6 Cryptocurrencies I Just Added to my Portfolio for their Huge ROI Potential – Part 1

As you’ve seen in my previous post, I have decided to take the long-term approach when it comes to cryptocurrency investing and to reveal my portfolio in front of everyone.

Moreover, I went ahead and focused on the WHYs when it comes to each coin I have put my money into, because I am a strong believer in the idea of having a calculated and well-argued reason behind your every decision. Even if it turns out to be a bad one, even if I lose all the money I’ve invested, there lessons to be learned and applied in the future.

So, I developed my own 10-steps (A to J) “grading” system, which helps me decide whether to invest in a coin or not.

Remember, you’re not actually investing in a coin, but rather in a project, a vision and a team’s potential.

If you’re nothing more than a day trader, that’s fine, good luck to you! But I’m not in this business to flip coins, buy one at 20 cents and sell it at 25, also not here for a 2x or 5x or even 10x profit. My goal is that at least one of the coins I invest into generates 100x profit, if not even more. Also, I am willing to wait and hold my coins until one of them reaches 1000x. Am I a dreamer? Certainly not, because that did happen in the past.

Anyway, having that said, let me reveal the 6 coins (5 already established ones and an ICO I found very interesting) I have invested in this week and, most importantly, WHY? Again, I will use my assessment system to answer that question. I will reveal the first three of them today and the other three in my next post, so you can digest the information better.

One more thing, please remember I am looking for high-potential, low-cost coins, that can have a huge ROI a few years from now. So, if you’re asking me why Dash or Litecoin or Monero isn’t on my list, it’s because I cannot image Dash going to $30k or $300k, given its current price of roughly $300+. It’s as simple as that. Not that it isn’t a great coin/project, it’s just that I don’t see the massive ROI.

Before we begin, please note that this post and the ones that follow are not professional financial advice. You should always research the projects and cryptocurrencies on your own and make an educated decision based on your findings. I cannot advise you what to do with your money.

Let’s see the 10 items on my list of criteria before diving into the new coins:

*A. The whitepaper. Is it clear and describes the project in detail?

*B. Do I feel like this technology will solve an existing issue?

*C. Are there any founders / developers / special advisors with a solid background?

*D. Is there a well-established and active community? (Slack, Telegram, Discord, Twitter and so on)

*E. Is the current price low enough to believe in a future 100x return?

Additional parameters I look at:

*F. How high is the circulating supply of coins? The higher the circulating supply, the more trading volume the coin needs in order to have a considerable rise in price.

*G. Are there any current or announced partnerships with big names in the industry?

*H. Is there any existing product / prototype / alpha version for this technology?

*I. Does the technology solve a particular issue or tries to be the jack of all trades? (to not be confused with point B. Here, it’s very important to me if the team tries to address a particular problem and do it well, rather than trying to build X apps and platforms all at once, which can be counterproductive, especially when having a small team or budget)

*J. Does the Fibonacci retracement technique reveals a good entry point to buy right now? (More about Fibonacci retracement here: goo.gl/qqSZfC)

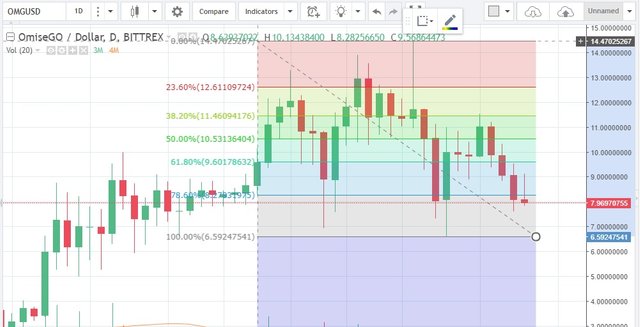

- OmiseGo (OMG) - https://omg.omise.co/

A. 1 point – Short (16 pages long) and to the point whitepaper (goo.gl/ieRDCu). Stated right from the beginning, “OmiseGO is building a decentralized exchange, liquidity provider mechanism, clearinghouse messaging network, and asset-backed blockchain gateway”. And, boy, do we need a decentralized exchange!

B. 1 point – As I said above, definitely yes.

C. 1 point - Jun Hasegawa (goo.gl/VQm93j), the CEO of the Omise company, which is a is a venture-backed payments company operating in Thailand, Japan, Singapore, and Indonesia, has a solid background (over two decades) as a CEO and Director. Among the huge team of advisors, OmiseGO has Vitalik Buterin on their side. Should I say more? Check out all of them in the About section on their official website.

D. 1 point – There are over 10k members in the Slack omise_go channel and more than 58k followers on the OmiseGO Twitter page (which is a very active page, by the way).

E. 0.5 points – The OMG token is at $8.06 at the time of this writing, so it’s kind of hard to see a 1000x return anytime soon. But 100x, sure, I can see that!

F. 1 point – There is a current circulating supply of 98,312,024 OMG out of the total of 140,245,398 OMG, so a more than decent number here.

G. 1 point – Omise definitely has a lot of investors on their side, like SBI Investment or SMBC, a fresh partnership with McDonalds Thailand and a lot of buzz around potential partnerships with Apple or Google.

H. 0.5 points – They do have a Product page on the website (https://www.omise.co/go), but there isn’t something to be downloaded immediately. They are promoting the OmiseGO mobile wallet on that page, but no working product yet. The wallet is scheduled for release in Q4 2017, so it should be just around the corner. I gave them 0.5 points, because Omise is an existing, well-established company, without a doubt.

I. 1 point – I really think that OmiseGo’s main achievements will be the mobile wallet and decentralized exchange. Compared to other projects I’ve seen, that try to do 10 things at once, OmiseGo is pretty focused on their goal: “Unbank the Banked with Ethereum”.

J. 1 point – OMG is currently at the 78.6% Fibonacci level and I think this is a good buying point, at $8, if you wish to invest. Let’s not forget OMG was over $13 not too long ago, so it has room to grow.

TOTAL POINTS: 9 / 10

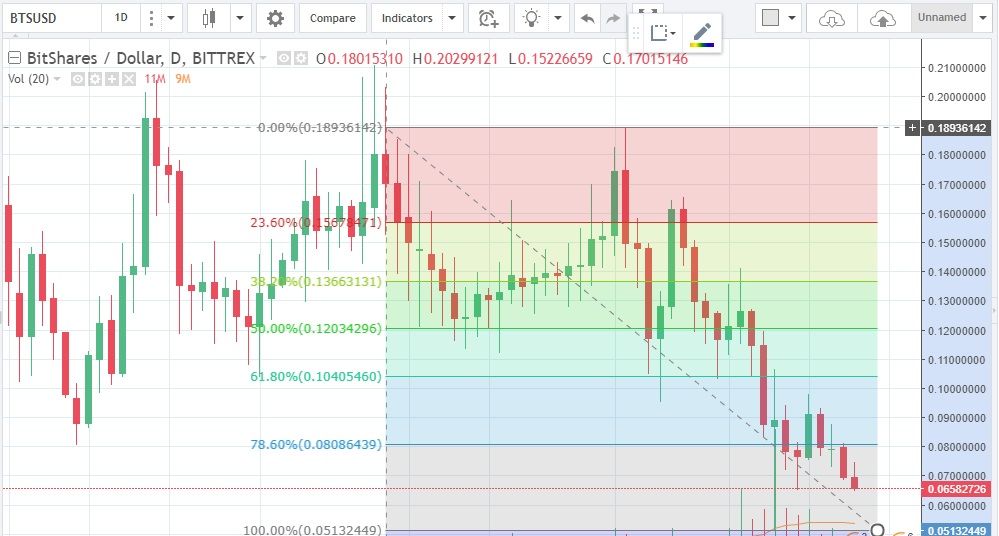

- BitShares (BTS) - https://bitshares.org/

A. 0.5 points – From what I see (goo.gl/g5i1bd), Bitshares has a lot of papers and documents bundled together on a web page, but I would’ve loved to see is a damn 15 pages, well-formatted and easy-to-understand whitepaper, with a clear vision, goal, strategy, and roadmap, without any math formulas and with a one-column text.

B. 1 point – Yes, the need for a digital asset exchange.

C. 0.5 points – Good luck finding a list of Bitshares’ team members. However, after digging into the history of Bitshares, I found Daniel Larimer (goo.gl/7C9roa) as the “founding father”, Charles Hoskinson (ex-CEO of Ethereum) as Co-founder and CEO for about 4 months in 2013 and Mr. Li Xiaolai (one of the largest holders of Bitcoin in China) as an investor. But seriously, there needs to be a list of active leaders and developers on the website!

D. 1 point – Bitshares does have an active Twitter profile with more than 22k followers, over 3.3k readers on Reddit and a Telegram chat with over 3.7k members, called BitsharesDEX.

E. 1 point – Yes, 1 BTS is currently $0.0679.

F. 0.5 points – Kind of a huge supply of 2.6 billion BTS in circulation.

G. 0 points – I found nothing about any partnerships. Not even rumors.

H. 1 point – Yes, they have an online exchange and a desktop app available for download.

I. 1 point – Yes, they do solve a particular issue.

J. 1 point – BTS is currently under the 78.6% level, so it’s definitely a good entry point since the price is so low. Of course, only if you believe in the project itself.

TOTAL POINTS: 7.5 / 10

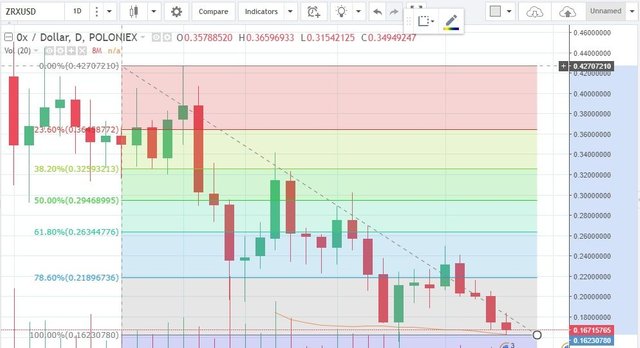

- 0x (ZRX) - https://0xproject.com/

A. 1 point – Good, short whitepaper (goo.gl/oYnciY), which clearly explains the technical basics behind the 0x project. Also, I’m starting to like whitepapers with a “Contents” section more and more, since I’ve seen a lot that just start talking about the product in the first row of the first page. Learn to write a document, people! You’re not publishing “Little Red Riding Hood”, but a technical and business-related paper! However, the folks at 0x have done a good job and deserve 1 point. And by the way, yes, this is yet another decentralized, peer-to-peer exchange based on the Ethereum blockchain. We need them like air!

B. 1 point – Again, like I said before, yes!

C. 0.5 points – To be honest, I’m not very impressed about the CEO and CTO of 0x, Will Warren and Amir Bandeali, respectively. According to their LinkedIn profiles, Will was an advisor for Basic Attention Token for 3 months and worked in research (physics) before that, and Amir was a trader before taking the CTO position at 0x, which is kind of disappointing to me because I was expecting a software engineer as CTO. Nevertheless, 0x does have some interesting advisors, with Fred Ehrsam (co-founder of Coinbase) being one of them.

D. 0.5 points – Their Slack channel (goo.gl/M9epN9) is offline for maintenance for some time now and that is pretty disappointing, but they do have an active Twitter page with over 24k followers.

E. 1 point – Yes, definitely, 0x is at a great price of only $0.173.

F. 1 point – There is a circulating supply of 500,000,000 ZRX at the moment, with 1 billion tokens in total.

G. 0.5 points – 0x is backed up by Polychain Capital, Blockchain Capital, Pantera and others and has a partnership with Aragon, but nothing spectacular in terms of partners.

H. 1 point – Yes, 0x does have an exchange portal available on their website: https://0xproject.com/portal

I. 1 point – 0x is solving a particular issue and it seems to be focused on that thing alone.

J. 1 point – ZRX is currently way below the 78.6% Fibonacci line and, given its current low price, I considered it to be a great low-risk investment. However, as I said many times, you should make your own research and assume decisions and risks based on your own assessment.

TOTAL POINTS: 8.5 / 10

That’s it for now, guys and girls!

In my next post, I will reveal the other 3 coins I decided to invest it (one of which is a newly launched ICO) and the reasons behind my decision, following the same evaluation system.

So, until next time, happy investing!

I would be curious to know you take using your parameters on Steem. @jerrybanfield has a post the other day in which he stated that he sees Steem at $100 and could possibly see it getting to $1067.

I am not sure I buy into the 1000x gain but it is an interesting thought.

What are your on this?

Hey, just check out my previous post (https://steemit.com/bitcoin/@mihaiteodosiu/my-crypto-portfolio-revealed-10-cryptocurrencies-i-truly-believe-in-for-the-long-term) where I talk about Steem and the other coins I have.

$1067? Where did that come from? I am not a follower of Jerry Banfield, I just think that he gave a lot of bad advice recently.

I have no idea where he got it from...I watched a video of his and he mentioned it. Take it for it is worth.

I'll take everything Jerry says with a grain of salt.

http://cryptolegion.io/

Thanks.

Needs more NEO

I didn't invest in NEO. I don't see it at 500x.

Congratulations @mihaiteodosiu! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPLiking the last 2 posts I read from you, given you an upvote and follow.

Just followed you back, btw.

Thank you! A new one (Part 2 of the last post) coming soon :)