Why you should be excited about recently launched LIQUID financial platform! Worldbook|Margin trading|Fiat pairs|Lending

In crypto, much as in life, patience is not easy to come by, let alone exercise, despite it being one of the most important qualities to an investor. One of my most favorite projects is Liquid and I was excited to see what the launch of the platform would give. Expectations are always high in the buildup to any milestone, and with Liquid it was no different. As expected, the launch will be a phased rollout, so not every feature will be availed from day one. Luckily some of the core elements that investors would be interested in, are being piloted so it is a step in the right direction. Liquid launch heralds the dawn of a new era in fintech and we are lucky to be part of this ambitious project, there will be starts and stops, as is common with breaking new ground but hopefully we will get there eventually.

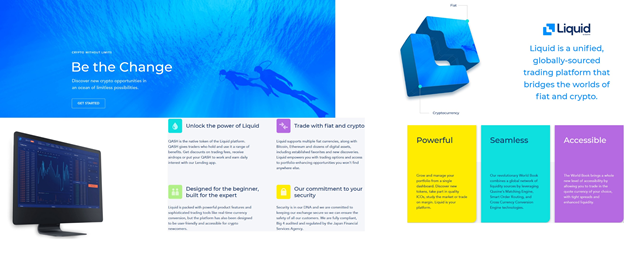

Liquid is a Japanese project whose goal is to aggregate trading orders on all crypto exchanges, in one worldbook, solving crypto's liquidity problem. Think about the convenience of no longer having to transfer funds between exchanges to purchase your favorite coin. In addition, Liquid plays a much-needed role of bridging traditional finance and crypto, by offering regulatory compliant crypto-financial services such as prime brokerage. To be able to achieve this, Liquid is JFSA licensed and also audited by Deloitte, a big 4 audit firm. Liquid supports all countries bar those in the FATF high risk list. Think of Liquid like Coinbase but which includes investors from all over the world and has a multitude of features for both beginners and advanced traders.

‘For financial industries, liquidity is so important. Without it it can lead to a financial crisis’

‘Liquid will continue to evolve and soon be crypto and fiat agnostic. We will launch new features (there are so many coming up!) and Liquid will be the ultimate platform for casual traders, whales, institutional investors, token issuers and for all crypto service providers.

The Liquid Distributed Ledger will be the preferred DLT for emerging fintech companies and we will continue to innovate and push the boundaries. We will take action and strive for greatness.’

-Mike Kayamori, CEO and Co-founder

The launch of Liquid has been smooth, bug free and conducted within the time frame allocated. Users have been able to use the new platform about a day after the upgrade began.

The new Liquid landing page looks exciting.

Liquid’s default theme comes in three shades (white, black and light blue, my preferred). Navigation around the product is easy due to a minimalist design of the dashboard. Messy products fracture focus and difficulties usability. I believe a picture is worth a thousand words.

To be able to enjoy most of the features on Liquid, a new user has to be verified. Currently, the verification process is so streamlined. It can happen in an hour, and in case of an issue, resolution can be reached through a video call.

LIQUID FEATURES

The main features offered on Liquid yet are:

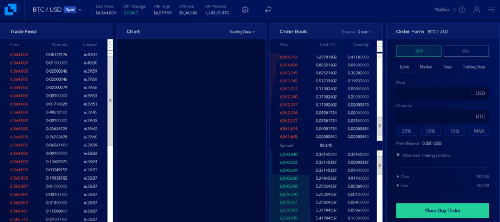

Trading- occurs with fiat pairs and not stable coins, like Tether.

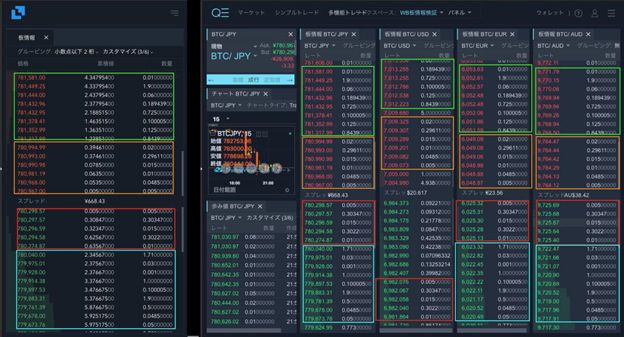

Notice the spread of only about $0.8 on this image!

The interface supports trading for both beginners and advanced traders.

Fiat pairs available include USD, JPY, SGD, AUD, EUR

This are going to be expanded in future, and even allowing direct bank deposits. This will be made possible when Liquid receives a full banking license in 2019.

Margin Trading — offered on a leverage of up to 25x

Lending

Lending is the most risk-averse opportunity on the platform. Anyone bar citizens from a few supported countries can lend their assets to margin traders, earning interest on top.

ICO Market- investing in ICOs

An end-to-end solution for holding a regulatory-compliant ICO with the benefits of verified users and the Liquid exchange to trade soon after.

The first ICO to be launched on Liquid is XAYA, a gaming platform. XAYA will conduct an airdrop to all QASH holders, with a minimum of 500 QASH. Users with above 5000 QASH will earn a unique higher reward.

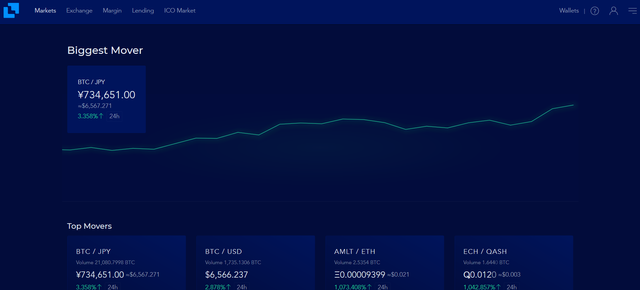

Internal worldbook

A preview of the worldbook was given a few days earlier by the Chief Trading Officer.

This video shows what to expect from Liquid across all crypto pairs.

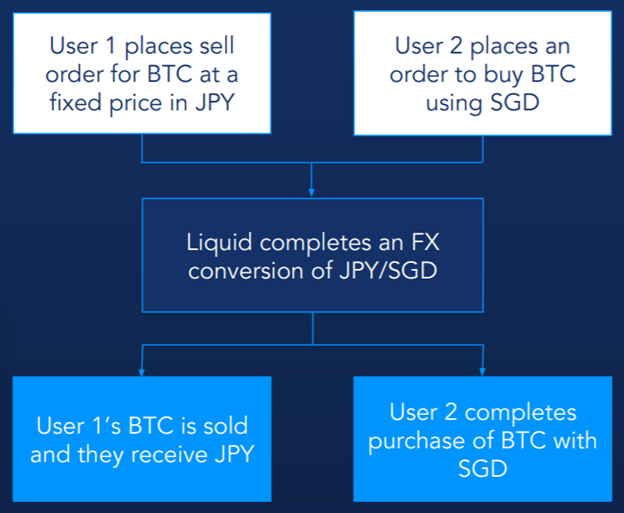

How does the worldbook work ?

Right now only the internal worldbook is rolled out for fiat pairs with BTC, ETH and BCH.

For example, currently spreads on ETH are only determined by ETH/FIAT orders.

Whereas other crypto will be able to tighten those spreads in phase two

ln a recent interview with Mike revealed that only phase 1 of internal wb is active. Phase 2 will be across different crypto and fiat orders, so an order with ETH/USD could match against BTC/JPY

To get a glimpse of the spreads vis-à-vis previously:

What is yet to be launched

✅An updated roadmap post-liquid launch era.

✅The rollout of external world book is next and that is the main feature.

✅Direct bank deposits e.g. using VISA wll be enabled.

✅Exchange partnerships announcements will also

✅Rebrand of Qash to Liquid token etc.

✅And hopefully some of the recent amazing projects will also be listed on liquid.

✅The Liquid Distributed Ledger (LDL) will be launched next year, offering an amazing new array of utilities for the Qash(to be Liquid) token.

✅Liquid will also have a banking license next year.

Conclusion

Am looking forward to the features of the Liquid platform working properly in this early stage, setting up for rollout later. The fact that Liquid operates within regulatory approval cannot be understated. Most of the traders today access a number of the most popular crypto platforms today through VPNs or DNS proxies to get advanced and unique trading features. For instance, this is how some US traders bypass to access Bitmex for high leverage margin trading. Liquid currently supports 25x leverage(which can be improved) and it’s regulatory compliance mean it is a matter of time before Liquid is the go-to platform for traders who want straightforward regulatory approved crypto-financial instruments. In addition to that, Liquid’s cold storage make it particularly appealing to institutional investors. I don’t worry about the token price too much, not only because we are in the bear market but also since I know the utility is there, and more will come with activation of features on the platform, eg the external worldbook. In the short to medium term price movement might be influenced by trading fees. Liquid employs a unique novel feature that involves purchasing qash from open market to meet trading costs. However, only a small portion of Liquid volume has fees since majority of the fiat pairs have no fees. This will change when the fee structure is revised soon enough. Natural demand for qash beyond speculation will increase when the option to buy qash to receive subsidized trading fees from the market and not from traders' holdings is enabled. When this is enabled automatically, there will be buying pressure on qash with the rise in trading volume as a result of the worldbook. In the long run, for exchanges to be able to be part of the world book, will pay a fee in qash token creating external utility.

The performance of Liquid since launch has been impressive. One of the yardsticks to measure is the spread, and currently ranges at about $3, from a high of $20–30 on the twin exchanges Quoinex/Qryptos. I think the lowest minimal spread achieved on mmo-activated Liquid is about $0.01. That’s impressive!

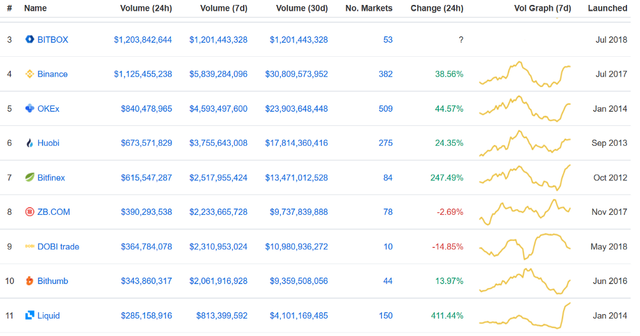

Currently Liquid volume is growing sharply. And the bulk of this volume comes frm the BTC/JPY pair at about $267M. There are lots of reasons that can be attributed to this e.g. recent price volatility or even people waking up on Liquid. I am excited and hopefully Liquid will be on top of the chart in a few years. No significant marketing drive has been launched perhaps because the best product is not yet launched. What we have now is a teaser of the complete thing. The fact that Liquid highlights are very eye-catching even now when the internal worldbook is activated on only a few pairs is a good indication of whats to come. Since testing is still going on, we have seen Bitcoin volumes exceeding some of the biggest exchanges in the space-and this is only on internal worldbook. I expect when the external worldbook is rolled out, Liquid will stand out as the exchange to beat with parabolic volumes. Don’t we all want that?

Liquid CEO and Co-founder Mike Kayamori has been around the globe talking about matters crypto, and I see as this ostensibly as an opportunity to spread the word about Liquid. Just recently, he was a panel speaking on Cracking the Crypto Code at the World Economic Forum. In addition, the Liquid team will be at Consensus Singapore, I believe this is another amazing opportunity to market Liquid, even though it may not be the full-out marketing campaign that a lot of people are hoping for. I don’t expect marketing when the product is clunky and missing crucial components. I would not worry too much, these things have a life of their own once they achieve a certain critical mass of technicals and community.

For more information about Liquid, visit the website here today!

If you liked my article, kindly upvote or follow me or both :)

U gave sufficient knowledge about liquid platform

Thanks:) will update any new information as soon as revealed too!

Congratulations @neferpitou! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPFam your name and pic just put a smile on my face.

hunterxhunter any day :)