Bitcoin (BTC) VS Bcash (BCH) - A Closer Look At The Transactions - Decide Yourself!

The war between Bitcoin and Bcash is raging on and many are left with confusion. Some sources say that BCH is the real Bitcoin and other call it a scam. Some say that Bitcoin is broken, not usable anymore and even compromised and others say that Bcash is insecure and centralised. Let’s ignore all the noise for a while and look at the facts.

People can say whatever they want, only facts speak the truth!

Let’s have a closer look at the transactions.

Transactions are the main purpose of the Bitcoin and Bcash blockchain, so the amount and quality of the transactions can give us an idea how valuable both networks are for it’s users. When we compare the transactions and the price of both networks we can estimate which one is valued better as a medium of exchange.

###The amount of transactions

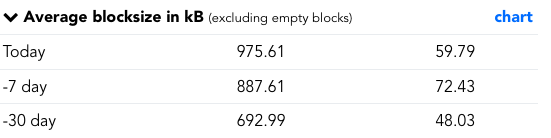

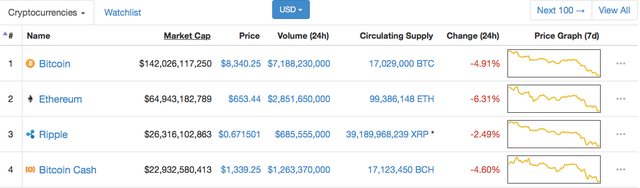

Today there were 16,31 times more transactions on the Bitcoin blockchain and over the last week 12.25. Over the last month there are 14.43 times more transactions done with BTC than with BCH. This means that there are almost 15 times more transactions on the BTC network, while the price is only 6.22 times higher. This means that Bcash is valued 2.32 times higher per transaction than Bitcoin.

Around 15 times more transactions take place on the BTC network

The BTC price is 6.22 times higher

Transaction value

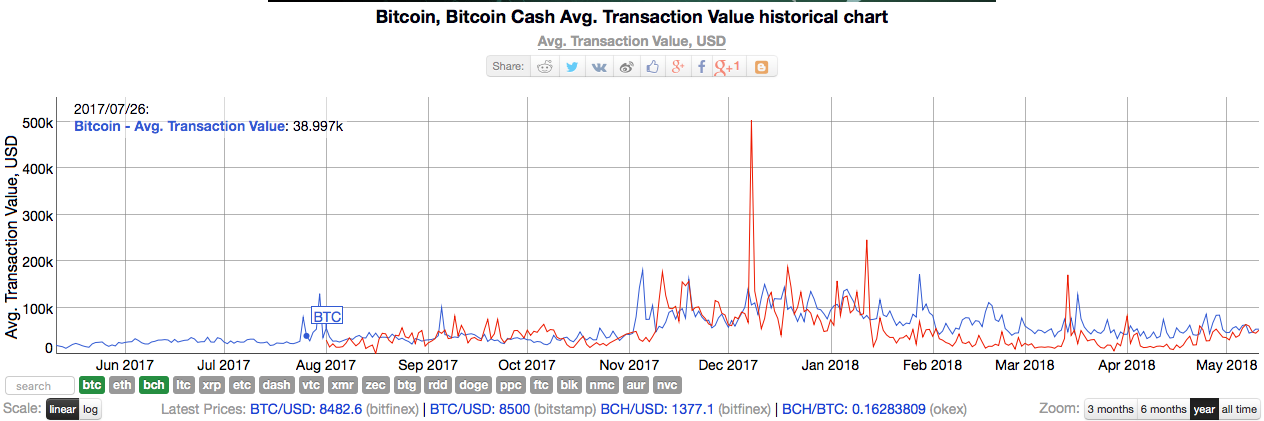

The Bitcoin network is used for higher value transactions than the Bcash network. It is interesting to see that normally the USD value per transaction is around two times higher on BTC while during the three pumps that took place in Bcash the value per transaction reached parity.

Does anyone know why the value per transaction is reaching parity during every Bcash pump? Please let me know in the comments!

The value per transaction is important for the valuation, because to send bigger amounts of money people need to hold bigger stakes. This will increase the demand and thus the price. BTC has not only more transactions compare to the total market capitalisation, but there is also more money send per transaction.

Transaction efficiency

Because Bitcoin had a period with high transaction fees the fee market caused users to use the network more efficiently. Weekly payments were done monthly and less necessary transactions were cancelled or postponed. Even more important is the fact that businesses like exchanges started with batching. This means that they combine a bunch of transaction in one single transaction.

Many businesses started to do this in the downturn from January until now and this made the transaction count smaller while the same amount of payments was made. Considering this I think that there are way more than 14.43 times more transactions on BTC than on BCH, I would estimate it between 15 and 20 times more.

Second layer solutions

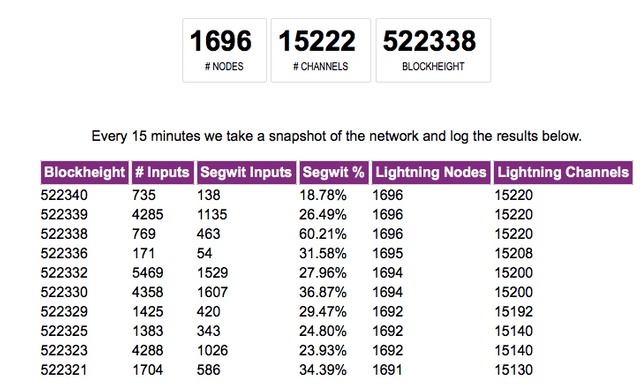

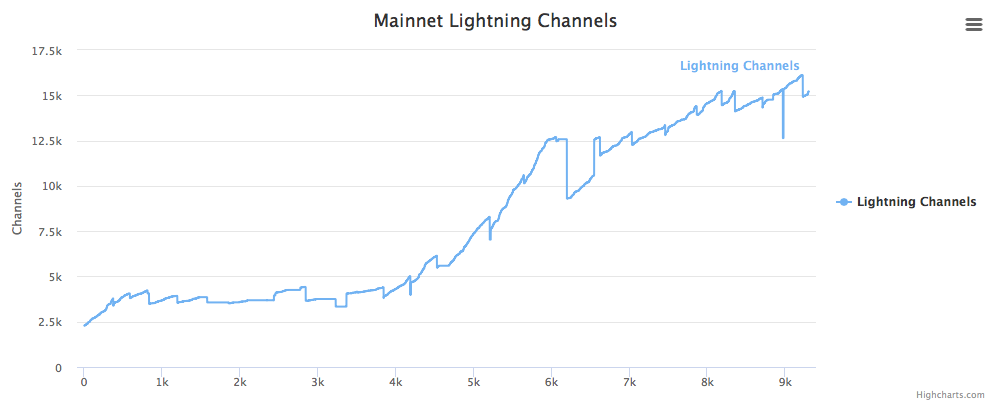

Lightning Network is now in Beta and growing fast. Transactions that take place on the Lightning Network are mostly not recorded on the blockchain and thus not counted in the earlier figures. It is hard to measure how many transactions are made on LN today and I don’t expect it to be very relevant compare to the onchain transactions yet, but seen the explosive growth I think it will become relevant soon. Beside LN also Rootstock (RSK) and Liquid will add to the total transactions while they are not registered.

Lightning Network is growing fast!

Transaction cost

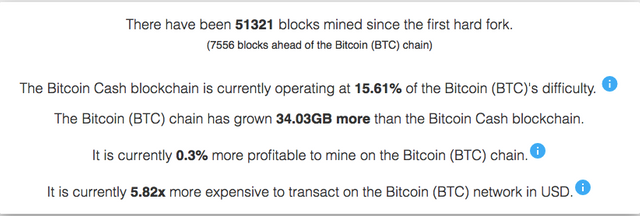

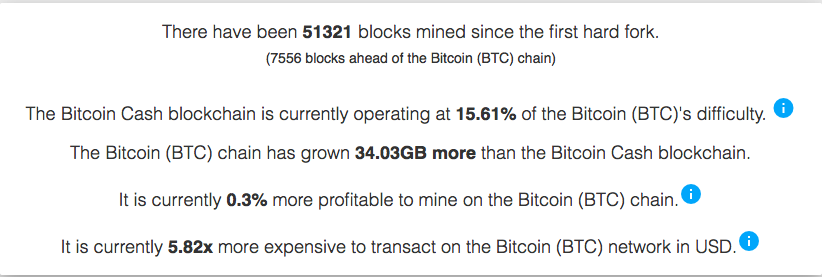

Transactions on Bcash in USD terms are cheaper, but the Bcash price is also lower. Fees are calculated in Satoshi per Byte, so if the price of a currency goes up the fees will go up too. If Bcash would be at the same price as Bitcoin, the fees would be even higher!

At the moment a BTC payment is 5.82 times more expensive than a BCH payment, but since the Bitcoin price is 6.22 times higher it would be more expensive to make an onchain transaction on Bcash when the price was at the same level.

Lets also compare the store of value function

Beside transfer of value Bitcoin is used as a store of value too. This is maybe even a more important issue to consider when doing a valuation because one user who want to store his value will probably demand a way bigger amount of BTC to serve his purpose than someone who want to make transactions.

You can see the wallet of a user who uses BTC as a store of value as a saving account and wallets for daily spending as a spending account. Say that a saver keeps in moderate 10.000 USD in his account and someone who intends to transact only 500, then a store of value user is causing 20 times more demand and thus driving the price up much more.

Decentralisation

Decentralisation is a very important feature to function as a store of value. Centralisation creates a single point of failure / to attack and increases the chance of fraud and corruption. Bitcoin is more decentralised on every measure:

Consensus

Consensus in Bitcoin takes place through a long hard fight between opponents, it is very hard to make fundamental changes. All hard forks in the recent years on the main chain have failed and that brings huge value to the HODLers. Investors can be certain that the Bitcoin they buy today will still be the same Bitcoin in 5, 10 or 20 years and will still have the same valuable features.

Bcash is forking regularly and there is no discussion to come to consensus at all. Forks that are making fundamental changes and not backwards compatible can be made whenever the leaders want to. An investor will not be Able to estimate what a BCH that he buys today will look like in the future.

Miners

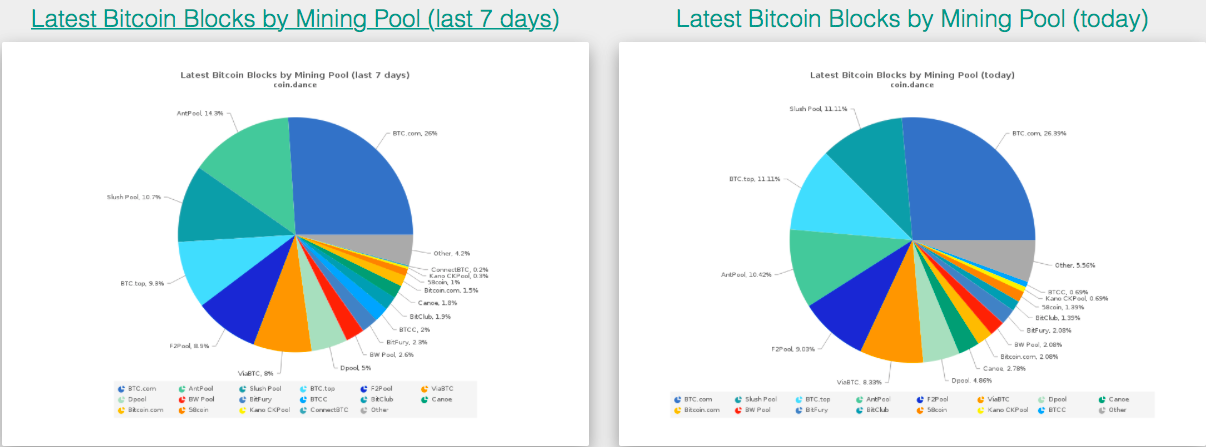

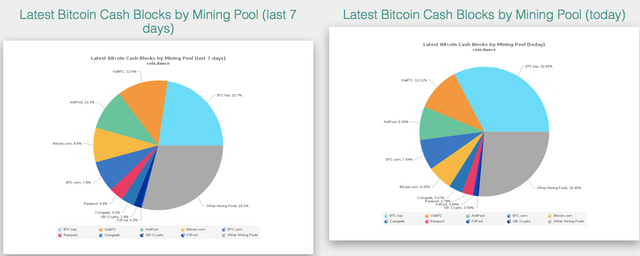

As you can see below, mining is much more centralised in BCH than in BTC. Centralisation is more likely to get worse in BCH because propagation takes longer because blocks are bigger (miners in the centralised area will get most blocks earlier than the rest of the world, the big firewall makes this even worse) and the absence of Segwit enables them to use Asicboost.

Centralisation of miners can lead to censorship, double spending and failure of the consensus system. This is bad for HODLers and spenders as well and will greatly reduce the value of the network. Beside that, miners hold huge stacks of BCH compare to BTC and when they start dumping they can crash the price.

Bitcoin mining is a bit centralised..........

But in case of Bcash it is worse and less transparent

Security

The security is dependent on the amount of hash power that miners deliver to the network. Bcash has only 15% of the hash power, so BTC is 6.66 (LOL) times more secure. Also, a colluding part of the BTC miners can successfully attack BCH, but BCH miners can’t attack BTC. Furthermore, the having will take place in BCH earlier than in BTC, and it is expected that many miners will leave BCH then to mine the more profitable BTC. Temporary slow confirmation of transactions and low security is expected.

Track record

Bcash is in existence only for 9.5 months while Bitcoin is around and functioning for 10 years already. Bcash had periods of hyperinflation and extreme low security and long block times because of the flawed EDA while Bitcoin was always functioning well if you paid a proper fee although that could be high in 2017.

Since BTC is up and running around 12 times longer it is better tested and has proven itself way better. Beside that the network effect and bigger infrastructure adds to it’s odds.

Conclusion:

Bitcoin has 14.3 times more transactions and the value of these transactions is around 25% higher. Beside that batching and 2nd layers are adding additional unregistrated transactions what I would conservatively estimate on an extra of 10%. I estimate that the total value of the transactions on BTC is 14.3 x 1.25 x 1.10 = 19.66 times higher than on BCH while the price is only 6.22 times higher. This leads to an over valuation of 19.66 / 6.22 = 3.16 times.

This means that Bcash is 3.16 times more expensive than Bitcoin when the value as only medium of exchange is compared to the price. On top of this comes the value as a store of value that is obviously way higher for Bitcoin.

I think Bcash is 4 or 5 times more expensive than it should be based on fundamentals. The price is mostly driven on hype and manipulation. With the current Bitcoin price a fair Bcash price would be somewhere between 267.85 and 334.81 USD (current price divided by 4 and 5). The rest is all hot air caused by hype and manipulation. When you compare the fundamentals of Litecoin to Bcash you will come to the same conclusion.

Disclaimer

This is no financial advice, just my view on the market.

Never stress in a bear market anymore: Follow my diversification protocol

Store your Bitcoins securely

Ledger hardware wallet

Trezor hardware wallet

Trade Cryptocurrencies

Binance Exchange

Buy Bitcoins anonymous with cash

Localbitcoins

Protect your privacy with VPN and pay with crypto

Torguard

Buy gold securely with Bitcoin and store in Singapore

Bullionstar

Like this post? RESTEEM AND UPVOTE!

Something to add? LEAVE A COMMENT!

i`m still on btc side

BCH a fraud

semantically speaking bitcoin is bitcoin and Bcash is Bcash. Personally i dont see the longterm usecase for bitcoin or its forks outside of being reserve currencies for the greater market.

I see the coins with actually utility and scalability becoming more important than bitcoin.

The blockchain technology is the true gem in this story and bitcoins Blockchain isn't really that useful compared to it rivals. eventually as investors become more educated in the space they will begin investing in utility over popularity.

btc is the crypto reserve currency

Currency? Like Fiat? BTC is no Money?

Maybe the best valuation article I have read. Forbes and all these newspapers trying to cover this should buy your article so they can publish.

I am surprised the transactions are that different than the price ratio. And bitcoin has some off chain transactions while bch has memo cash. Nice note. I still think it’s too risky to not have the same number (not same solar amount) of both.

Bitcoin is the original and dominant cryptocurrency. Bitcoin was the invention of blockchain technology and it is rapidly becoming a new asset class for investors and possibly the future of digital payments and peer2peer transfer of money.

Bitcoin Cash is a recent offshoot of Bitcoin when a Bitcoin mining company and a few developers and investors in the Bitcoin community decided to make their own coin, but brand it with the “Bitcoin” name for legitimacy.

agreed

Thanks for the info bro!!!

Great article.

Also interesting to note the lack of full nodes running on the bcash network. As a matter of favt theres actually already more lightning nodes running on the btc mainnet than there are Bcash full nodes total. Bcash is centralized

You forgot to mention that in 2016, Bitcoin BTC was taken over by the Bilderberg Group, and ruined with high fees.

All links & proof below.

Flowchart

Links & Proof

Today:

All my claims are documented & sourced.

Sure it is....