Weekly Update Diversification Protocol Week 24 - Multiple 0.64 - 59% Undervalued - Long Term Extremely Bullish - 100% In BTC - Living Off Gold

Today is the 12th weekly update of the Diversification Protocol. This protocol is designed to allocate a weekly income or funds to be invested mostly to BTC when it is undervalued and mostly to gold and optional stable coins when BTC is overvalued. It also tells you to spend gold for living when BTC is undervalued and BTC for living when it is overvalued. This will create higher returns on your investment through a full cycle and reduce stress in a bear market. HERE you can read the protocol in dept.

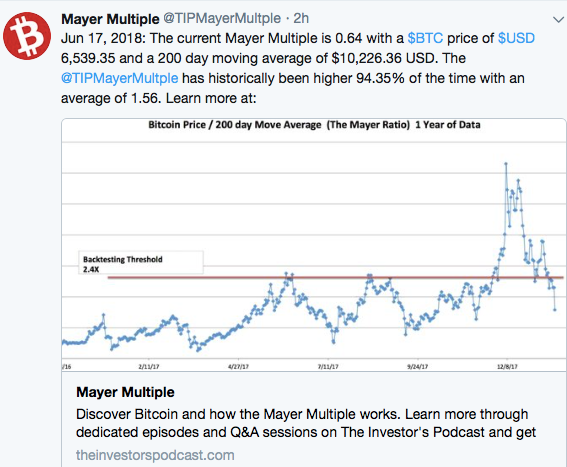

The valuation is done by using the Mayer Multiple and compare it to historical values. The Mayer Multiple is the current BTC price divided by the 200 day moving average. We use data from mayermultiple.com. When you want to be updated on the multiple several times a day you can follow THIS twitter account.

Because I just started the protocol, I didn't accumulate gold and stable coins yet. In this update I will exactly follow the protocol, but since I only start saving gold and stable coins from a multiple of 1.6, I will only be able to execute it 100% according the rules after that point is broken. Funds invested in BTC today will eventually at least partly be converted to gold, since the BTC accumulates in the same wallet and a percentage of the total BTC in this wallet will be allocated to gold at higher valuations.

The current multiple

Weekly allocations of funds

The protocol will be slightly boring till we get to a multiple of 1.6, till then we allocate 100% in BTC because it is undervalued. With the current 200 day moving average we need a BTC price of over 16,362 USD to start allocating to gold and Stable coins. This can take days or months, but it is good to be prepared already.

Important news of the week

Price manipulation through Tether

The Bitcoin price has been manipulated by buying big amounts of Bitcoin on critical moments with Tether according to researchers and this news didn’t do any good for the Bitcoin price this week, all the main stream media was mentioning it. The Bitcoin price rose 50% more through this manipulation in the previous bull market and the price of alt coins even 64% according to the paper.

I am a bit sceptical about this research, because the investigation was only done on the blockchain by tracking addresses of Bitfinex, it doesn’t say anything about the backing of Tether by real dollars. Since Tether is a stable coin to store your value when you think the crypto market is overvalued it makes a lot of sense that they are spend after a big drop. Isn’t this the entire purpose of Tether? When the Tethers are really backed it is just how the market works right?

BTW, even if Tether is not backed, where are US dollars backed with?

Furthermore, since we already had a drop of 50+% and there are not really more Tethers printed since the start of this year the air should be out already. After a huge drop we made already 3 bottoms at 6k without the help of Tether so it is fair to suspect that the overvaluation caused by manipulation is already gone.

Not many extra Tethers are created since the beginning of this year

Lightning Network keeps growing

Lightning Network keeps growing but more importantly, Dapps that go further than just a payment method are being created. Slowly but surely the amazing possibilities of micro transactions are becoming visible, it could implemented through all the apps over the entire internet!

https://ambcrypto.com/new-features-bitcon-btc-zap-lightning-network-wallet/

https://www.infoq.com/news/2018/06/Bitcoin-Lightning-Oracles

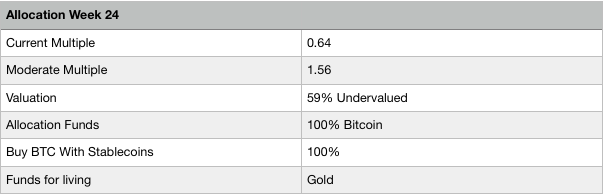

Bitcoin Google searches rising

From the 9th of June Google searches for the keyword Bitcoin are on the rise. Price and Google searches are correlated but it is hard to say what the leading indicator is. I did some investigation by comparing the recent tops and bottoms and it turns out that both of them sometimes start the trend first. This rise in searches won’t promise anything but it could be an indicator that interest is coming back and a new uptrend will follow.

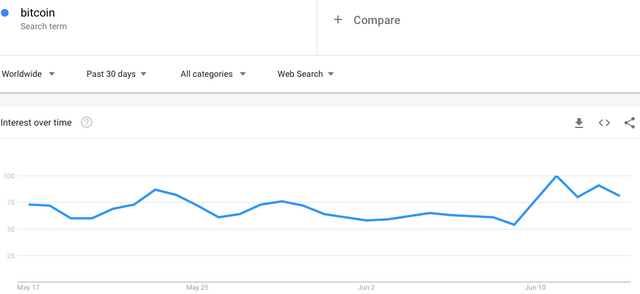

Three times more transactions on Dogecoin than on Bitcoin Cash

Over the last week there were more than 3 times more transactions on Dogecoin than on Bitcoin Cash and it is not a single spike, it looks more like a trend. This is remarkable because the market cap of BCH is 45 times higher than the market cap of DOGE. The amount of transactions on peer to peer payment network is one of the most important factors for the valuation, and BCH turns out to be almost 150 times more valuable per transaction than DOGE. Where is all this value coming from?

When you believe the BCH isn’t overvalued, Doge is a HUGE buy LOL

EOS stuck

EOS going main net is not going smoothly, first voting didn’t work out well and later the network was frozen. Voting required the private key to be online and multiple bugs were removed at the last moment. For a heavily funded project it doesn’t go really smooth.

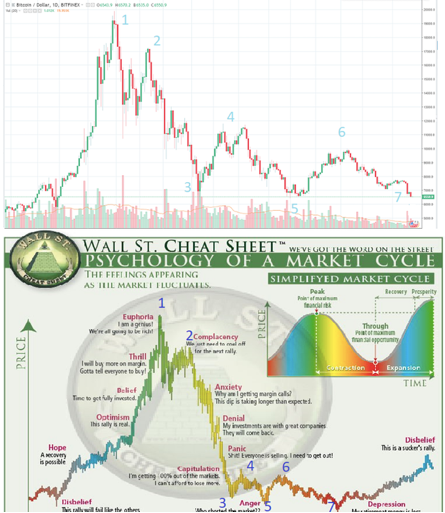

Bitcoin chart VS Wallstreet market cycle cheat sheet

The Bitcoin chart of the last year looks amazingly like a typical market cycle complete with a bull trap and a triple bottom. This could indicate that the low for this cycle is set, but historical results are no guarantee for the future. Time will tell.

The Bitcoin price is down again this week

The Bitcoin price went down 9.5% this week from 7259 to 6564 dollar. We are now hoovering around the 6500 for a while near the 3rd bottom after the crash. The biggest influencer of the price was the manipulation news this week and technically the moment of truth is coming closer. When we break to the downside a crypto winter can be expected, but when we break to the upside it could signal the end of the bear market. Since the volume is extremely low, whales can play the market relatively easy now, so technical analyse could terribly fail when a whale decides he want it different.

Fundamentals and valuation

In the history of Bitcoin the multiple was lower than today only 5.65% of the time. Since the multiple today is 0.64 while the moderate is 1.56, there is 59% discount on BTC according to this valuation method!

Long term the prospects are still extremely bullish. Lightning Network and Segwit adoption are growing and improving faster than expected and can boost adoption for day to day payments, micro transactions and even Dapps. Wall Street, governments and central banks are on the sidelines to come in and could inject huge amounts of money. Short term sentiment is neutral to bearish, but for the long term almost everything is bullish.

Disclaimer

This is no financial advice, just my view on the market.

Never stress in a bear market anymore: Follow my diversification protocol

Store your Bitcoins securely

Ledger hardware wallet

Trezor hardware wallet

Trade Cryptocurrencies

Binance Exchange

Buy Bitcoins anonymous with cash

Localbitcoins

Protect your privacy with VPN and pay with crypto

Torguard

Buy gold securely with Bitcoin and store in Singapore

Bullionstar

Like this post? RESTEEM AND UPVOTE!

Something to add? LEAVE A COMMENT!

It is very interesting to follow your original research using the Mayer Multiple. I take it that you are DCA'ing currently? If so at what rate are you buying?

I have also posted some research here about the benefits of DCA, but have yet to investigate what the rate of DCA (Daily, Weekly, Monthly) does to your average price.

Thanks for your comment! Actually I am not able to DCA because in 2014 I started to invest in BTC, 2016 went all in and summer 2017 quit my fiat job to go work full time in the crypto world. Since then my income comes from some bitcoin related affiliate sites that pay in BTC and Steemit. So my entire investments AND income is in crypto.

The visitor count on my websites is way more volatile than the Bitcoin price itself, in the bull run it earns money like water and in the bear it almost dries up, around 98 percent down. This is exactly the reason why I created this protocol, in the next cycle I want to have accumulated a solid stack of gold that enables me to survive the bear market without stress.

I have nothing to worry yet, I still can live good. But it is extremely frustrating to have to cash out BTC for living while you know it is extremely overvalued. Actually I am forced to make a trade whereof I know that it will be probably the worse trade you can ever make, but we all have to eat. Long story short: All the BTC I have left after cashing out for living will go in this protocol, some weeks it will be a lot and other weeks it will be nothing or even negative. Mostly depending on the market.

Same boat, we have to eat.

You are welcome and thank you for your reply :) That's really interesting - you seem to be in the opposite position than most people, I've encountered. I think that makes your project even more fascinating.

It makes a lot of sense to me that you want to scale into something else than crypto. Is it ideological reasons that keeps you from fiat or even property, bonds or stocks? Or is it because you put enough trust into your model and BTC being undervalued? If I were in your position, I would surely consider such ways as not to "put all my eggs in one basket".

But Kudos for jumping all in at 2016, it seems like one of these life changing decisions and I am surely more risk adverse than you :)

Nice

Go here https://steemit.com/@a-a-a to get your post resteemed to over 72,000 followers.

Coins mentioned in post:

You have recieved a free upvote from minnowpond, Send 0.1 -> 2 SBD with your post url as the memo to recieve an upvote from up to 100 accounts!

Nice read. I leave an upvote for this article thumbsup

Go here https://steemit.com/@a-a-a to get your post resteemed to over 72,000 followers.

This post has received a 26.82 % upvote from @booster thanks to: @michiel.

I love these posts. Are you using it with dollar cost averaging to get started? I'm in agreement with you about Tether being priced into the market for a long time now. I'm frustrated at the down turn but that comes with the territory.

You got a 30.26% upvote from @upme thanks to @michiel! Send at least 3 SBD or 3 STEEM to get upvote for next round. Delegate STEEM POWER and start earning 100% daily payouts ( no commission ).