Crypto-currency market in the year 1974.

Trading method ANALOGUE

According to this trading method, the market of crypto currency will grow 10 times.

Understanding the "Analogue"

The analog model uses one data array to predict the results of work with another, similar array of data.

In the context of investments in securities, the analogue is the period of time when an array of trading data is consistent with another set of trading data. Sometimes such arrays can separate decades.

That's exactly Paul Tudor Jones, our young trader, and earned his $ 100 million in 1987. He, together with his partner, Peter Borysch, made an astonishing discovery.

Analyzing the great bull market of the 1920s, Borysch realized that he had seen similar data tables before, then he got data on the bull market of the 1980s and compared two arrays.

After Borish manually entered data on the discoveries of the Dow Jones index, highs, lows and closures in the 1920s and 1980s, he discovered something striking.

Both markets, which separated six decades, showed almost identical movements, which coincided in 92% of cases. Tudor and Borysh called their research "Analog".

They put all the funds of their young hedge fund to continue work on the "Analogue". In 2014, an article in Business Insider mentioned the method "Analog" in the quote of Tudor Jones about the striking results of his work in 1987. Answering the question how he managed so smartly to make money on events that no one knew about, Jones says: "Our model is an analog of the market movement in 1929 ..."

Throughout the 1980s, Jones followed his method. "Analogue" was a secret road that led Jones and his investors to a real gold vein.

Our "Analogue"

Sitting in an unfinished conference room in Las Vegas in January 2016, I finally realized that I discovered the colossal potential of cryptographic assets.

At that moment, I realized that I had opened a striking opportunity to get rich, comparable to the technological boom of the 1990s.

I saw that in the 80s and 90s, in just a few years, information technology, personal computers and the Internet evolved from some kind of ridiculous spectacles to the basic necessities.

This evolution has become for me the "Analogue" of how the crisis-exchange market will develop.

I knew that cryptoscopes also do not understand how information technology was at one time, I knew that cryptoscopes would face serious skepticism, but in the end they would have an impact on virtually all aspects of our lives.

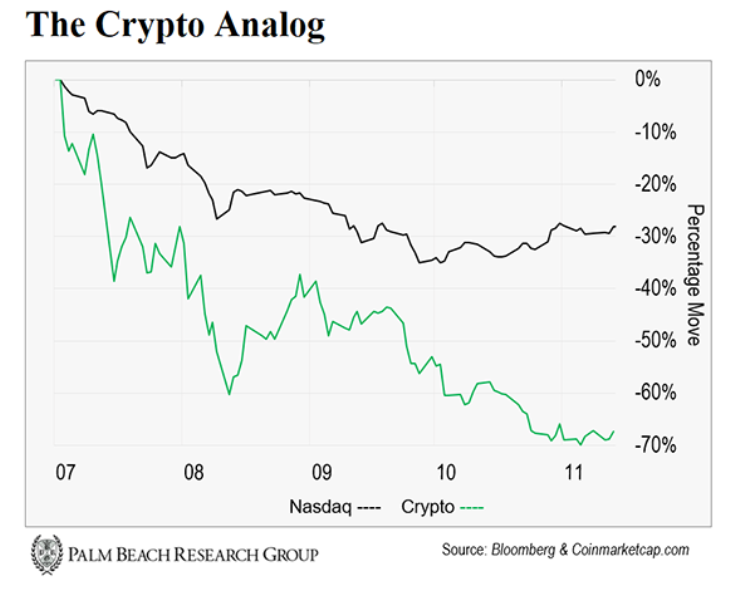

Even the bounce that is currently going through the cryptorets is similar to the rebound in the information technology market in 1990. Just as the market of the 1980s repeated the market movements of the 1920s in the study of Peter Boris, the market for cryptography clearly follows the trajectories of the 1990s.

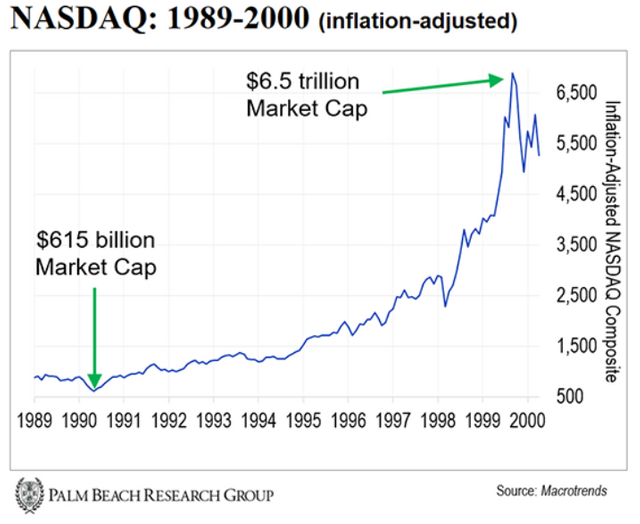

At the moment, we see an 87% correspondence between the movements of the Nasdaq index in 1990 and the market is crying out in our time (see graph).

Although these markets are 27 years apart, the correspondence between them is striking. You will see that the Crypto currency market is more volatile and moving faster.

The reason is that in our time everything is much stronger interconnected. In other words, information moves faster and spreads much more around the world now than in the 1990s. Thus, the up and down movements occur faster, and their amplitude is stronger.

According to Analog, soon we will see a new phase of the bull market. If it repeats the restoration of the information technology market after the 1990s, we will see growth in the market in April-May this year.

In 1990, the market reached its peak in 14 months. If the market kriptovalyut reiterate this movement, we will see the rally of the market as a whole by 300%.

However, considering that the global currency market is crypto-active (cryptoactive assets are traded all over the world, and not within a small region, as the shares of technology companies in the 1990s), we expect the market to reach peak values about two times faster than it happened on the market information technology in the 1990s.

Thus, we will see peak values in November.

It's too late to go in?

Most often they ask me: "Is it too late to invest in crypto-currencies?"

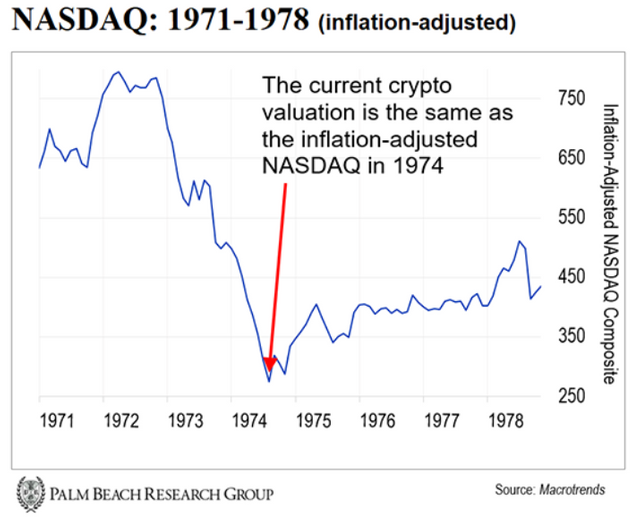

To answer this question, I prepared such a schedule.

The current (more than a week ago) market assessment of the Crypto-currency is the same as the Nasdaq index in 1974, adjusted for inflation

The graph shows that the current market volume of the Crypto-currency is equal to the Nasdaq index in 1974, adjusted for inflation.

Let's compare 1974 with our time using the following chart:

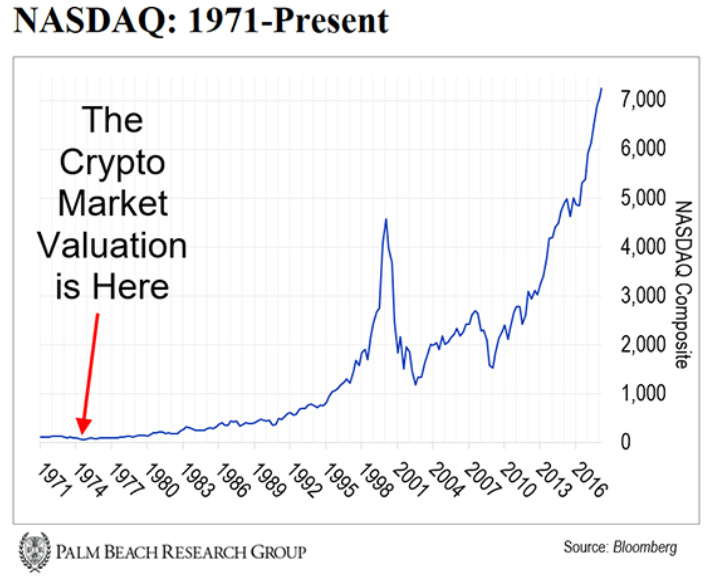

The market valuation of the Crypto-currency is at the point corresponding to 1974 on the Nasdaq index chart

Do you still think that crypto assets are expensive?

You can see that 1974 was the most successful time for entering the Nasdaq index. He began his long-term movement up, which did not stop until 2000. The market of crypto currency will move in this way, with only a slight difference ...

Everything will happen much faster.

As I explained earlier, due to the fact that in our time everything is much more closely interconnected, prices are becoming known much faster ... thus the price movements become bigger and sharper.

Since the beginning of the work in the market of crypto currency in 2016, I have gone through the bull market for the ninth time and for the fourth time many assets in my portfolio have fallen in price to 85%. I'm not particularly worried about this, because we are at the very beginning of the journey.

The graphs above show that the market of the Crypto-currency is traded on the basis of the 1974 Nasdaq index. Imagine that you are buying the Nasdaq index during the 1990 sales, but at 1974 prices.

It is precisely such opportunities that we now have in the market of crypto-currencies.

Even better, because in the 1990s the Internet was not yet a mass phenomenon. From the point of view of development, the current market is similar to the market in 1994-1995. Then the Internet evolved from some unusual thing into an object of serious institutional investment. 2018 will be a similar transition year for the crypto currency market, when institutional investors will begin to take it seriously.

The inflow of funds from institutional investors will provoke what I call the "Second Explosion" of the Crypto-currency courses. I will show how the statement about the forthcoming explosive growth of the market is supported by the "Analog" method.

Let's summarize the current situation:

*The evaluation of cryptology is comparable to the 1974 Nasdaq index.

*His movements are 87% consistent with the market movements of technology companies in the 1990s.

*The technological development and interest of institutional investors correspond to the period 1994-1995.

According to Analog, the price increase will be explosive.

Imagine an elastic band stretched according to the schedule from 2018 in 1974. According to the "Analogue" of 1990, our rubber band will recover, bouncing up sharply.

In 1990, the Nasdaq index fell to the 1982 level, before rising 10-fold from the 1990 minimum.

The change in the Nasdaq index, adjusted for inflation

Based on a conservative estimate using the "Analog" method, the Crypto-currency market will recover at around $ 2.6 trillion.

Summary.

According to "Analogue", the volume of the crypto currency market will grow at least ten times. This is enough to make you rich, not just to provide yourself with prosperity, namely, you have become rich.

You will see such explosive growth of courses cryptocurrency, that everything that you saw before, will seem to you insignificant.

The action plan is simple:

*If any asset is now below the recommended purchase price, and you do not yet have this asset, buy.

If you already have all the assets, just keep them. According to "Analogue", we are almost at the bottom. Remember, the sharpest upward movement is yet to come.

Source:http://telegra.ph/Na-rynke-kriptovalyut-1974-god-04-26