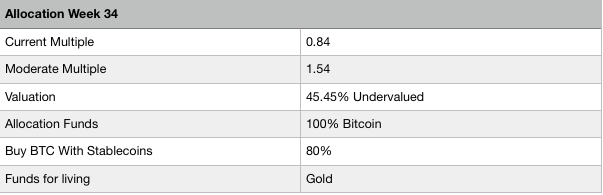

Weekly Update Diversification Protocol Week 34 - Multiple 0.84 - 45.45% Undervalued - Long Term Extremely Bullish - 100% In BTC - Living On Gold

Today is the 22th weekly update of the Diversification Protocol. This protocol is designed to allocate a weekly income or funds to be invested mostly to BTC when it is undervalued and mostly to gold and optional stable coins when BTC is overvalued. It also tells you to spend gold for living when BTC is undervalued and BTC for living when it is overvalued. This will create higher returns on your investment through a full cycle and reduce stress in a bear market. HERE you can read the protocol in dept.

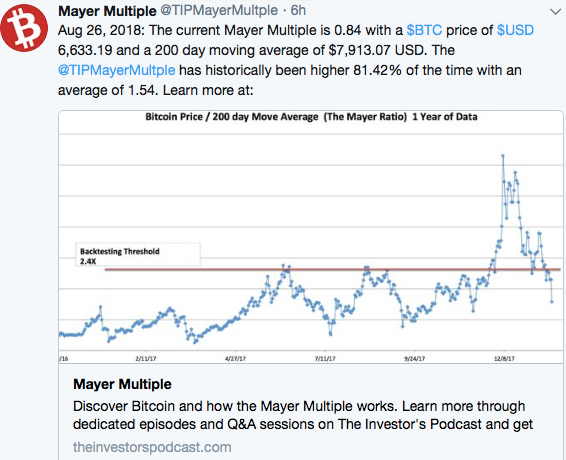

The valuation is done by using the Mayer Multiple and compare it to historical values. The Mayer Multiple is the current BTC price divided by the 200 day moving average. We use data from mayermultiple.com. When you want to be updated on the multiple several times a day you can follow THIS twitter account.

Because I just started the protocol, I didn't accumulate gold and stable coins yet. In this update I will exactly follow the protocol, but since I only start saving gold and stable coins from a multiple of 1.6, I will only be able to execute it 100% according the rules after that point is broken. Funds invested in BTC today will eventually at least partly be converted to gold, since the BTC accumulates in the same wallet and a percentage of the total BTC in this wallet will be allocated to gold at higher valuations.

The current multiple

Weekly allocations of funds

The protocol will be slightly boring until we get to a multiple of 1.6, till then we allocate 100% in BTC because it is undervalued. With the current 200 day moving average we need a BTC price of over 12,186 USD to start allocating to gold and Stable coins. This can take days or months, but it is good to be prepared already.

Important news of the week

SEC denies 9 Bitcoin ETF’s

This week the SEC rejected 9 Bitcoin ETF proposals, but the market hardly reacted. It was not really shocking since the market is mostly excited about the Van Eck ETF, this decision will be the 30th of September.

China intensifies Bitcoin ban

After the China ban of last year Chinese Bitcoin investors circumvented the ban by trading on foreign exchanges. This week China came with more restrictions: Foreign exchanges are not allowed to send and receive money to China anymore, hotels are not allowed to host crypto meetings anymore and crypto related websites will be blocked. It will be interesting to see what the answer of the market will be.

CNBC tweets as extremely reliable contra indicator

If a trader had sold on every bullish tweet of CNBC about Bitcoin and bought on every bearish tweet from the beginning of 2018 until now, he would have had a staggering 95% of his trades right! In the past week CNBC made three new bearish predictions, thus according this indicator there is a 95% chance that the Bitcoin price will rise!

The price of Bitcoin went slowly up this week

The Bitcoin price rose slightly from 6412 to 6677 this week. The reaction on the ETF rejections was minimal, the price was back on track in no-time and this can be seen as a bullish signal. The volatility was extremely low in the recent weeks what I see as a very positive thing after the violent drops in the previous months. It looks like we entered a consolidation period, a new fresh bull market is the next phase!

Fundamentals and valuation

In the history of Bitcoin the multiple was lower than today only 18.58% of the time. Since the multiple today is 0.84 while the moderate is 1.54, there is 45.45 % discount on BTC according to this valuation method!

Long term the prospects are still extremely bullish. Lightning Network and Segwit adoption are still growing and improving faster than expected and can boost adoption for day to day payments, micro transactions and Lapps. Wall Street, governments and central banks are on the sidelines to come in and could inject huge amounts of money. Furthermore, the Mt. Gox selling fear is off the table, Bitmain can’t dump much more bitcoins and an ETF is coming closer. Short term sentiment is neutral, but for the long term almost everything is very bullish.

Disclaimer

This is no financial advice, just my view on the market.

Never stress in a bear market anymore: Follow my diversification protocol

Store your Bitcoins securely

Ledger hardware wallet

Trezor hardware wallet

Trade Cryptocurrencies

Binance Exchange

Buy Bitcoins anonymous with cash

Localbitcoins

Protect your privacy with VPN and pay with crypto

Torguard

Buy gold securely with Bitcoin and store in Singapore

Bullionstar

Like this post? RESTEEM AND UPVOTE!

Something to add? LEAVE A COMMENT!

Hey @michiel, did you ever find a buyer/get some traction regarding the domain names you bought a couple of years ago?

I love. Congratulations men, right process. There is still an extended way to head, I have seen the films of the cup and that I appear very thrilling and humorous.

This post has received a 57.26 % upvote from @boomerang.

best way to explain with chart so this article is really good

Posted using Partiko iOS

Nice information, thank you

Posted using Partiko Android

Super analysis and i also analysis wow

Posted using Partiko Android