😂 Bitcoin is Bubble, told Forbes when the coin was worth $ 32

The price of bitcoin had a new historic high: it surpassed $ 4600. This record bites many analysts - and haters - that a few years (and months) ago said that Bitcoin is a financial bubble, and that they predicted the price drop and until the end of the crypto-currencies.

It's increasingly clear that the record $ 32 on this June 8 marks the peak of a speculative bubble that is slowly bursting - said technology columnist Timothty B. Lee at Forbes on August 7, 2011

To be fair to these analysts, it must be said that when they made these predictions it was difficult to consider rational the evolution of the price of crypto-currency.

The multi-million dollar pizza 🍕

Until the beginning of 2010, the currency was simply worthless. On May 17 of that year, when an American bought a pizza for 10000 bitcoins (the equivalent today to $ 34 million), the deal seemed like a bargain because at the time bitcoin cost less than half a cent.

The ascension 🚀

But it closed 2010 at 36 cents. In February 2011, it achieved parity with the dollar. In May it already cost 9 dollars; in June tripled in just one week, reaching $ 27. As consistently as bitcoin showed, it was clear that the irrational behavior and the euphoria of investors guided the price, that is: a bubble was formed.

Bubble or Fear? 👻

And she burst. After a record $ 31 on July 8, 2011, the price of bitcoin plummeted to two dollars in December 2011. Only in March 2013 did the currency return to the level of $ 30 when another bubble formed.

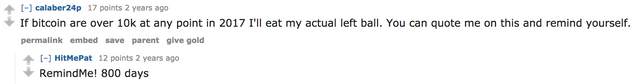

What's your bet?

What gives Bitcoin value? In my opinion, the only value is the belief that Bitcoin will eventually become a viable international payment platform. When everyone needs to be holding some bitcoins to be able to buy their daily bread, the bitcoin will be naturally rare and valuable - I think the value of a bitcoin would be sufficient to buy a quite proper house in such a situation.

At the other hand, Bitcoin as a "store of value" only, without the payments use-case, that's a dead end. Currently the very most buyers of Bitcoins are buying Bitcoins just because they speculate the price will increase even more. That's not sustainable - that's just "digital tulip mania".

I'm iterating over and over again how important the Bitcoin scaling debate is. For the last four years or so, the so-called "small-blockers" have more or less decided the direction of the project. In their mind, bitcoin should not be considered a means of payment, but a store of value. We haven't had any meaningful capacity increase for ages, due to that the bitcoin transaction fees have just grown and grown, and reliability has also gone down and down. I said in December last year that we were heading for a bubble ... the price back then was less than 1/4 of what it's now, so I was wrong.

I'm still concerned that we're in a big bubble, but if the SegWit2X-initiative succeeds in November, then maybe there is a hope that we'll see continued growth. If capacity stays constrained at 1 MB blocks, I believe we're in for a big crash sooner or later.