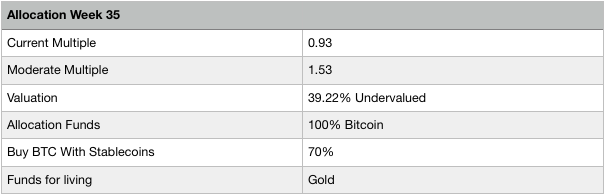

Weekly Update Diversification Protocol Week 35 - Multiple 0.93 - 39.22% Undervalued - Long Term Extremely Bullish - 100% In BTC - Living On Gold

Today is the 23th weekly update of the Diversification Protocol. This protocol is designed to allocate a weekly income or funds to be invested mostly to BTC when it is undervalued and mostly to gold and optional stable coins when BTC is overvalued. It also tells you to spend gold for living when BTC is undervalued and BTC for living when it is overvalued. This will create higher returns on your investment through a full cycle and reduce stress in a bear market. HERE you can read the protocol in dept.

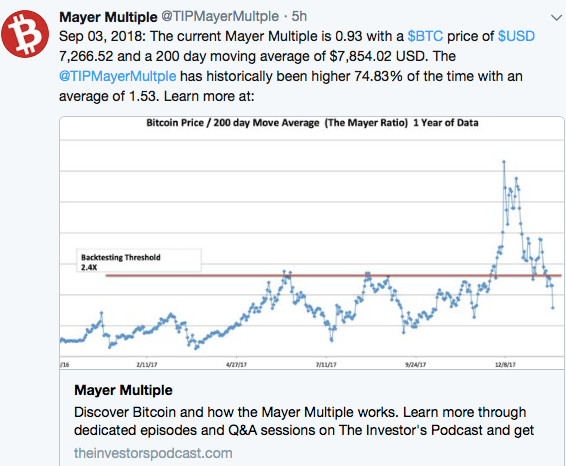

The valuation is done by using the Mayer Multiple and compare it to historical values. The Mayer Multiple is the current BTC price divided by the 200 day moving average. We use data from mayermultiple.com. When you want to be updated on the multiple several times a day you can follow THIS twitter account.

Because I just started the protocol, I didn't accumulate gold and stable coins yet. In this update I will exactly follow the protocol, but since I only start saving gold and stable coins from a multiple of 1.6, I will only be able to execute it 100% according the rules after that point is broken. Funds invested in BTC today will eventually at least partly be converted to gold, since the BTC accumulates in the same wallet and a percentage of the total BTC in this wallet will be allocated to gold at higher valuations.

The current multiple

Weekly allocations of funds

The protocol will be slightly boring until we get to a multiple of 1.6, till then we allocate 100% in BTC because it is undervalued. With the current 200 day moving average we need a BTC price of over 12,566 USD to start allocating to gold and Stable coins. This can take days or months, but it is good to be prepared already.

Important news of the week

Argentina is the next victim of the flawed monetary system

After Zimbabwe, Venezuela, Iran and Turkey, Argentina is next to face a currency crisis. The Peso tanked 45% against the dollar this year and the bank had to raise interest rates to a staggering 60% to maintain some interest to hold the weakening currency. Also other countries like India, Indonesia and South Africa are experiencing weakness in their currency, fear for a global currency crisis in emerging markets is increasing. Both Bitcoin and gold will be the safe heaven assets and gain in price as result of the financial mismanagement by our keynesian leaders.

The Bcash stress test

The first of September the Bcash stress test took place, more than 2 million transactions were done on the BCH network in 24 hours and the biggest block that was found was 15.4 MB. As I predicted in THIS post: Bcash supporters are claiming that Bcash can scale onchain and that a network can handle big blocks perfectly. However, the main reason that many Bitcoin Core developers are against big blocks is that every transaction have to be downloaded by every node and stored forever and this will greatly increase the requirements to run a full node. Obviously, these problems will not pop up in 24 hours, it will take months or years to develop. The fact that the network could handle a higher load for 24 hours was very predictable, thus actually the stress test proved nothing. It was purely a strategy to pump the price through fresh hype.

https://www.cnbc.com/2018/08/30/argentina-crisis-peso-crashes-to-record-low-amid-imf-plea.html

The price of Bitcoin maintained its uptrend this week

The Bitcoin price rose from 6732 to 7228 this week, probably driven by technicals because there was not much fundamental news. The amounts of shorts was rising and a 10.000 BTC short position was opened on the first of September. This can result in a big move either way: Over the past year it usually led to a short squeeze that caused a huge green candle. However, results of the past are never a guarantee for the future!

Fundamentals and valuation

In the history of Bitcoin the multiple was lower than today only 25.13% of the time. Since the multiple today is 0.93 while the moderate is 1.53, there is 39.22 % discount on BTC according to this valuation method!

Long term the prospects are still extremely bullish. Lightning Network and Segwit adoption are still growing and improving faster than expected and can boost adoption for day to day payments, micro transactions and Lapps. Wall Street, governments and central banks are on the sidelines to come in and could inject huge amounts of money. Furthermore, the Mt. Gox selling fear is off the table, Bitmain can’t dump much more bitcoins and an ETF is coming closer. Short term sentiment is neutral to bullish, but for the long term almost everything is very bullish.

Disclaimer

This is no financial advice, just my view on the market.

Never stress in a bear market anymore: Follow my diversification protocol

Store your Bitcoins securely

Ledger hardware wallet

Trezor hardware wallet

Trade Cryptocurrencies

Binance Exchange

Buy Bitcoins anonymous with cash

Localbitcoins

Protect your privacy with VPN and pay with crypto

Torguard

Buy gold securely with Bitcoin and store in Singapore

Bullionstar

Like this post? RESTEEM AND UPVOTE!

Something to add? LEAVE A COMMENT!

I saw on Twitter that Gavin and Judas unfollowed Faketoshi and vice versa, the btrash saga continues. For me a coffee only please :)

More about #bitcoin #investing in these posts:

Are Li-Ion Batteries true successor of Bitcoin ? !! - Part 2 by bee84

VERTEX PROJECT OVERVIEW by chamika

The Bitcoin Bounce - Up, Down and Back Up It Goes [Bitcoin][Crytpocurrency] by streetstyle

Decent.bet 2.0 is Coming! by steemengines

Has Bitcoin Bottomed in 2018? + EOY Price Prediction ft High Altitude Investing by louisthomas

Il this comment you think is useful please consider vote it

I guess this is a nice information to learn more about bitcoin.👍👍👍👍

Good stuff man! This exactly what I have been doing forever. It’s the absolute best way to play the crypto game. Staying out of cash will help build your wealth at a beautiful pace. When you need cash.....if your holding gold or bitcoin your in good shape to buy it with either. Holding large amounts of cash is reckless.

There was a time that Bitcoin went down for like a year. It was 200 a coin at the time and dropping. Think about it. What you need to spend in the next four months, you probably should keep in some asset which has less volatility. Down the road, it might continue to drop to 6000 again and then jump to 18,000 suddenly.