapt if they want to retain artists.

So why aren't we there yet?

How does Bitcoin and crypto become the next business strategy sensation? Well, the first thing is trust, and the second is widespread adoption.

Businesses around the world are coming up with new ways to incorporate cryptocurrencies into the way they run, whether big or small. At finder for instance, we're being paid by some of our exchange platform clients in cryptocurrency.

As personal use increases and consumers become more familiar on their own terms, trust will increase, adoption will rise, and more businesses will incorporate it into their business models. If you start planning now, your business will be ready while the rest of the world is still catching up.