How profitable is Ice Rock Mining?

Ice Rock Mining plans to create a new business model and is actually raising funds to build up this project.

Ice Rock Mining is located in Kazakhstan and going to offer the most profitable mining of Bitcoins.

These days are very hard for Bitcoin-mining, because the profits are decreasing by the market correction of Bitcoin, but Ice Rock Mining has developed a possibility, to offer highly profitable Bitcoin mining even at a low Bitcoin-price.

Why Ice Rock is more profitable than other mining companies?

The main reason is the special location, Ice Rock has chosen for mining. It is planned to install the miners in a naturally cooled cave system. This cave system was a former Soviet bunker, bought by Ice Rock Mining’s CEO, Malik Murzashev. Now he is the owner of this location and costs for rent are already done.

So, a big advantage is the passive cooling of the miners by the constant low temperature in the cave of only 12°C. The energy required for cooling is very low.

And the price of electricity for Ice Rock’s mining project is one of the cheapest: only $ 0.03 per kWh must be paid.

The earnings from the mining are spent in the following way:

- 50% of the profits will be payouts to the owners of ROCK2 tokens

- 20% are reinvestments in new miners, to increase the mining performance by installing more hashpower

- 20% for repair and maintenance costs

- 10% are profits of Ice Rock Mining

The 50% profits are paid out to the owners of ROCK2 tokens by first exchanging the mined Bitcoins by a smart contract in Ethereum and sending them automatically to the addresses where the ROCK2 tokens are located.

What is the price, Ice Rock Mining won’t be profitable anymore?

This question is asked very often, especially by having a look at the increasing of mining difficulty and the market correction of all cryptocurrencies.

Ice Rock Mining promises to offer the most profitable mining. I did some research and came to the result, that Ice Rock Mining could still be profitable around $750 per Bitcoin.

The reason is quite simple: should the price of Bitcoin go down continuously, almost all miners will be forced to turn off their equipment, as mining is no longer profitable for them. As a result, the mining difficulty will also drop step by step. Only the most profitable miners will be able to make profits even at lower prices and not have to switch off their equipment. And yes, there will be less money per block, but also less miners who are searching for blocks, which means more blocks per miner.

The key advantages are the low costs: Ice Rock is one of the miners who can mine Bitcoins even at very low prices, because all other companies, which are more expensive, have to shut down their miners earlier, which reduces the difficulty.

Why $750 ??

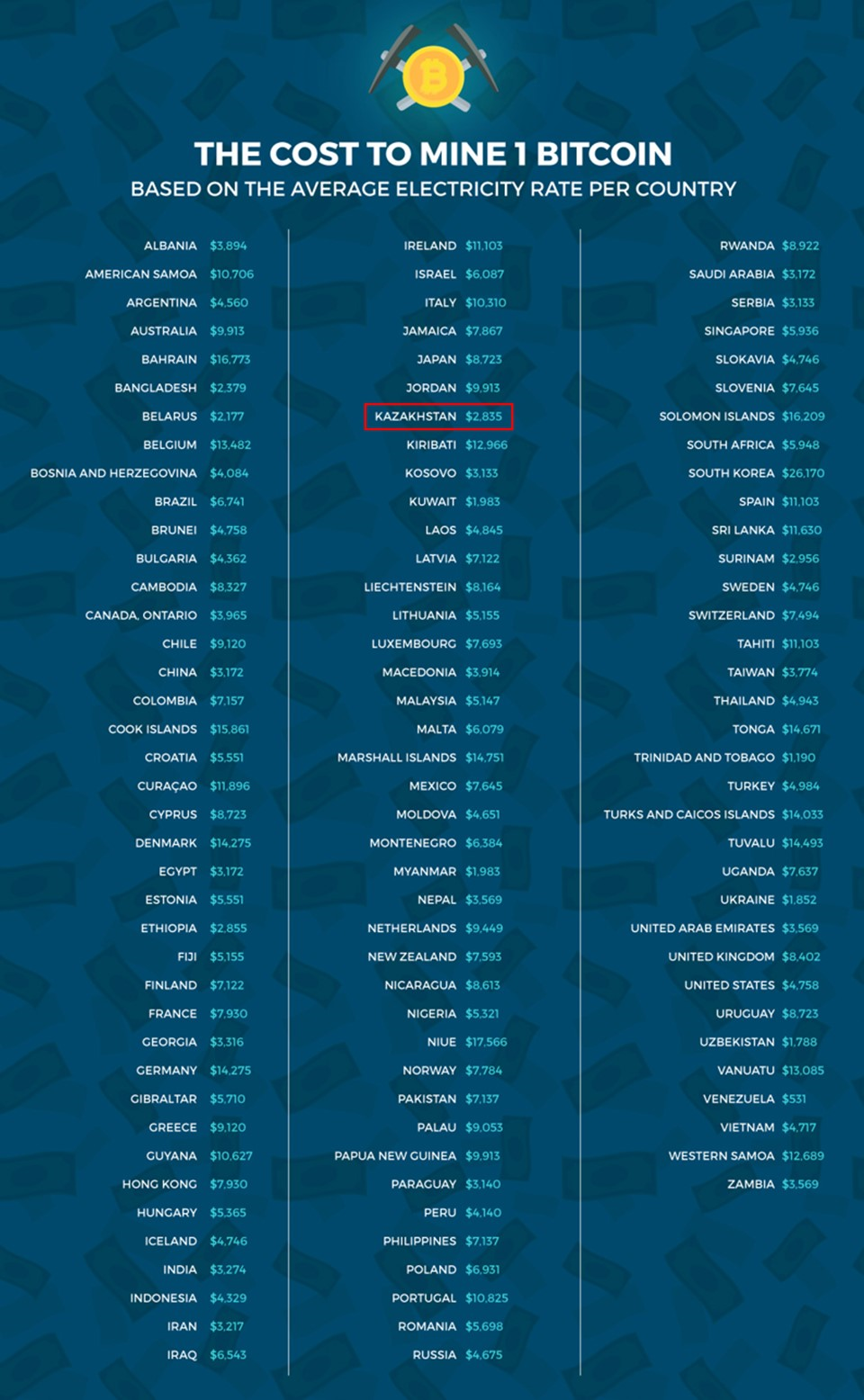

The following table shows the costs to mine 1 Bitcoin in different countries. In Kazakhstan you need 2,835 dollars to mine a Bitcoin (date: 26/03/2018). That’s the average price in Kazakhstan, but it is even more likely, that Ice Rock has lower costs than 2,385$ per Bitcoin.

However, I’m calculating conservative this time using 2,385$.

Now, we expect, that Ice Rock Mining, having very low costs, is among the top 20% of the most efficient miners. So, 80% of all companies are more expensive in producing than Ice Rock and have to shut down their miners sooner. This also means, the difficulty drops by 80% before the break even is reached, when Ice Rock must turn off its equipment itself.

If you refer that to the price in the table, when the difficulty has dropped by 80% before Ice Rock isn’t profitable anymore, the result of the new, lower difficulty is a price to mine a Bitcoin by 550 Dollar.

At this price, Ice Rock would make no profits and would have to shut down its miners.

To have sufficient profits, the price of Bitcoin should not drop below about $750. But this scenario is very unlikely, that the price of Bitcoin decreases so much.

But it's good to know that Ice Rock Mining still has a lot of space before they have to shut down mining activities - currently the Bitcoin is at $ 7,500.

If the price of Bitcoin decreases, not all companies immediately shut down their miners because they may not even know they are not mining profitably, the number of remaining hashrate in the network tends to be slightly more, so a Bitcoin price of $ 750 is quite a bit more realistic break even for Ice Rock.

This value tends to be even lower, my calculation assumes only the average price per Bitcoin in Kazakhstan. The cost of producing a Bitcoin by Ice Rock would currently be well below $ 2,835 per Bitcoin, as Ice Rock has lower prices than the Kazakh average.

But at all, it is not possible to predict this break even exactly, it depends on how cheap Ice Rock can offer mining and at the moment Ice Rock is very well positioned. Maybe the limit is $ 600 or $ 800, you can’t calculate exactly... Importantly, Ice Rock is more profitable than a big part of the competitors, and I’m very confident when I look at Ice Rock’s low costs.

Calculation (conservative: only expecting Ice Rock is one of the 20% efficient miners and using Kazakh average costs):

2,835$ x 0,20 = 567$

Expected break-even could be 750$.

If you are interested to be part of Ice Rock by investing in their ICO and holding ROCK2 token, to receive mining profits, you’ll find more informations here:

Ice Rock Mining Website

Whitepaper

Telegram

Twitter

Medium

Bitcointalk

Youtube

Here's my introductory article, how Ice Rock Mining will achieve their goals:

)