The first major Central Bank Crisis

Today central banks are seemed as a necessary part of the economy and the guardians of financial stability, however this hasn't always been the case. With humble beginnings around the 17/18th century in Sweden, Netherlands and England first as private institutions their role developed from lending to the government to their current role in which they control interest rates, print currency, stabilize the price of their currency and finance their government as well.

This transition wasn't as smooth as we tend to think (same with most innovations) and there were a lot of hiccups and mistakes across their history, perhaps none as noteworthy as the Banque Generale of France. On the early 1700s after King Louis XIV died, leaving France heavily indebted due to his expensive taste and previous wars, France was close to bankruptcy. Enter John Law, a Scottish banker and gambler, who had a revolutionary idea, he established the Banque Generale with the backing of the regent, the Duke d'Orleans. He developed a scheme in which he issued paper currency backed by gold, it became a hit right away and helped boost the economy as the French coinage, the Livre was deemed weak and suffered a high devaluation around that time.

Afterwards he created another company known as the Mississippi company which had the exclusive rights of all trade with the French Land in the Mississippi river and later on all foreign trade. Since he controlled both the Banque Generale and the Mississippi company, Law, tried a maneuver in which he sold shares of the Mississippi company which was booming for government bills issued by the Banque Generale, this was supposed to help France to raise money and stabilize the economy. The shares for the Mississippi company skyrocketed as well as the price of the government's debt, this led to the frenzy printing of money by the French government as their notes were accepted to repay their debt because they could be used to buy more shares of the Mississippi company.

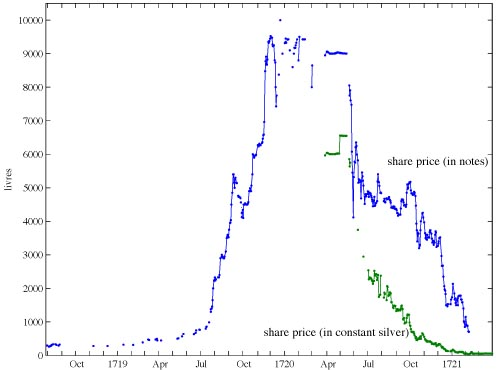

The price of the Mississippi company went from 500 Livres to 10,000 in a short period of time, however this bonanza period was just a time bomb, created by the massive printing of money which fueled the value of the Mississippi company, increasing the price of its shares while also inflating the value of the French Government bills. Once the profits from the company started to flow back, they were a lot less than expected, given the excessive valuation created by this self-feeding mechanism. This led to a crash of the Mississippi company, which caused a collapse of the whole economy as people tried to sell their shares back to Livres and converting the paper money back to coins.

The aftermath of this whole scheme was a huge bubble that burst, impoverishing France and becoming a big burden for the French people for decades. It is also one of the reasons why France was very slow to adopt new banking practices and innovations that spread across Europe as most french people mistrusted banks, which didn't make a comeback until the french revolution with the Assignats, 100 years later.

The morale of the story is that Central Banks weren't perfect when they started and they sure looked very different from what we have today, which even after 300 years of refinement are still flawed. Next time a banker or politician dismiss a new technology (i.e Bitcoin) because it has flaws and its not contemplated in our current central bank system, this story can serve as a good reminder. Central Banks weren't perfect and they are still not perfect.

Links:

https://www.forbes.com/sites/stevehanke/2018/03/06/on-public-private-partnerships-john-law-the-mississippi-co-a-cautionary-tale/#60fc5faa5319

http://www.mshistorynow.mdah.ms.gov/articles/70/john-law-and-the-mississippi-bubble-1718-1720

https://www.wikipedia.org/

Twitter - https://twitter.com/Mvais3

Congratulations @mvaisberg! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!