Is Bitcoin mining still profitable in 2019?

Huumm!! Could be either yes or no!

Actually, comparing to last year,2018, the situation has changed drastically. In 2019, mining competition is much more bloody tight and costly! It needs you know the main factors and parameters around bitcoin mining to decide if you can start and survive in this mining market. In 2018, I wrote an answer about the profitability of bitcoin mining and its necessary parameters. Anyone considered those parameters which I said, has survived in this bearish market. So take a look at that short article:

Is Bitcoin mining still profitable in 2018?

But what is the situation in 2019 what hardware we should invest in?

Last year maybe the electricity price of 5 cent$/KWh was ok even very good for bitcoin mining and those who achieved this cheap prices, established their farm but…..The situation didn’t go well and the crypto market value drop was way beyond the previous predictions and assessment! Even the pessimistic analysts couldn’t see this situations. If they say we knew that let me say they are liers or fools!! Stay away from them!

I would suggest the bitcoin miners to continue or start their mining if they access to energy price of below 3 cent$/KWh! Yes. That’s too cheap to achieve but this is the necessary situation. Otherwise, you should know you are in a huge risk of losing your investment.

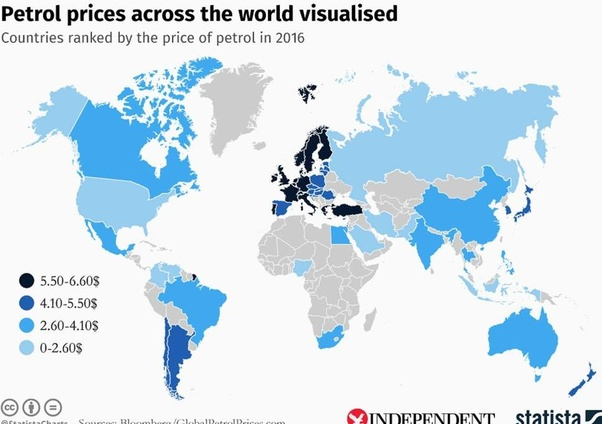

As I had said in my 2018 article that named some special regions as potential ideal places for mining, we could see now that I was right and those bitcoin farm who were mining in Canada, north Russia, Venezuela, Georgia, Iran and China survived in this market crash while unfortunately others left market by a big kick ass!

However, those losers opened a new opportunity for the survived players and made more profit for them by leaving the network and reducing of bitcoin difficulty. So you see it’s savage competition that means if you could survive and push others out of mining space the you will win more money by staying in the battle field! And let me say this, there is an unwritten rule in bitcoin world which is “someday Bitcoin will rip off the sky ceiling soon”. I still believe it will finally happen and I don’t know when though, but it will happen! And those who will have survived till then will gain a big wealth in their pocket.

Therefore, consider electricity price of 2–3 $cent/KWh for 2019 otherwise if you still wish to stay in the bitcoin mining battle field then you are on your own and you have got big balls! ;)

According to the mentioned energy price, Europe is already out in 2018! China is some kind of on the verge of leaving or staying as their electricity price could barely tolerate prices below 3 $cent/ Kwh and even the fact that most of Chinese miners are deploying coal energy for producing power will exacerbate the situation. Then miners in China should be very cautious and I know they are and they are seeking for new energy sources in other countries like Iran.

Georgia is still in the game and thanks to their huge source of hydro electricity they can offer energy in very low prices. However, I think those power capacity of them which is proper for mining could be full-in short term regarding big rush of miners to their potential regions.

Canada and Quebec county are among those ideal place for bitcoin miners and could offer very cheap hydro electricity in different part of them. Alberta is also a hub of mining for HUT8 Mining corporate and their mining containers with power consumption of near 60 MW if I am right.

Russia, especially north of it is still a very good place for bitcoin mining. You can have access to cheap electricity as well as very cold weather as a natural cooling of your mining farm. Their government also support and give incentives to those foreign investors who are interested to build huge mining farms there. One of cheap energy sources in Russia for mining is Nuclear power plants.

- HUT8 Corporate and its bitcoin mining containers in Alberta, Canada

Iran is one of the ideal place for bitcoin miners and recently several big mining farm owners are gradually providing themselves for transferring their bitcoin business into Iran. Regarding that Iranian foreign investment incentive law are among the best one in the world, It could be very lucrative place for huge bitcoin miners to transfer their facilities their at least till the time bitcoin price goes high enough to guarantee the profit margin. Since Iran is under heavy sanctions by US, many are scared to go there and avoid increasing their risk. However, if bitcoin price comes down more or even stay at its current price (now is 3600$ at 20 Dec 2018) this risk could easily get justified for those who prefer to survive more in the heavy bearish market condition.

To wrap it up, if you are interested in bitcoin mining in 2019 you should care about the energy price and the region that is going to provide that energy to you. You should be familiar totally with the governmental laws and rules of countries you want to land your facilities. And you should even pay attention to state or county rules in a country since it could changes from region to region!

Ok let’s assume you have access to very cheap electricity or even free and you don’t even concern about the power price, yep! So which hardware you should choose and what ROI(return of investment), ROR, (rate of return) and profit you could count on?!…I am going to tell you all these precious information all for free! ;)

Let’s take a look at the mining machines for 2019. If you remember we had a table already released on link below:

What is a good Bitcoin mining hardware?

According to answer above, we should choose our miner on the basis of efficiency factor which have reached to higher levels in 2019. We are talking about the increase of miners efficiency from 1% in 2018 up to 2% in 2019. But should we select the highest yielding miner with 2% efficiency?!…No!

Efficiency is not the only factor you should pay attention. You should also consider the credibility of manufacturing company who produces the miners. For example, the GMO, the high prestigious and high-tech company has opt out of miner production as the bitcoin price declined drastically in latest 2018! However, their machines where of high quality but they could survive in the market. And let me tell you, all the market of mining machine production is in hands of Chinese companies like the huge one Bitmain! Even we did’t hear any news from other new comers with their claimed big miners like AsicMiner, Ebang and Holic!

Also it’s pretty much long time that we haven’t heard any new release of Dragon Mint miner 16 TH/s from its company Halong mining which was once among top miners in the market!

But there still exist several companies in the market like the bigger one Bitmain producing famous Antminer and other ones like Canaan producing so-called Avalon miners, MicroBt producing Whatsminers and Innosilicon with product Innominers. We could also name Bitfily with SnowPanther miners but they don’t look long-lasting in this tight competitive market!

Apart from manufacturer credibility, the main factor of buying miners still depends on its price. So how much is it worth paying for a high-yielding high efficient miner?

I already covered an answer to how much ROR we should expect from our mining machines in topic:

Can I profitably mine $50 - $100/day of crypto-currency if I get free electricity?

In the above answer, in 2018, I have talked about the rate of return of (ROR) .006$ and called it as “Golden Rate”. However, due to unpredictable decline in Bitcoin price in late 2018 and also the improvement of mining hardwares with new 7-nm chips, we should expect lower ROR in 2019 and I would suggest the new Golden Rate as .004$ per day.

To be continued soon….(in Quora version)

Congratulations @merano! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking