Tether/Bitcoin Manipulation And It’s Relationship With BTC Futures

I’ll keep this introduction brief — the purpose of this writing is to expose the relationship between Tether and Bitcoin and tie it in to the bigger picture of how the price is being manipulated intentionally for the purposes of allowing financial institutions to make more money off of the shorts from the CME (mainly) and the CBOE (deadline for first futures contracts is gone now).

This is a complex web, and although NOTHING has been proven, I firmly believe that the inferences that can be made from what we currently know are very strong.

Without further ado, let’s intro part 1 (brief don’t worry)

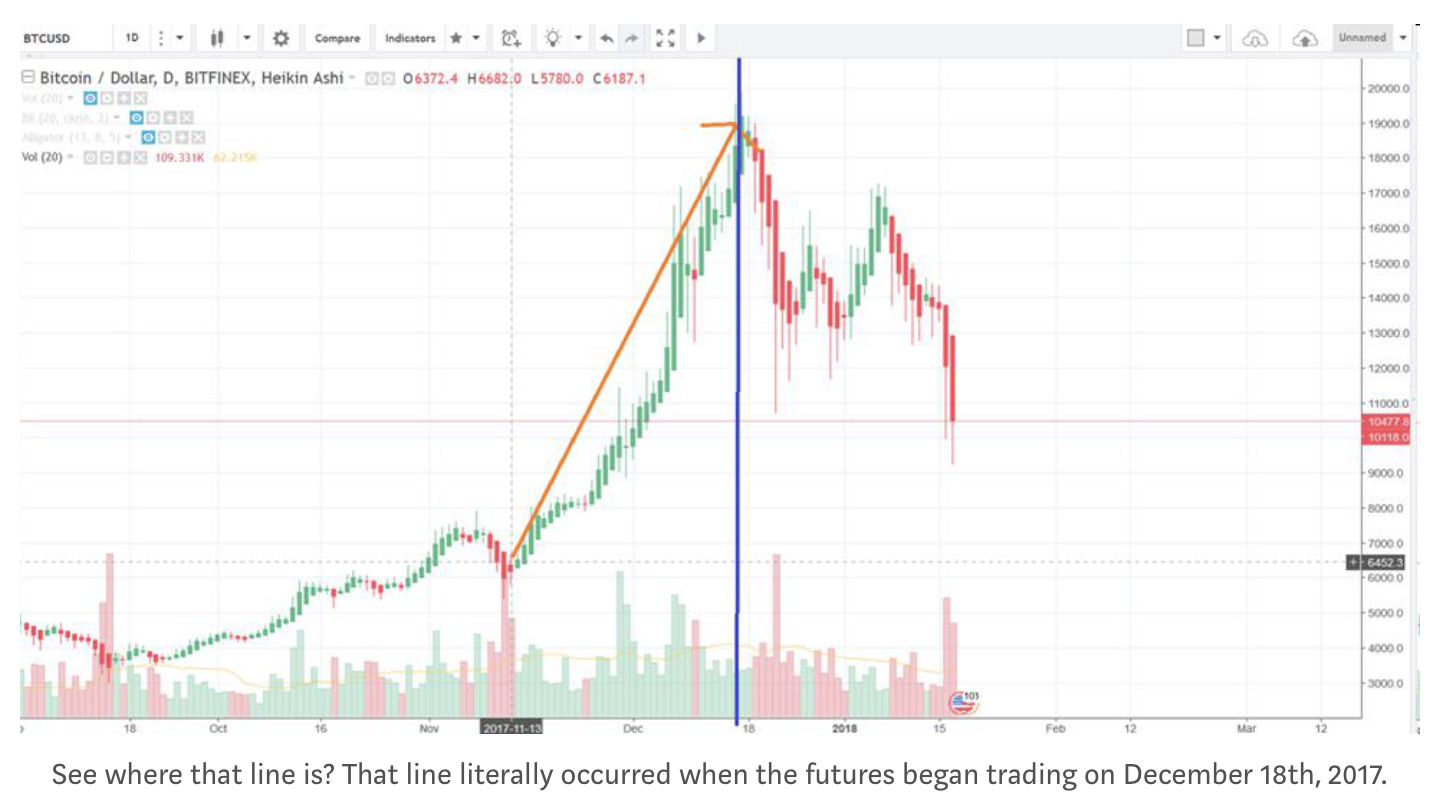

Anyone who’s heard about Bitcoin noticed its steep run up to $19,900. Let’s pull that up on a chart shall we?

In just one month (approximatelly), the price of Bitcoin spiked dramatically from $10,000 USD (which was already damn near an all-time high) to $19,900 USD on Bitfinex (an astounding 100% increase) from November 13th, 2017 to December 17th, 2017.

Let me draw your attention to that date — December 17th, 2017. What’s significant about that? It was the very day before the CME announced that they would be initiating futures trading.

Here’s the article covering it: http://www.chicagotribune.com/business/ct-biz-cboe-cme-bitcoin-20171201-story.html

I remember in the days leading up to this release that there were several articles released in secession that announced the most likely course of action for Wall Street would be shorting the coin:

https://www.fool.com/investing/2017/12/10/cme-bitcoin-futures-a-better-way-to-buy-or-short-b.aspx

http://www.livemint.com/Money/izzpR2IwNz6T9cIOW1xydJ/Want-to-short-bitcoin-anyone.html

There are a wealth of other articles from different financial circuits that not only outlined the plausibility but the sheer likelihood that Bitcoin would be shorted.

Sure enough, as the trading of futures revealed, shorting did begin.

—Let me pause here so I can make sure we’re all on the same page —

Quick lesson for those that don’t know what futures/shorting is:

‘Futures’ are a contract where two parties agree to buy and sell something (bitcoin in this case) at a certain price at a pre-determined point in the future. For example, I could ‘sell’ a contract to someone where I agree that at some future date in time (a month later), I will sell a Bitcoin for $15,000. If I believe that Bitcoin is going to go down to $10,000 in that time, this is a lucrative trade for me. On the flip side, if I agree to BUY that Bitcoin for $15,000 in a month’s time and I believe that it’s going up to $20,000, then I’m getting an AWESOME discount on some Bitcoin in the future and I can turn around and get rid of that for 25%+ profit.

This is more or less how it works on the ‘futures’ exchanges. The main difference is that, instead of receiving physical Bitcoin when the contract is up, they just pay you the cash difference.

However, before we move on, I just want to clarify that people don’t ACTUALLY receive Bitcoin from these futures. They just get the cash difference. So if you meet someone and you guys both say “Hey, it’s January 17th today. On February 14th, I give you my WORD (contract) that I will buy Bitcoin from you at $15,000 no matter what the price of Bitcoin is. Even if it’s $7,000, I HAVE to pay you $15,000 anyway.” Let’s say BTC goes to $7,000 by February 14th after we made that agreement — instead of me buying a literal Bitcoin for $15,000, I just agree to pay the difference between the price we agreed on and what it’s at currently. However, it works both ways. If Bitcoin goes up to $20,000 — you HAVE to still sell it to me for $15,000. That’s our agreement. So if you’re making a deal to SELL something on a futures market, you MUST believe that the price is going to be LOWER than what you’re SELLING it for.

— — RESUMING THE MAIN STORY —

Now that you understand futures, I can introduce the fact that there were quite a few short positions that were taken. In other words, there was a plethora of financial institutions that agreed to sell Bitcoin at market price a month later.

So, let’s revisit that chart again:

The left side is before futures. The right side is after futures launched on the CME.

Based on what we see here above, things turned out PERFECT for institutional investors…Almost too perfect. But without any concrete source of manipulation in the markets, all we can do is just chuck it up to smart financial analysis and extraordinary timing.

Surely there can’t be any other red flags to indicate that this stroke of amazing fortune on behalf of financial investors was due to some sort of planned maneuvers or manipulation, right?

Wrong.

Part 2: USD Tethers

There have been a series of posts by the Twitter user @Bitfinexed on both Medium and Twitter that have exposed USDT. I’m not here to do that.

For those that aren’t aware, USDT is a virtual currency that is allegedly ‘tethered’ to the value of the U.S. dollar. It was created by Bitfinex and essentially is supposed to be a way for one to move their money from crypto to fiat whenever the markets are volatile.

Question: Why even bother going through the process of getting USDT when I can just get real U.S. dollars?

Because it’s not that easy. Very few exchanges allow users to directly cash in USD for crypto and for many, this is their only ‘portal’ into the crypto world. ATMs charge absurd fees if you’re able to even find one. So, with USDT, that problem is solved! Right?

In theory, this would work. However, the major problem with this is that we have no clue what USDT is actually backed by. There have been no independent financial audits to verify that the USDT in circulation are truly backed by U.S. dollars. In other words, there is a possibility (not EMPIRICALLY confirmed) that USDT is simply being created at will and traded with crypto directly.

So, how does this factor into this shorting picture?

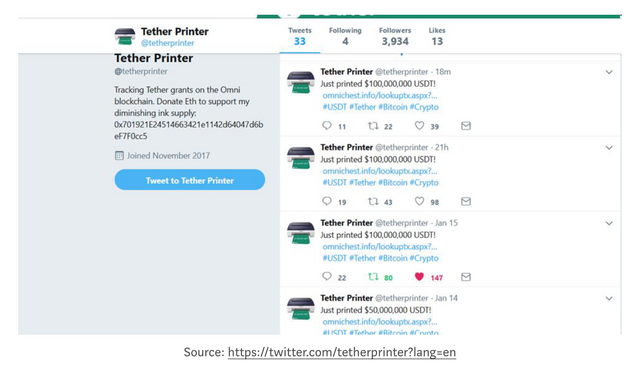

Let’s trace back to that big run that I was mentioning in the charts that I posted earlier. During this run, hundreds of millions of dollars of USDT were being created. How do we know? Great question. The wallet where USDT is created and sent to is visible on a public ledger. See the link here:

Here’s the direct URL for that USDT wallet: http://omnichest.info/lookuptx.aspx?txid=b182888725cff4486d4080cf04736ab0d2250a78a02948cfc348d8e1672ef52c (that’s one of the most recent tether injections)

To be clear, there have been hundreds of millions of USDT that have been created JUST since the end of October.

Let’s go ahead and visit at which point the USDT was created and what happened on the chart:

I outlined above all the instances in which USDT was injected into BTC. In total, there was $370 million worth of USDT that was injected into BTC on it’s ascent from $10k to $19.9k.

What’s interesting about this is the fact that there is so much USDT being printed during BTC’s ascent.

Sure, one could assume that the demand for USDT increased out of need for an immediate portal into BTC, but we should examine the price fluctuations in USDT in order to determine whether that claim is plausible or not.

Here’s a chart of $USDT’s value in USD (yes, it does fluctuate despite being tethered) from November 15th to December 19th.

Throughout the majority of the run that Bitcoin went on, the price of USDT was at a low.

During the times it spiked, Bitcoin was going through a slight depression in price.

Simple economics tells us that a decrease in price stems from a decrease in demand. Also, common sense tells us that only a fool would want to obtain USDT at a time when BTC is going through the roof. Other than those hoping to enter into the market (remember Coinbase was the PRIMARY source for BTC transactions during this time — not Bitfinex or any other USDT portals), there is no other plausible reason — and the chart above shows that this most likely wasn’t the case.

Therefore, USDT was being printed by the hundreds of millions during a time when the demand should have been at it’s lowest.

So, why print so many?

To find out, let’s revisit that chart:

If you notice the spots on the chart where the USDT was printed, it appears that it was correlated heavily with a sharp increase in the price.

Question: So What About When the Price Decreased? If USDT is used to pump Bitcoin, why would they print so much of it while Bitcoin is falling in price?

I also believe that USDT was the shorting mechanism. See the second half below here:

If you notice, the injections are followed by steep declines most of the time. Keyword: most.

There are a select few times when the injections lead to direct boosts in the price. However, this begs the question of what’s going on here. Here are a couple facts:

•If they were buying BTC with the USDT every time, the price would increase. Invariably.

•Since there are a few times that the USDT did not lead to direct increases but were followed by steep declines, the USDT could not have been put directly into BTC.

There must be an incentive for the injection of so much USDT.

So, where did the USDT go? It doesn’t make sense that they would print it right before a decline because they could wait for the ‘dip’ and pick it up if that was their intentions.

Here’s what I think that happened:

USDT was used to pump other traded pairs in order to avoid raising the price of BTC directly.

Once BTC was obtained from the pumps of these currencies, it was then sold immediately for USD, which ‘flooded’ the market and depressed the price of BTC.

Need proof?

Roll back to the other USDT traded pairs — notice something that happened with them in the past month or two? LTC, XRP, ETH, ETC, NEO, ADA, and Bitcoin Cash among others.

I could go over the rest of the USDT traded pairs, but I think you get the picture here. All of the USDT pairs (with the exception of LTC and DASH) were pumped heavily during Bitcoin’s descent after December 18th.

This all indicates to me that:

•The USDT must have been placed in one of these trading pairs at various times as a means of acquiring additional Bitcoin.

•Once the Bitcoin was acquired after the pairs were sold — the BTC itself was probably sold off for USD.

•The sudden and unexpected flooding of BTC in the market caused the price to continually go down.

•Tether dumpers could then ‘buy back’ the deflated BTC price and increase the amount of BTC that they hold and continually exert pressure upward and downward on the market at will.

How Does This All Tie Into the Futures?

Great question. The reason why I think this is attached to the futures market is because it allows whales to make their money “twice” essentially. I’ll walk you through the logical process below:

•“Whales” or some entity decides to short Bitcoin on December 18th on the CME/CBOE.

•The $100M is transferred to an exchange (Bitfinex probably) and a USDT traded pair is pumped beyond belief.

•Whales are able to triple the amount of BTC they would have had if they would have just simply bought the BTC outright by pumping the price of another traded pair and then selling that for BTC.

oExample: Before XRP got pumped, it was worth 7k sats a coin. It eventually crossed the threshold of 20k sats a coin. If one were to have sold all of that coin at the highest price, they would have nearly tripled the amount of BTC they could get with that $100M investment.

•After swapping to BTC, whales can flood the market with a swathe of Bitcoin that did not exist previously.

•The price is thus lowered by 10–15% “out of nowhere” and once they effects of their dump are finished, they buy back all of the artificially deflated Bitcoins for a much cheaper price than what they were dumped for. This allows them to amass way more BTC than what they originally had before.

•Having more BTC increases their leverage, and they don’t need to really liquidate that Bitcoin because, after all, there’s always more USDT that can be printed if anything must be bought on the market.

Rinse and repeat.

Okay, that makes sense Pete but what’s the point?

Here’s the point:

By artificially deflating the Bitcoin price, these traders can make out like bandits when the futures contracts are up (I explained this concept earlier). Then they make a shitload of money on the way down for BTC (remember they pumped all those investments). As BTC goes back up, they cash out on their original investment by like 5–10x.

Can these tethers really have this much impact?

Absolutely. Think about it. $100M is a considerable amount of volume to add to any market in crypto. Even in the S&P500, this would add a lot of volume. It’s enough to easily tear down any sell walls that exist and create an upward momentum.

It would tick off volume indicators, allow folks to manipulate the TA that people like myself and others do on coins and “trigger” a reaction where people start thinking “Bitcoin is back! We’re going moon!”

Imagine how much easier it is to do that with a smaller market currency like TRX, NEO, LTC, ETH, BCH and others?

Also, consider the fact that the markets are FRAGMENTED. Each exchange has it’s on trading volume. Imagine how much easier it would be to elevate the price from there.

Example: I take $100M and I jack up the price of $NEO on Bittrex. People on other exchanges will see the activity on there and will naturally begin buying up $NEO because of the crazy arbitrage opportunities that have now become available.

As $NEO continues to rise on that one exchange, others will follow. Since the trade volumes are rarely in excess of a couple of million at best at any given momentum of time.

Conclusion

•I believe that the people who are printing Tether are also one of the institutional players who shorted Bitcoin on the futures exchanges.

•I absolutely think that they are deflating the price of Bitcoin for the sake of ensuring profits off of these futures contracts.

•The CBOE contract period (January 17th, 2018) is over. However, the CME contract period isn’t over until January 26th, 2018.

Strategy:

I’ve hedged half of my BTC in USDT and the other half I’m in various trades with — I still believe that the price will touch down below $9k sooner or later. More than likely before the CME futures are due on January 26th. When it hits in the $8k region, I’ll probably cash out.

However, I do think that the price will increase in the intermediary. Why? Because $450 million has been injected into the market since January 14th and it would be more advantageous for anyone with a short to increase the price temporarily so that more shorts can be taken in the CME market from a higher price before depressing it again.

Once again, this is all a theory. I may turn out to be entirely wrong on every front, but I personally doubt it. There just seem to be too many things that “connect” together in this situation. One would need to believe that the drop in BTC price occurring IMMMEDIATELY after the CME Bitcoin futures is purely coincidental.

One would need to believe all of the injections of USDT are purely coincidental as well and that they were transferred for legitimate purposes — this includes the $450 MILLION worth of USDT that was injected in just the last 72–96 hours alone!

You've put together this story quite beautifully. I literally read everything before my morning coffee. I've been reading about this subject since the launch of the BTC futures back in December. Honestly, I'm impressed. I've been talking about this market manipulation for over a month now. You're totally right about using USDT as a shorting mechanism. Institutional investors in this case can control the price actions quite easily. If they control the financial markets, imagine what they can do to the cryptocurrency market. It's still an inefficient market. I'll do my own research then we can compare results. For now, I'll resteem your post 👍🏼