The art of investing in art

For a long time, art markets were steeped in mystery, seemingly reserved for the upper echelon, the 1 % of the top 1%. These markets were often described as being illiquid and non-transparent; it was hard to buy and sell art in a timely fashion and no one knew where to do it. Over the years more and more high net-worth investors are embracing art as an asset class unto itself.

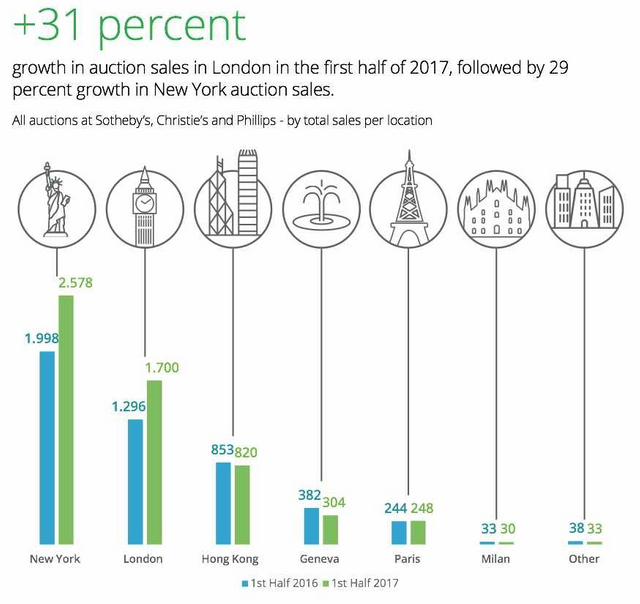

The global art market is bigger than you think. In 2016 the total market was $45 billion, up from $44 billion the previous year (2017 was even bigger). That’s the size of the entire U.S. Leisure Products industry, a segment that includes manufacturers of sports equipment, bicycles and toys. Of that global market, the biggest players are the USA, the UK and China with a combined market share of nearly 70 %.

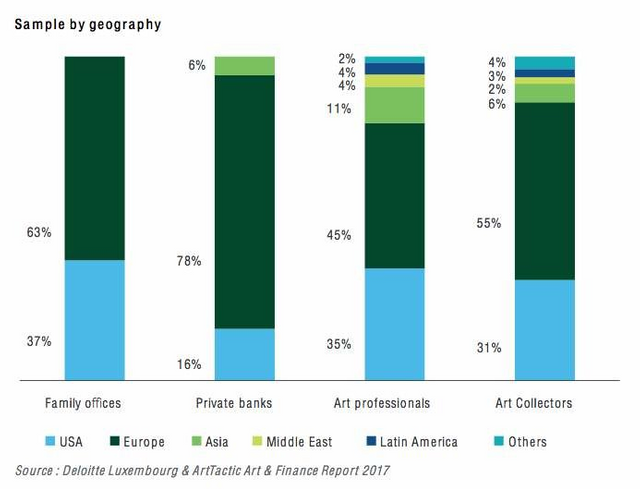

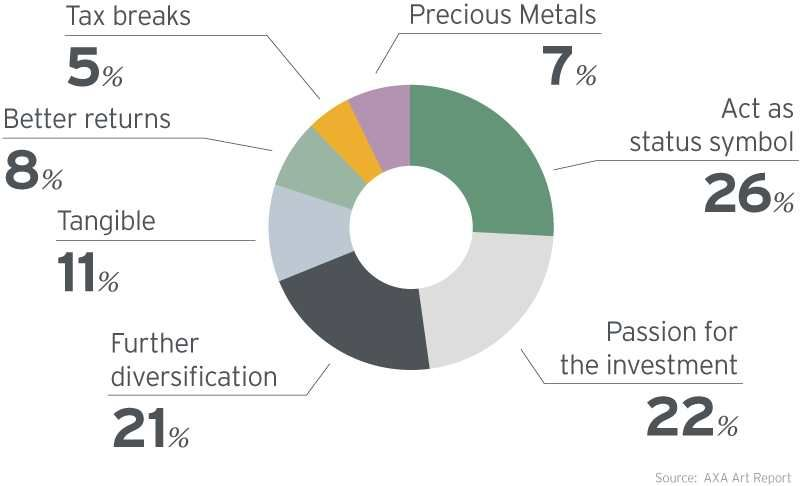

Most people collect for reasons beyond an appreciation of the finer things in life. According to report put out by Deloitte, three out of four wealth managers indicated that art and collectibles should be a wealth management offering. They’re collecting art as an investment – holding for the long-term to try and cash in. With the S&P 500 hitting new highs, investors are looking for alternative areas to store their cash as fears of a market crash ramp up.

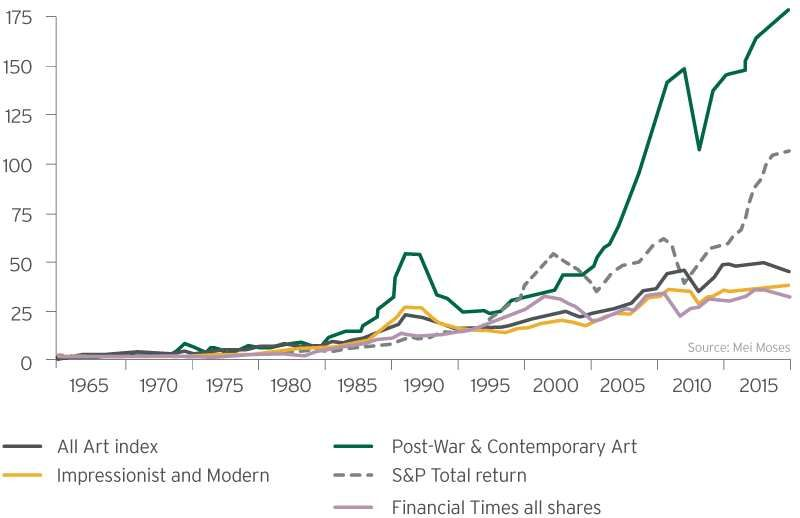

And it did rather well. The Art 100 Index, a measure of the global art market, has outperformed the MSCI World Index between 1985 and 2012. In other words, the art market nearly tripled the return from global equities in that time period. Research from JP Morgan also indicates that art has a low correlation with other financial asset classes, so if the S&P 500 crashes art doesn’t necessarily go down with it.

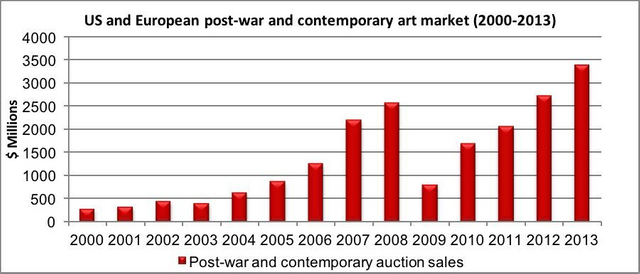

Notwithstanding the aforementioned obstacles, the growing demand in the art sector is real and can be explained largely by wealth increase (especially in emerging countries). After the crisis of 2008, auctions' sales have been going up again. Since art is primarily a luxury good, increase in demand does not only stimulate the existing market but also, theoretically, pushes prices upward.

Some say that buying art is speculation. Buying and selling art comes down to taking action at the right moment. What is popular in the market and will increase in price? What is unpopular (or unknown) in the market and will prove to be a great investment in a few or in many years? Yes, it is very similar to the stock market (but much less liquid).

Art is not really an investment, looking at the reason why collectors and professionals buy art. A work of art does not produce an income (it does not pay dividends, for instance). On the contrary, a work of art has to be kept in perfect condition (in a climatized room or storage), it has to be insured and appraised, and when buying and selling considerable margins are involved (especially when using an auction house).

From this point of view, buying art is speculating. Investing in art is gambling on the popularity of an artist and his work in the future.

But there are some reasons why buying art could be really something for you. And these reasons can be of more importance than money.

Nonetheless, the main strength of art as an investment lies in the fact that it is not correlated (or has a low correlation) with returns on shares and bonds. In this way, art can offer appealing diversification opportunities in a balanced portfolio strategy and improve the tradeoff between risk and return. On top of that, funds dedicated to art are available for investors, spreading risk by buying large amounts of works of art without obligations to sell at a loss. The art market is still at a very young stage and only the future will reveal how it will evolve.

But you should only get involved because you love art, want to know more about it and want to show off a bit to your friends and relatives. Don't do it if you want the assurance that you will be able to make a profit.