Digital currency Markets Move Again Into Green After Considerable Selloff

Cryptocurrency markets are bouncing back today, Feb. 3, following yesterday's multi-month low in Bitcoin's cost. The majority of the main 50 coins are in green, with 24 hour increases more than 20 percent.  to some extent because of weight from misdirecting covering directions in India, the general digital currency showcase took a gigantic crash beginning Thursday, Feb.1, shedding more than $100 billion in advertise top in the 24 hours following the news.

to some extent because of weight from misdirecting covering directions in India, the general digital currency showcase took a gigantic crash beginning Thursday, Feb.1, shedding more than $100 billion in advertise top in the 24 hours following the news.

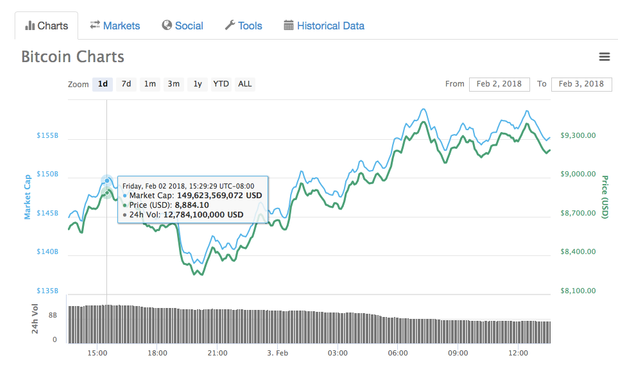

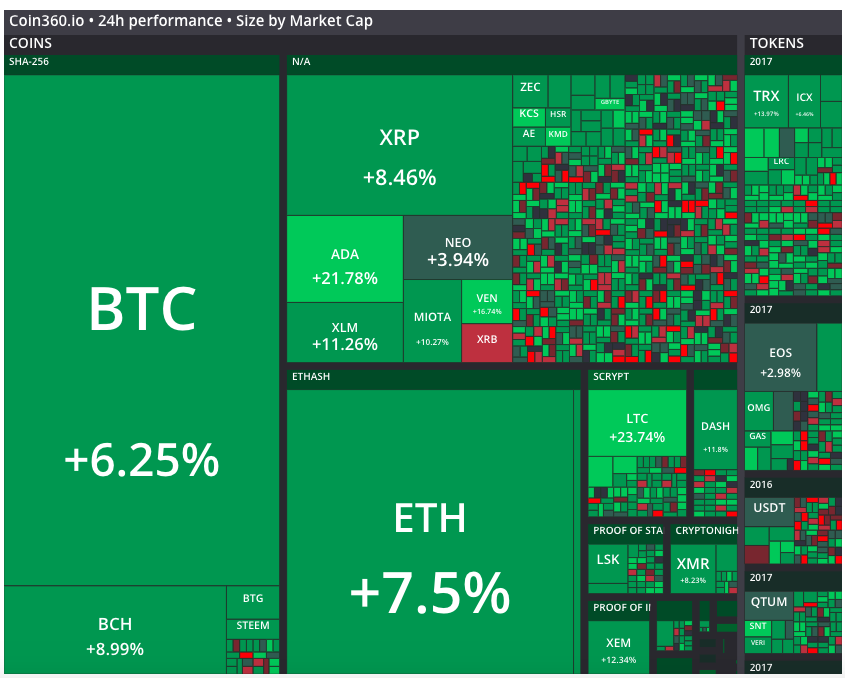

Be that as it may, after the significant selloff, the market has spent today bobbing back, with Bitcoin transcending the $9,000 level. At squeeze time, Bitcoin was exchanging at a normal of $9,095, up 3.54 percent on the day Following Bitcoin's lead, different coins have additionally mobilized generously. With the aside from of three coins, each main 50 cryptographic money has seen picks up, with Litecoin (LTC) and Cardano (ADA), and Skirt (XVG) standing out with picks up in the vicinity of 15 and 20 percent.  A snappy look at the Coin360 advertise preview shows a reasonable positive turn after the significant negatives of the week.Despite the market lows this week, figures, for example, Litecoin organizer Charlie Lee and Cryptotrader have Ran Neuner have put forth bullish expressions as of late about Bitcoin. In a meeting with Cointelegraph, Lee specifically offered some prudent viewpoint on instability in crypto markets, regularly ailing in a market swarmed with frightful newcomers.

A snappy look at the Coin360 advertise preview shows a reasonable positive turn after the significant negatives of the week.Despite the market lows this week, figures, for example, Litecoin organizer Charlie Lee and Cryptotrader have Ran Neuner have put forth bullish expressions as of late about Bitcoin. In a meeting with Cointelegraph, Lee specifically offered some prudent viewpoint on instability in crypto markets, regularly ailing in a market swarmed with frightful newcomers.

News of the primary Canadian Blockchain ETF endorsement may well have played into the present rally.

Bitcoin hit a record high of 20,000 in late December, just to crash, alongside whatever is left of the market, only a couple of days after the fact, Dec. 22, when Bitcoin and altcoins lost 20-30 percent.  From that point forward, the main digital money still can't seem to completely recoup, floating generally between $10-$15,000 per coin, until this present yesterday's multi-month lows under $8000.

From that point forward, the main digital money still can't seem to completely recoup, floating generally between $10-$15,000 per coin, until this present yesterday's multi-month lows under $8000.

The whole month of January saw a market auction, to some degree because of expanded administrative news from South Korea – and misdirecting providing details regarding it – that left numerous financial specialists frightful.