How likely is it for bitcoin to reach one million or even one trillion per coin?

Looking

at today’s prices I don’t really know it, and I’m sure no-one knows it, but chances are that it can be worth $1 trillion. But I’ll explain it at the end of this post. All I know is that bitcoin is having nice short therm rally. Whether it holds or not, we shall see.

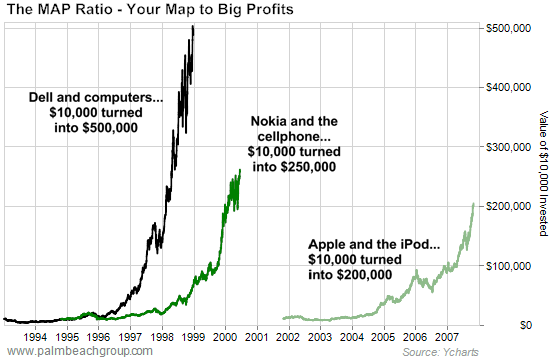

Now, imagine that you are Nokia in 2000 and produce this:

…also, there is no other competitor that can compare to you in terms of market share, product quality, demand, feedback, etc. In other words, you are the greatest company in the world in your specific niche. Now, you reach this point:

So, considering the fact that your share price costs over $50, how do you think: How much would one Nokia share be worth in 2010? - $100? $200? $500?

None of that - check here:

It was under $13 per share. Today, it is less than $6 I guess.

How comes that? Would people at that time spend $50 for a stock that the very next year would fall under $15? No! So why were they ready to spend $50 per stock anyway?

Because they didn’t know what was coming.

Now check this out:

Today Apple’s market cap is over $1 trillion opose to Nokia’s less than $32 billion market cap.

So how likely

is it for bitcoin to reach one million or even one trillion per coin?

No one knows the future, so making a confident prediction of this kind is not that smart. Well, making a prediction is smart, but a confident one - saying that you know X or Y for sure - doesn’t inspire common sense at all.

However, if you still want a prediction, check this:

At the end in 10 years Bitcoin price can be in these ranges:

- $0–10 - because maybe a completely new and game-changing cryptocurrency takes the leading position. Its blockchain makes the one behind Bitcoin look outdated, while big institutions make the move to the new system. Bitcoin still costs a few dollars because some people are nostalgic and keep it. Maybe a new global currency is officially implemented by the UN or by a new global government.

- $10-$100 - the same reason + a bit inflation in US dollar.

- $100-$1000 - Bitcoin is a cryptocurrency of choice, but loses dominance against Ethereum or some other coin. It’s still in the top 10 or 20.

- $1000 - $10,000 - Bitcoin is doing OK along with other blockchain-based ecosystems.

- $10,000 - $100,000 - Bitcoin is the leading coin that is regarded as a safe-haven against vulnerable fiat money.

…oh, and it can be this way: - $1,000,000- $10,000,000

Right now on this planet with over 7 Billion people on it, our $72 Trillion economy is produced almost entirely by less than 1 Billion of its' members. The rest can't even get a bank account because they have no prospects for making enough money to use one. However, Bitcoin will give them all bank accounts and let all of humanity run their own businesses on a global market for the first time in human history. Mankind's output would go exponential. GDP will be measured in Quadrillions or Septillions of dollars within a few short years. - $1 trillion+

Don’t believe that Bitcoin has this potential to reach $1 trillion? Well, if Bitcoin can’t, then the US dollar can. Hyperinflation is very possible in theory, because the USD is a world reserve currency, and if it loses demand (OPEC selling oil for other currencies - just one example), then people would surely lose confidence and it would devalue.

Hyperinflation already happened in Zimbabwe for example (because of war spending). How about this kind of money?

I am not exaggerating, check this:

According to renowned economist Marc Faber, hyperinflation in the U.S. is a certainty within the next 10 years. Mr. Faber has correctly predicted some of the most important financial events in the modern era including, the stock market crash of 1987; the rise of oil, precious metals and other assets in the 2000's; and on Fox News in February 2007, he said a U.S. stock market correction was imminent.

Source

So - everything is possible.

Hope this helps.

I think that we can realistically assume that the total market cap of all cryptocurrencies will exceed 10 trillion USD (in todays dollars) by 2030. Hard to say which coins will make it to the top. Many have already dropped off the charts.

I suspect that the DPoS coins could gain a lot of traction in the next year or two (EOS, Bitshares, Steem). The scaling issue for bitcoin still looms large as a major obstacle to mainstream adoption, but these three don't suffer from that problem.

You got a 35.99% upvote from @brupvoter courtesy of @milano1113!

Congratulations @milano1113! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!