Top 10 Tips for New Crypto Traders

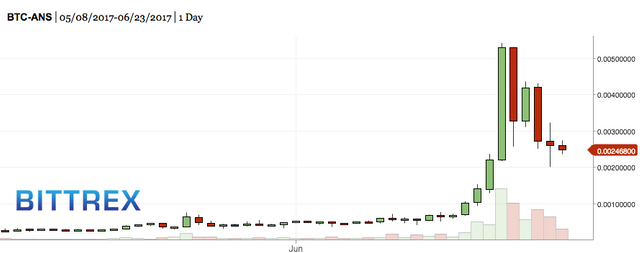

These ideas have proven helpful in my crypto trading. Many of these tips are equally applicable to stock or equity options traders. The chart below for Antshares (ANS) is a perfect example of the hype cycle for a crypto.

Decide how much capital you are willing to risk - How much capital do you risk? This is a foundational decision. Even if you make 2000% returns with a $100 portfolio, it will be difficult to make any real money. Conversely if you risk 100% of your $50,000 in savings in crypto and gamble it all away, this could threaten the financial security of your family. Some people can’t sleep at night if their positions are too large. There is a happy medium where a trader risks an amount that will be meaningful potentially life-changing , yet within their financial means so the trader can sleep at night.

Select at least two crypto exchanges - At a minimum you will need two crypto exchanges: one is the gateway exchange that permits conversion of dollars (or Euros or CNY) to BTC. The second exchange will likely be a crypto only exchange for purchasing small cap crypto currencies. One established exchange for retail investors is Coinbase. Two of the best-known US crypto only exchanges are Bittrex and Poloniex. If you sign up at Coinbase at the link above, you and I will both earn $10 in free Bitcoin but their fees are a bit higher than other brokerages.

Control your emotions - Be very wary of buying after a crypto currency has experienced a parabolic rally over a short time period. These panic driven Fear of Missing Out (FOMO) trades are more than not disastrous. It is easy to be sucked in especially when you watch other traders make 1500% on a coin in 5 days. But the problem is that if you buy the coin at the peak of the hype cycle, the trend could be nearly over and the price on the way down because no one is left to buy (please see the attached Antshares chart). The crypto may quickly crash 30% to 40%. 💣 Indeed it is best to keep emotions in check as much as possible.

Learn how limit orders work- NEVER use market orders when entering or existing positions. Market sell orders means the position is sold at the best available price, but there is no guarantee or promise as to the expected proceeds from the sale. In volatile moving conditions market buy orders may lead to paying a price 200% more than you intended to pay. Always use limit orders when buying or selling and this will help you manage your risk exposure. By setting a market limit order, you define your risk as X amount, e,g. 0.01 BTC, and that's the most you could lose on that particular long trade.

Learn the basics of technical analysis - It is a good idea to learn the basics of technical analysis, especially concepts like support and resistance levels and reversal patterns on high volume. Technical analysis methods don't always work. In fact the currency may break right through a resistance level which was touched three times, but nonetheless my personal experience suggests entering positions at resistance levels seems to work much better than random entries and much much better than buying positions at all time highs. Technical analysis has a bad name, but the key value of technical analysis is to employ discipline and apply a business like approach to investing.

Gain knowledge of fundamental trading - Crypto is its own unique space and this topic deserves it own article or even book (please see my other blog post on low market cap crypto with appreciation potential). Just like any other market, whether its stocks or corporate bonds, there is a deep pool of knowledge that needs to be acquired to analyze a currency successfully: depth of the team, scalability of the technology, roadmap, uniqueness of the business model, degree of competition, understanding of the shortcomings, etc. It is well worth reading up on the forums such as www.bitcointalk.org and joining the slack channel for the crypto to get a sense of where the crypto is going by listening in on the developer’s conversations.

Develop a strategy for locking in profits - When to sell is one of the hardest techniques to master as a trader. I am certainly not an expert but once a currency reaches what I believe to be fair value, I will sell 10% to 50% of the position and lock in the profits. The problem with having no sell discipline is that the coin can go back to your original purchase price due to excessive volatility and you could lose all of your hard earned profits simply because of lack of discipline. Trees don't grow to the sky and neither do coins so its best to take some profits on the way. The book by Cassidy Its When You Sell That Counts could be a wise investment.

Protect your capital with wallets - It is risky to keep all of your crypto currencies at exchanges. Mt Gox is a very good example of what happens when investors place their faith in an exchange when things go wrong. Suggest that new traders consider hardware wallets such as the Trezor and the Nano Ledger S. Another wallet that is help in high regard is the Electrum.

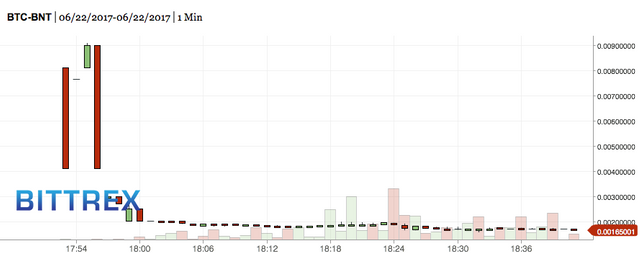

Beware of fads and other investment traps - There is nothing new under the sun. Unscrupulous Wall Streeters and dishonest promoters will always find ways to fleece the gullible. I am of the view that the Internet Coin Offering (ICO) craze will lead to large losses for many of the investors that participate. Many of these ICO coins are very weak business models that seem to serve no other purpose other than to enrich the promoters. The attached graph of Bancor (BNT) is an example of the 80% losses that were suffered by unfortunate investors that bought on the day of the ICO. Yet there is ample evidence that Bancor ICO was flawed from the start and could have been avoided, see http://hackingdistributed.com/2017/06/19/bancor-is-flawed/.

Don't second guess yourself - It is human nature to make errors, nowhere more so than in trading where emotions and capital are on the line. Sometimes you will sell too early. Other times you will overstay your welcome and not reap much of the profits on a trade. All that we can do is the best that we can and no more. There is no use beating yourself up over what could have been. Let's just not trip over the same mistakes over and over again!

If this post has been helpful, you could consider upvoting or you could send me a DOGE tip. 😄 As always feedback is welcome.

D7apSaAtRg84fzsFy6GrqdZuc4H4eeprsh

This article is absolutely great! Good and wise points all the way! Upvoted and followed. I got in Steemit particularly for crypto insights and tips (to read and write), though to be honest was carried away with other topics as well. Hope this post does good!

Thank you for resteeming my article. Glad you enjoyed it. As an example of these ideas in action I sold about 30% of my shares in XBB at 29,500 satoshis today when the 24 hour price move was about +130%.

This is great information. Thanks for taking the time to write it. I am new to the cryptocurrency world and this will help me along just fine!

Your welcome, the whole idea is to help new traders so that they can be successful and avoid the many pitfall of investing in cryptos.

Very helpful post for a novice like myself. Thank you sir.