Leave ICO’s alone!

Leave ICO’s alone!

Before we start inviting regulators to come and save the "widows and orphans" of the cryptocurrency world it behoves us, esp those not well versed in history, to remember just how we got here.

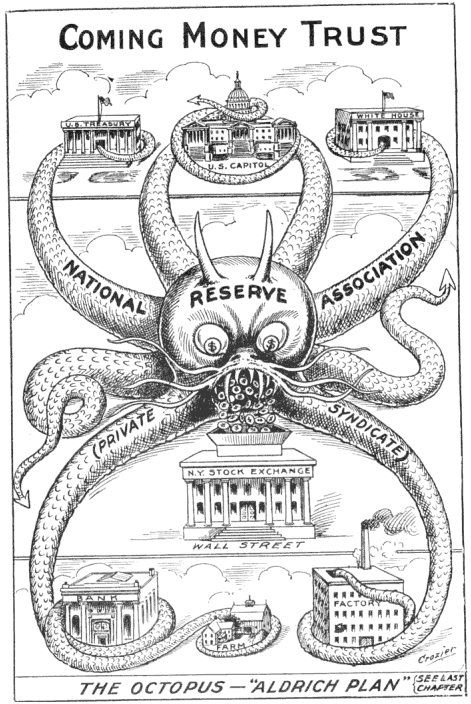

The passage of the 1913 Federal Reserve Act, controversial then and still controversial now allowed Wall Street to capture the US Government at first in relation to money management and fiscal policy and eventually extending to virtually every facet of our lives. It was Fed’s meddling in the fiscal policies of the day that caused the 1929 wall street crash (NOTE: https://www.federalreservehistory.org/essays/stock_market_crash_of_1929). They are proud that they saved the commercial banks at the expense of the stock market (NOTE: ibid). In other words they protected large banks over individual investors. The devastation in the generation was so widespread that it was not until 1954 that the Stock Market recovered, and only because a new generation began to believe in industry again and WWII and it’s after effects were behind us.

Fast forward to 2008 and we again find a bubble created by the Fed, accelerated on by the illegal creation of MERS (NOTE: https://en.wikipedia.org/wiki/Mortgage_Electronic_Registration_Systems) by Wall Street. That lead to the Fed bailing out large financial institutions again, this time via forced acquisition at the expense of individual investors.

After over 100 years of meddling why is it not obvious that correcting, directing, controlling a market simply DOES NOT WORK. Markets are chaotic structures. Trying to linearly control a market simply creates feedback ripples that result in outsized negative effects that are hard to predict and even harder to control. What do we call a black swan event if it happens often? Gray Swan?

This is why Bitcoin was created. THIS is why it was launched. Let’s remember that Bitcoin was the first ICO.

While some of us are quick to scream "SCAM" around every new token issuance they see, ICO’s serve a very important purpose. They reduce the cost of raising capital by 100x.

The current estimated cost to take a company public in the US is north of $100million. In 2014 the cost for Markit, a financial data provider, to go public and raise $1.45 Billion dollars was 5%. That’s $220million. (NOTE: https://www.forbes.com/sites/jayritter/2014/06/19/why-is-going-public-so-costly/#2f8258264ff0) Notably most of the raise came from existing shareholders, which one would presume would lower their regulatory compliance and marketing costs.

Additionally Wall Street firms won’t touch firms with less than 50million in sales, high profitability and low variance of income. An article in Fortune on 2013 argues that 100million WAS the old standard, but 50mil is ok if… (NOTE: http://fortune.com/2013/02/25/is-your-company-ipo-ready/)

But one of the major reasons why a company fails is undercapitalization. (NOTE: http://www.investopedia.com/slide-show/top-6-reasons-new-businesses-fail/) And access to capital is one of the top competitive advantages a company can have (NOTE: ). Amazon is a great company but their cash cow, 2nd day delivery of most products, is due to their ability to have hundreds and soon thousands of warehouse locations around the country. Their capital access gives them a competitive advantage small warehouse owners and small retailers cannot match.

On the other hand the launch of a new crypto currency ranges from $2.5million at the top end to virtually free at the bottom. A young entrepreneur, let’s call him "Satoshi", can create a new p2p piece of software, release it on an obscure forum and in less than 10 years have each unit of said currency be worth not more than just the almighty dollar, but more than an ounce of gold.

Without a doubt there are many scams coins and s__t coins in the ecosystem. Onecoin deserves to be called out as the scam it is, and many coins released in the early years of Bitcoin have now been virtually abandoned. It is important to us, as an industry, to call out these problem coins loud, often and to the authorities if necessary. Naming and Shaming works, although it is a blunt instrument. Notice however, that existing fraud and Ponzi laws worldwide are sufficient in the case of Onecoin and that the death of old coins is a natural occurrence, not a result of regulations.

Some people may argue that "reasonable" regulation is a middle road that we could all tread, but I disagree vehemently. We already know the many problems with attempts to regulate the internet, technology, and media so I won’t rehash them here. I would like to, however, point out two problems with regulations that aren’t obvious.

Regulation is a binary switch. It either exists or it does not. However ONCE it exists it is impossible to extinguish, rarely does it get smaller and usually it proceed to the left.

Regulations also absolve consumers of personal responsibilities by shifting quality control to the regulators. It is THAT precisely that allows non-sophisticated investors, "widows and orphans", to have enough confidence to invest. But of course when markets panic as they tend to do the “widows and orphans” get hurt anyway and regulators try to pick up the pieces afterwards.

These effects directly contradicts the ethos of crypto currencies as I understand them. Individual responsibility, individual control, self knowledge, lack of trust in counterparties are the hallmarks of what we do and are a reaction to the betrayal of trust by those to whom we have given the keys. Regulations are a step backwards. ICO’s should not and cannot ever be regulated.

David Mondrus

CEO

http://trive.news

[email protected]

The truth is the truth no matter who speaks it.

As you said a lone dev (or small group) could create Bitcoin, without any financial reward, except their early knowledge and therefore investment advantage over others.

ICOs are not a good development, because now we see devs getting the money ahead of time, and having the early investment opportunity. Also the concepts of fair coin distribution are being thrown away, if you miss an ICO or cant get subscribed before the time limit, you are frozen out as the post ICO hysteria forces you to buy in at inflated rates.

With the standard coin issues of the Bitcoin era, you usually had months/years to become aware, research, see if the devs were really progressing towards a working model, then buy in, still at a low rate.

So the complaint is, new people are trying and it's too fast? And you can't make money at it?

Actually no, Im concerned its over-heating the space as everyone scrabbles to buy into vapourware while actual working projects, get underfunded.

Which "actual" projects are underfunded. All I hear is how "this is the easiest fund raising environment ever". And is it "over"heating or just right? Maybe too cold?

speed of growth and investment is not a corollary to a bubble. Your uncomfort, not liking specific projects, etc, is the whole REASON to leave it alone. Not you, not I, noone knows what'll work long term. The ONLY way to know is it try.

this makes no sense... if a project is underfunded in this space it's for lack of making some minimal effort or the core group isn't listening to their community or user base... you would be surprised how money seems to flow in the right directions when you listen to people...

The problem is once you allow the regulators to step in on one part of it, you open the door to the entire system being regulated, and that is the antithesis of cryptocurrency to begin with. Education is a better option, and services that can impartially look at the new ICO on their own merit. Is it using new tech or algorithm or just a cloned coin? Is the purpose of the ICO to further an existing business, or is the coin the only asset of the devs? What does it bring to the table other coins do not? We can do far more through education and accurate information than we can on regulation.

Exactly. And every part of the ecosystem should play a role. Exchanges, attorneys, developers, etc... We can never stop a website from putting up code but we can Name/Shame the real scams. Just watch out for "the boy who cried wolf"

Yeah Im not in favour of regulation, Im just ICO-wary.

As we all should be. But there's a big difference between "I'm wary", and "EVERYTHING IS A SCAM"...

And thats why I never accused any project of being a scam, I tend to believe devs have the best of intentions, but making a coin in short supply via an ICO to get huge publicity, in my humble opinion isnt ideal when nothing close to an operational product has been delivered.

Individual investor decision IMHO. Everyone has a different risk appetite.

Agreed, Im not trying to say there isnt a place for ICOs, ever, under any circumstances, but I miss the old days of devs delivering something, then it getting adopted.