HUOBI USERS VOTE ON FUTURE OF HUOBI TOKEN – airdrops vs token burn

“One of Huobi’s core values is giving our users maximum choice so putting this up to vote was a natural choice for us,” said Huobi Group Vice President Livio Weng. “We feel our HT community should have a say in the overall future of this project.”

Today cryptocurrency exchanges are among the biggest service providers in the cryptosphere. As new competition emerges each and every day, it is necessary to remain steadfast to be ahead of the curve. Whether or not new exchange token models are sustainable, such as the upcoming mining exchanges, remain to be seen. There are many metrics to analyse the overall performance of a cryptocurrency exchange, and exchange tokens have slowly crept into this discussion.

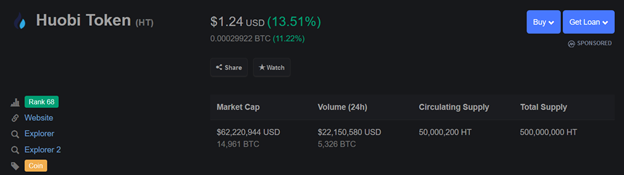

Huobi Token(HT) the native token of Huobi Global, one of the leading cryptocurrency exchanges, is due for a huge decision on December 3. HT is the fuel that facilitates a lot of functionalities in Huobi ecosystem from token voting to subsidized trading fees. The total amount of Huobi tokens is 500 M.

Huobi Token Buyback Program

In response to a section of the community’s, all owners of HT on Huobi will participate in a public vote held by Huobi to determine the fate of tokens of Huobi Token Buyback program. The event will take place on 15:00, Monday, December 3 to 15:00 Thursday, December 6 (Singapore Time). The ballot will pit the current HT airdrop model against a coin burn, to reduce supply.

Burning is not a new concept. A number of exchanges burn buyback tokens including Binance. BNB, the native Binance coin, is the only cryptocurrency that did not perform negatively this year.

The voting process

According to the official Huobi blog:

Participation Rules:

Snapshot of HT held: 23:59:59 on December 2 (Singapore Time)

Voting: December 3, 2018 15:00 to December 6, 15:00 (Singapore Time)

Who: Users with more than 1 HT in their account can vote.

Voting Rules:

-Each HT you own entitles you to one vote

-Each user can only cast their votes once

-Results will be announced within five working days following the voting

-Percentage of votes will be calculated relative to the total number of votes

-Trading of HT and cryptocurrency assets will not be affected

Case for airdropping

This has been the de-facto model that Huobi has been taking care of the buyback tokens. A snapshot of user balance is taken at specific predetermined times and used to calculate the coins to be received. Airdrops serve as proof-of-stake model or a dividend model with coin owners able to earn even more coins by simply earning HT airdrops commensurate to their holdings. Overall the amount of HT coins remains constant.

Rich get richer

To be able to earn a significant amount from airdropping one needs to hold a good amount of HT. Unfortunately, the airdropping model is not an equitable model for all participants in terms of upside. This is related to the criticism against Proof-of-Stake, whereby the rich get richer. Plus there is no assymetric incentive for people to purchase HT in speculation for a future price spike.

Case for Token Burn

Burning tokens refers to deliberately removing tokens from circulation by making them inaccessible to anyone. This is done by sending them to certain addresses referred to as verifiably unspendable address - are invalid (unavailable private keys). Anyone can be able to track the burn process using the blockchain explorer and transaction ID.

Deflationary model

This creates a deflationary model for HT, and as a result, burning tokens will most likely cause a price increase. This is because supply will decrease even as demand becomes constant.

Considering how crucial HT are to the larger Huobi Global ecosystem, it should be expected that burning tokens will create a higher demand for the diminishing supply of circulating HT.

I believe a token burn will result in a fairer profit model for both small holders as well as large holders. The benefit of this is compounding, and can attract even traders to purchase HT looking forward to future price increase.

In conclusion

Exchange tokens have utility, one of the few cryptocurrencies that can boast of this- they fuel the business model of cryptocurrency exchanges. However, as witnessed this year, the larger movements in the cryptosphere can have significant impact on both decent and poor projects alike. This is the occupation hazard of exchanges in the environment that they operate in.

As such any edge that can be captured to decouple from industry constraints should be welcome. I believe a token burn contributes greatly to this logic. Exchange tokens can be resorted to as safe hedges in the turbulence, with investors expecting at the very least little devaluation of their investment.

This is a very huge move for Huobi Pro, and it is a very encourageing to see the community actively involved in the process altogether.

Open an account on Huobi [here](https://www.huobi.com/en-us/?utm_source=GlobalWriters)

Full disclosure: This article is not intended as investment advice. It is just my personal opinion on Huobi. You should always do your own research. Huobi Global rewards me for writing this article and supports me for ventilating my own personal opinion.

According to the official Huobi blog:

Participation Rules:

Snapshot of HT held: 23:59:59 on December 2 (Singapore Time)

Voting: December 3, 2018 15:00 to December 6, 15:00 (Singapore Time)

Who: Users with more than 1 HT in their account can vote.

Voting Rules:

-Each HT you own entitles you to one vote

-Each user can only cast their votes once

-Results will be announced within five working days following the voting

-Percentage of votes will be calculated relative to the total number of votes

-Trading of HT and cryptocurrency assets will not be affected

Case for airdropping

This has been the de-facto model that Huobi has been taking care of the buyback tokens. A snapshot of user balance is taken at specific predetermined times and used to calculate the coins to be received. Airdrops serve as proof-of-stake model or a dividend model with coin owners able to earn even more coins by simply earning HT airdrops commensurate to their holdings. Overall the amount of HT coins remains constant.

Rich get richer

To be able to earn a significant amount from airdropping one needs to hold a good amount of HT. Unfortunately, the airdropping model is not an equitable model for all participants in terms of upside. This is related to the criticism against Proof-of-Stake, whereby the rich get richer. Plus there is no assymetric incentive for people to purchase HT in speculation for a future price spike.

Case for Token Burn

Burning tokens refers to deliberately removing tokens from circulation by making them inaccessible to anyone. This is done by sending them to certain addresses referred to as verifiably unspendable address - are invalid (unavailable private keys). Anyone can be able to track the burn process using the blockchain explorer and transaction ID.

Deflationary model

This creates a deflationary model for HT, and as a result, burning tokens will most likely cause a price increase. This is because supply will decrease even as demand becomes constant.

Considering how crucial HT are to the larger Huobi Global ecosystem, it should be expected that burning tokens will create a higher demand for the diminishing supply of circulating HT.

I believe a token burn will result in a fairer profit model for both small holders as well as large holders. The benefit of this is compounding, and can attract even traders to purchase HT looking forward to future price increase.

In conclusion

Exchange tokens have utility, one of the few cryptocurrencies that can boast of this- they fuel the business model of cryptocurrency exchanges. However, as witnessed this year, the larger movements in the cryptosphere can have significant impact on both decent and poor projects alike. This is the occupation hazard of exchanges in the environment that they operate in.

As such any edge that can be captured to decouple from industry constraints should be welcome. I believe a token burn contributes greatly to this logic. Exchange tokens can be resorted to as safe hedges in the turbulence, with investors expecting at the very least little devaluation of their investment.

This is a very huge move for Huobi Pro, and it is a very encourageing to see the community actively involved in the process altogether.