HUOBI GLOBAL OPENS DOORS TO INSTITUTIONAL INVESTORS, SETS UP NEW OFFICES IN ASIA PACIFIC

“The cryptocurrency market is a fast-maturing one and, as this occurs, more and more institutional investors will be seeking to participate in it. Opening Huobi up to more elite investors in the region aligns closely with our global strategy.”

-Edward Chen, Huobi’s APAC Managing Director.

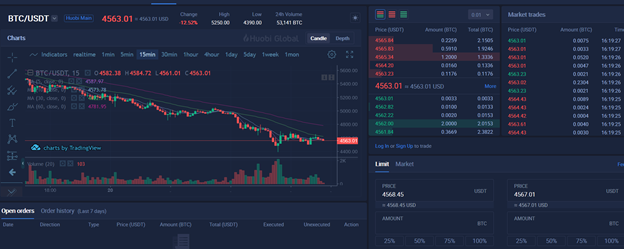

Huobi Global has made another move to woo institutional investors to its robust trading platform, holding the first APAC Prestige Investors Seminar. This workshop was held to at the opening of brand-new offices in Asia Square which serve as the center of operations for quantitative, API and institutional crypto trading in the Asia Pacific Region.

About one hundred quantitative traders graced the event. Industry experts like Justin Chow Head of Business Development of Cumberland, John Lin, CEO and Founder of Tilde, and Damien Loh, Chief Investment Officer of Ensemble Capital are some of the speakers who enjoyed the platform to share overall market insights.

The event covered topics such as application of artificial intelligence in cryptocurrency trading, the impact of quantitative trading on the market and tail risk within the crypto markets

Prestige Investors Club

Launched during the same event was the Prestige Investors Club, an exclusive invite-only club for elite traders (institutional traders, quantitative traders etc)

Benefits of this membership include:

• Dedicated account managers

• High-quality engineering support for API trading

• Invitations to monthly events on unique cryptocurrency topics

Lastly, there was recognition of some of the best traders at the event with an award.

Entry of institutional investors in cryptocurrency space has been the hot topic for a while now. Despite several rejections by US SEC of proposed ETF products in the US, it is a matter of when. A very huge development occurred recently when the first cryptocurrency ETP was approved in Switzerland. According to Trustnodes.com, the ETP will start trading on Europe’s fourth biggest exchange, SIX Swiss Exchange, whose value stands at $1.6 trillion. Among other things, this product will bridge traditional finance with cryptocurrency, by onramping investors who are only limited to investing in securities or who want to avoid the intricacies of digital assets’ custody. On December 12, Bakkt will go live and it signal a huge step forward in the the US.

For more information, you can read the official Huobi blog here

Some photos from the event

Such developments in the cryptosphere are encouraging and they show that despite the overall correction in the markets, a lot of progress is being made in the ecosystem development. Such progress hint at maturity that will attract participation of more institution players. Not to mention, being particularly involved across various geographical regions including the US gives Huobi a particularly strategic and regulatory compliant position that would push the whole industry forward.

Huobi Global

Huobi Global is consistently a top three cryptocurrency exchange, offering a plethora of ecoservices, not cryptocurrency trading alone. Up to today, Huobi has made a revenue turnover of over $1 trillion dollars, with origins in 2013. Huobi Korea, Huobi Australia, HBUS and Huobi MENA are some of the recently Huobi global moves to offer regional exchange services in various jurisdictions.

Congratulations @neferpitou! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard: