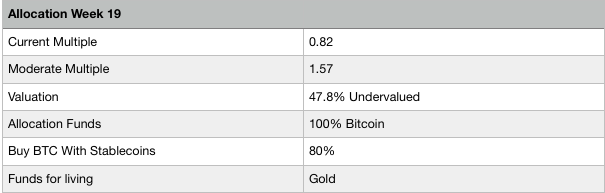

Weekly Update Diversification Protocol Week 19 - Multiple 0.82 - 47.8% Undervalued - Long Term Extremely Bullish - 100% In BTC - Living Off Gold

Today is the 7th weekly update of the Diversification Protocol. This protocol is designed to allocate a weekly income or funds to be invested mostly to BTC when it is undervalued and mostly to gold and optional stable coins when BTC is overvalued. It also tells you to spend gold for living when BTC is undervalued and BTC for living when it is overvalued. This will create higher returns on your investment through a full cycle and reduce stress in a bear market. HERE you can read the protocol in dept.

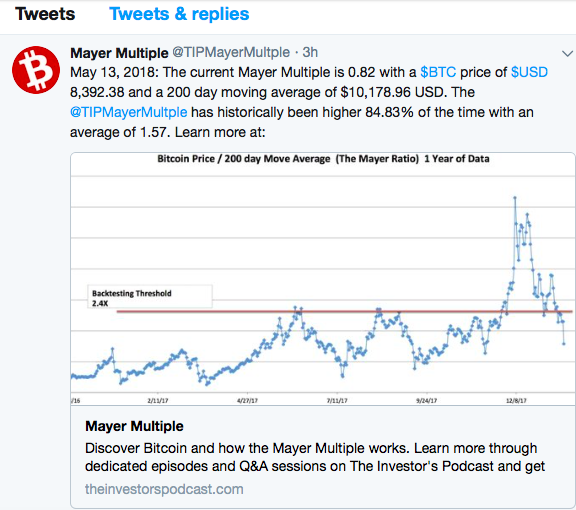

The valuation is done by using the Mayer Multiple and compare it to historical values. The Mayer Multiple is the current BTC price divided by the 200 day moving average. We use data from mayermultiple.com. When you want to be updated on the multiple several times a day you can follow THIS twitter account.

Because I just started the protocol, I didn't accumulate gold and stable coins yet. In this update I will exactly follow the protocol, but since I only start saving gold and stable coins from a multiple of 1.6, I will only be able to execute it 100% according the rules after that point is broken. Funds invested in BTC today will eventually at least partly be converted to gold, since the BTC accumulates in the same wallet and a percentage of the total BTC in this wallet will be allocated to gold at higher valuations.

The current multiple

Weekly allocations of funds

The protocol will be slightly boring till we get to a multiple of 1.6, till then we allocate 100% in BTC because it is undervalued. With the current 200 day moving average we need a BTC price of over 16,375 USD to start allocating to gold and Stable coins. This can take days or months, but it is good to be prepared already.

Important news of the week

Huawei launched a Bitcoin wallet

From now on every Huawei user can download the BTC.com wallet in the app store, but more importantly all new devices will have this wallet pre-installed on default! The global market share of Huawei is 11.8% and growing, so from now 11.8% of the smartphones sold anywhere in the world will have a Bitcoin wallet installed.

In China this is even a bigger deal, the marketshare here is 20.4% and Bitcoin wallets are more difficult to download because the government is blocking most of the foreign app stores. This will certainly boost adoption, especially when other manufacturers follow.

NYSE plan to offer Bitcoin swap contracts

The New York Stock Exchange is planning to offer Bitcoin swap contracts to make Bitcoin more accessible for institutional investors. The swap contracts will guarantee physical delivery, so it will directly influence supply and demand. This is really HUGE news, it means that Bitcoin will be available at the heart of Wallstreet and that REAL Bitcoins will be traded!

Iranians use Bitcoin to avoid sanctions

Iranians turn to Bitcoin to avoid sanctions and the direct negative results of it. They convert their local money to Bitcoin to still enable themselves to send it abroad and to protect it against strong devaluation caused by the sanctions. By holding their value in Bitcoin it can’t be frozen or seized and transactions can’t be stopped.

https://www.newsbtc.com/2018/05/10/iranians-turn-to-bitcoin-amid-iran-nuclear-deal-crisis/

Three billionaires share their negative perception about Bitcoin

Warren Buffet, Charlie Munger and Bill Gates don’t like Bitcoin. Warren Buffet said this week that Bitcoin doesn’t create anything, Charlie Munger compares trading Bitcoin to trading fresh harvested baby brains (WTF!?) and Bill Gates said that he would short it when he could do it easily.

All three of them are greatly benefitting from the (sick) current system and could lose a lot of power when they get disrupted by Bitcoin. It is totally expectable that they speak out against Bitcoin instead of in favour of it, and the pathetic way they do it signals that they are desperate. It is actually not bearish but extremely bullish that the wealthiest and most powerful people on earth can’t deny it anymore and start to fight it.

Warren Buffet about Bitcoin

Charlie Munger about Bitcoin

https://cointelegraph.com/news/bill-gates-id-short-crazier-speculative-bitcoin-if-i-could

Mt. Gox coins are moving

This week another 8200 bitcoins moved from the wallet of the Mt. Gox trustee. Traders are following these coins closely because it was probably one of the reasons behind the previous bear market. Every big drop was accompanied with a transfer of a big stack of bitcoins from one of the wallets of the trustee.

https://blokt.com/news/mt-gox-cold-wallet-moves-8200-btc-will-bitcoin-dump

The Bitcoin price dropped almost 15%

The Bitcoin price tanked from 9847 to 8411 dollar this week. All three of the above described positive news events are really good news. My claim is that the value of Bitcoin went up a lot while the price was going down. Short term the price was pushed down by the moving Mt. Gox coins and the negative words of the famous billionaires while this didn’t change anything on the fundamentals.

The good news events DID change the fundamentals: Bitcoin wallets on Huawei devices will boost adoption as a medium of exchange, the NYSE Bitcoin Swaps will increase the demand for Bitcoins and open the floodgates to institutional investors and the situation in Iran is proving the permissionles character and censorship resistance of Bitcoin and shows it to the entire world where many are facing the same issues.

<Tanking price and rising value means DISCOUNT!

Fundamentals and valuation

In the history of Bitcoin the multiple was lower than today only 15,13% of the time. Since the multiple today is 0.82 while the moderate is 1.57, there is 47,8% discount on BTC according to this valuation method!

Long term the prospects are still extremely bullish. Lightning Network is still growing and improving and can boost adoption for day to day payments. Wallstreet, governments and central banks are on the sidelines to come in and could inject huge amounts of money. The sentiment is positive, but the chance of a bull trap is still present.

Disclaimer

This is no financial advice, just my view on the market.

Never stress in a bear market anymore: Follow my diversification protocol

Store your Bitcoins securely

Ledger hardware wallet

Trezor hardware wallet

Trade Cryptocurrencies

Binance Exchange

Buy Bitcoins anonymous with cash

Localbitcoins

Protect your privacy with VPN and pay with crypto

Torguard

Buy gold securely with Bitcoin and store in Singapore

Bullionstar

Like this post? RESTEEM AND UPVOTE!

Something to add? LEAVE A COMMENT!

This service looks interesting I'll have to look into the protocol you have created. It can keep one prepared for the turns in the market.

This is a very interesting approach. I diversify within crypto among about 10 currencies, but haven't looked at this valuation metric before.

Diversification takes out the idiosyncratic risk of each individual investment, and offers a more balanced portfolio, without sacrificing returns. This protects you from a failure of anyone particular protocol, bad execution, legal issues, poor technology and so on.

It needs a great skill to make a big mark in crypto.

It is thoughtful.

where the price of steem today decreased $2.27| $30.3| $2.09|

Still excited for steemit.. trading btc

True Chain (True)

$2.64 USD (28.20%)

0.00030746 BTC (25.32%)

0.000380878 ETH (21.52%)

Helplful post sharing bro

Your post is helpful and informative. Today is bad day for cryptocurrency. But, I believe that, cryptocurrency is good oportunity........

Great work! Thanks for the article.

This post has received votes totaling more than $50.00 from the following pay for vote services:

upme upvote in the amount of $52.06 STU, $87.86 USD.

rocky1 upvote in the amount of $52.73 STU, $89.00 USD.

smartsteem upvote in the amount of $50.42 STU, $85.10 USD.

buildawhale upvote in the amount of $48.34 STU, $81.59 USD.

For a total calculated value of $204 STU, $344 USD before curation, with approx. $51 USD curation being earned by the paid voters.

This information is being presented in the interest of transparency on our platform and is by no means a judgement as to the quality of this post.

What does it means?? :O

Good post .informative post...thanks for this shareing