No, Bitcoin Is Not The Reason Gold Or The Dollar Moved Yesterday

Confusing correlation with causation is a logical fallacy so old that it is also known by its Latin name “Post hoc ergo propter hoc” ("after this, therefore because of this"). Just because two things happen at the same time does not mean that they are related, at least in the sense that one causes the other.

There was, for example a boom in the sale of color televisions in the U.S. in the 1960s, an era that also saw massive gains in population. That does not mean, however, that watching color television causes pregnancy. There is undoubtedly correlation between a rise in TV sales and a rise in the birth rate, but no causation.

That is an extreme example, but the same kind of thinking is being used by those that claim that bitcoin’s meteoric rise in price is why the dollar continues to decline in the face of North Korean aggression over the last few weeks, and continued its decline yesterday despite the North Korean missile launch.

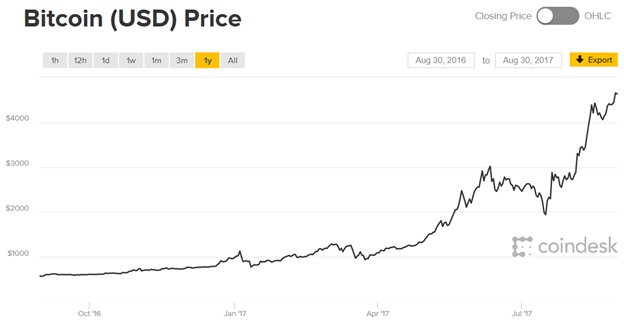

A simple look at the numbers shows why. Bitcoin’s price in dollar terms has increased by an amazing 2000 percent over the last two years to around $4,700, taking the dollar value of the bitcoin currently in circulation to around $76 billion. That is a massive increase for sure, but when it is taken in context the absurdity of attributing a move in the dollar index to a move in bitcoin is clear.

The forex market averages, depending on whose calculations you believe, anywhere between three and five trillion dollars in transactions every day, most of which involve the US dollar.

Compare that to Bitcoin, where the average daily market transactions total less than 1 billion dollars, and it is clear that while some may be buying Bitcoin rather than dollars as a safe-haven, to claim that that relatively small number is impacting the dollar’s overall value significantly is to massively overstate your case.

The same is true for the argument that gold’s reversal yesterday was a sign that the yellow metal has also lost its status as a hedge against disaster due to Bitcoin’s rise. One bitcoin surpassed one ounce of gold in nominal value a while ago, but there are many more ounces of gold in the world than there will ever be bitcoin. For bitcoin’s overall value as a currency to equal gold’s BTC/USD would have to be around $500,000, which, despite recent events, is still some way off.

Great post. Bitcoin and gold should reach the moon soon :)

hmmm Lets See

Congratulations @mudassirzia! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @mudassirzia! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!