How our fund works?

Dear followers,

Dear followers,

This is first article from the cycle about the Matador Fund: how it works, what are the main features and so on.

The theme of our first article will be about our trading strategy and how much can you could get if you have invested in our fund. Moreover we will tell you how we came up with our investing idea, the main points of strategy and why our strategy is better than our competitors.

When we came up with idea to found a cryptofund the first question was «what our investing strategy will be?».

We have looked up for ideas on the real market to answer questions: active or passive strategy, in how many tokens to invest, how to make a diversification and so on.

The first problem was where to find historic data on which we could test our strategy. On May 2017 there was not much information on different sources like Investing.com, Tradingview.com and others. The first version of the portfolio was based on the week historic data from Coinmarketcap.com (later all the necessary data was added on Coinmarketcap.com) but there was only a week information.

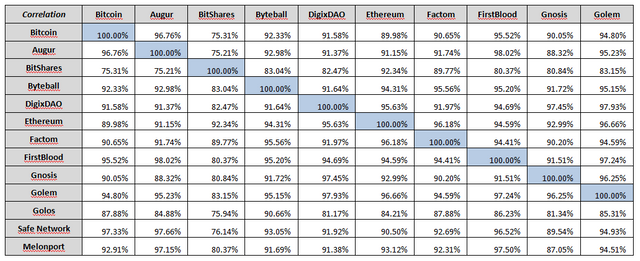

After that we have made some analysis to determine correlation between the different currencies and to test different existing real market strategies. Our analysis has shown that there is almost perfect correlation between all BTC and the other cryptocurrencies.

Moreover we have understood that a passive or mixed strategy is far better than an active one.

Than we have determined that equal weighted ETF is the best instrument to trade because it gives a good diversification with an acceptable risk level. But if we choose ETF than how many currencies we need to take into the portfolio to maximize the profit. We have made a back testing for the period from 2014 till the June 2017. We have made a simulations for more than top 100 cryptocurrencies and came to a conclusion that a number from 7 to 13 top cryptocurrencies gives the best profit. Moreover we have determined that a week rebalance of portfolio is the best one - the more or the less will lead to a decline in profitability. The first draft of strategy was ready.

Than we have started to make some adjustments into the strategy. First of all we have made a research to find out the moments to determine when the price of the chosen cryptocurrencies will rise and fall. Now we use it in our neural and machine learning tool that we will deploy in the near future (we will write about it in the near future). Based on this knowledge, we have made some adjustments in the rebalancing algorithm (if you want to know more pls subscribe on our telegram channel - https://t.me/matadorfund).

After all this adjustments our fund has shown one the best performance on the market -+11 143.2% while Bitcoin has shown +1318.0%, Ethereum +9 162.3%.

So if you want to know more pls subscribe and follow us or invest (which is better). There will be much more articles coming soon.

Site: https://matador.fund/

Investor’s platform: http://client.matador.fund/

Twitter: https://twitter.com/matador_fund

Steemit: https://steemit.com/@matadorfund

Telegram: https://t.me//matadorfund

Best Regards,

MATADOR FUND Team