If You Zoom Out It Is So Obvious - Bearish Stocks And Bonds - Bullish Gold And BTC - Long Term!

Everyone is analyzing charts on small time frames and reacting on short term FUD and news in the markets, but if you have a long term investing horizon the picture is quite obvious in my opinion. With a long term horizon I mean that you invest in assets that you hold on to for years. Also there will be a chance to get some short term losses, but if you hold through and focus on the long term vision you believed in it will pay off eventually. You only lose or win when you sell, so don't trade emotional when things go the other direction for a while, but keep focussed!

When you zoom out it is quite obvious

When you think long term you will filter out all the daily noise and invest on the bigger cycles. These are way easier to identify and with a long term horizon the entry point is not that important. Furthermore you will safe a lot of time and transaction fees because you don't have to trade every day.

Stock market SELL!

The bull run for stocks is already ten years underway, this makes it the 2nd longest bull markt ever. This fact on itself is suggesting that a crash could happen soon. Furthermore the technicals doesn't look good and a looming trade war and rising interest rates could trigger a huge sell off. With a P/E ratio of 27, the S&P is heavily overvalued (moderate around 15). Furthermore the entire growth was fueled by money printed out of thin air and dept, when this goes down it could goes hard!

What will it be? A double top or a triangle? Both bearish like hell!

Bonds SELL!

The bond market is in a multi decennia long bull run because of a long term downtrend of interest rates. Bonds become more valuable when interest rates drop and less valuable when they rise. The interest rates recently broke out of a 30 year (!) downtrend, this could very well be the end of the uptrend of bonds too!

The interest rates are clearly breaking out of a 30 year downtrend, bond prices are inverse related......

BTC (and some other quality crypto) BUY!

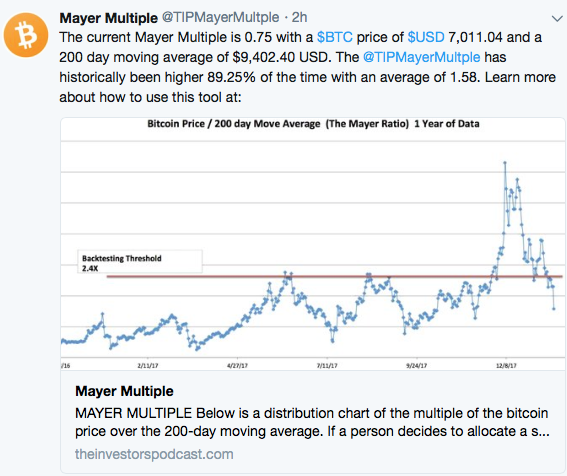

BTC just been through a crash of 70% and it is not sure if it is over yet. However, what is sure is that BTC is now heavily undervalued in almost every metric. According to the Mayer multiple BTC is now trading more than 50% below fair value, the relative price was only lower than today around 10% of the entire history of BTC!

Also the fundamentals are incredible good, amazing new tech is being rolled out and BTC is becoming a real serious asset class. I am very confident that Bitcoins that are bought today will hugely gain in value over the next years, even when the price tanks more in the short term.

The relative price of BTC is extremely low at the moment!

Gold BUY!

Gold is in a very nice uptrend since 2001. The uptrend goes almost in a strait line except for the bubble in 2009. A beautiful triangle is forming in the last two years and the breakout is near. The breakout could happen around the same time as the stock market crash and trigger a new bubble. Furthermore, seen the enormous amounts of money that is printed in the last decennium an asset that is immune to inflation is not a bad idea!

Gold is in a very nice long term uptrend and on the edge of a break out of a two year triangle that could trigger a 2009 like bubble!

Conclusion:

I think stocks and bonds are heading into the last phase of the cycle: THE CRASH. It is likely that BTC is already through (the biggest part of) the crash and will soon start a new cycle. Gold is probably still in the middle of a bull run, that might be maintained as long as the extreme QE goes on. Because stocks and bond will probably be driven in the opposite direction as gold and BTC over the years to come, I think good money can be made if you are on the right side of the trade.

Disclaimer

This is no financial advice, just my view on the market. Markets are unpredictable and can go in any direction. When you trade or invest you should do your own research and you are responsible for your own losses.

Never stress in a bear market anymore: Follow my diversification protocol

Store your Bitcoins securely

Ledger hardware wallet

Trezor hardware wallet

Protect your privacy with VPN and pay with crypto

Torguard

Buy gold securely with Bitcoin and store in Singapore

Bullionstar

Like this post? RESTEEM AND UPVOTE!

Something to add? LEAVE A COMMENT!

I could not agree more @michiel! I think you are spot on, I am very leery of many current metrics right now and even the fundamentals to international markets as well. Any kind of hiccup in the finance world is going to send markets falling. When that happens I think crypto gets more looks by the masses in exponential numbers each time that happens. Good stuff @michiel!

We are going higher. Called the lows yesterday and this morning gap down and explosion up confirms it.....

https://steemit.com/money/@heyimsnuffles/newsflash-btfd-markets-are-holding-where-they-need-to-bullish

That's the power of btc and crypto. Excellent explanation sir @michiel.

Post @michiel is very useful for others thank you for sharing

This is a great thing! Once stocks and bonds fall and Bitcoin rises then there will be more money coming into crypto that will lead to mass adoption. This is what I think what about you @michiel

this is worth in keep in mind, it is to be aware of hin achieve success in btc, thanks very interesting post @ michiel.

You got a 6.22% upvote from @postpromoter courtesy of @michiel!

Want to promote your posts too? Check out the Steem Bot Tracker website for more info. If you would like to support the development of @postpromoter and the bot tracker please vote for @yabapmatt for witness!

This post has been upvoted and picked by Daily Picked #21! Thank you for the cool and quality content. Keep going!

Don’t forget I’m not a robot. I explore, read, upvote and share manually ☺️

interesting post @michiel you are great