Will Bitcoin Reach 1 Million? It's Not an Arabian Nights Tale

Current State of Bitcoin Prices

In the ever-changing landscape of digital currencies, Bitcoin remains a focal point of global attention. As of [specific time], its price stabilizes around [$X]. Looking back, Bitcoin's price journey resembles a legendary saga of rollercoaster highs and lows.

In 2009, Bitcoin emerged as a near-worthless experiment within geek circles. Yet, this digital asset would later unleash a financial storm. In May 2010, a programmer traded 10,000 bitcoins for two pizzas—marking Bitcoin's first official valuation at about 0.003percoin.ByJune2011,itsurgedto30, a 10,000x increase that captivated investors.

The 2013 bull run saw Bitcoin soar from 13to1,200 by November. Exchanges multiplied, institutions entered, and media hype skyrocketed. By year's end, Bitcoin rivaled gold, astonishing the world with its "Bitcoin era."

After a crash to 3,122in2018amidregulatorycrackdowns,Bitcoinrecovered,peakingat69,000 in 2021—fueled by institutional adoption and Tesla's embrace. However, 2022 brought plunges due to Fed tightening and the Terra/Luna collapse.

In 2024, Bitcoin roared back. The SEC's approval of the first spot Bitcoin ETF in January opened new investment avenues, driving prices to $90,000 by November 13—doubling yearly. Its volatility captivates investors, sparking fevered speculation about its future.

Factors Influencing Bitcoin's Price

Bitcoin's price dance is orchestrated by multiple forces—a financial symphony where each element plays a unique role.

Supply and Demand

Bitcoin's 21 million cap ensures scarcity. Mining rewards halve every four years (50 → 25 → 12.5 → 6.25 coins per block), slowing supply growth. Demand stems from retail enthusiasts, institutions like MicroStrategy, and corporate adopters like Tesla. When demand outstrips supply, prices surge; when demand wanes, prices retreat.

Macroeconomic Environment

Economic turmoil—recessions, inflation—drives investors to safe havens. Bitcoin's decentralized, capped nature appeals as a "digital gold." Post-2008 crisis, its rise from pennies to hundreds mirrored this dynamic. Conversely, stable economies reduce its避险 appeal.

Interest rates also impact Bitcoin. Low rates fuel borrowing for investments; rising rates curb enthusiasm. The Fed's policies significantly sway markets.

Regulatory Policies

Diverse global regulations shape Bitcoin's fate. Japan legalized it in 2017, fostering growth. China's 2017 ICO ban and Russia's threats of prohibition caused sell-offs. Regulatory uncertainty breeds caution, exacerbating volatility.

Technological Developments

Innovations like the Lightning Network—boosting speed and cutting fees—enhance Bitcoin's utility. Mining tech advances improve network security. Yet, vulnerabilities (e.g., 2024 Bybit hack) or scalability issues could erode confidence.

Market Sentiment and Media

Bullish optimism, as in 2017, fuels rallies. Panic, like post-2018 crashes, triggers sell-offs. Media amplifies trends: Tesla's Bitcoin adoption boosted prices, while fraud reports undermined them.

Can Bitcoin Reach $1 Million?

Optimistic Views and Rationale

Bulls argue Bitcoin's ascent to $1 million is inevitable.

Institutional Demand: Bernstein analysts predict Bitcoin could hit 1millionby2033,citingspotETFs.Post−2024ETFlaunches,assetsundermanagement(AUM)surgedto190 billion by 2025, straining Bitcoin's limited supply.

Cathie Wood's Vision: ARK Investment Management forecasts $1.5 million by 2030, with Bitcoin surpassing gold as a store of value. Easing regulations under a Trump presidency might accelerate adoption.

ETF Catalyst: BlackRock and Fidelity's ETFs democratize Bitcoin access, attracting institutional cash. Record inflows in 2024 validated this thesis.

Decentralization and Innovation: Advocates highlight Bitcoin's role in a digitized economy, with blockchain expanding into cross-border payments and DeFi.

Pessimistic Counterarguments

Bears warn that $1 million is a pipe dream.

Volatility Risks: Bitcoin's wild swings—like a 10% daily drop in March 2024—deter risk-averse investors.

Technical Vulnerabilities: Hacks (e.g., Bybit's $1.5B loss) and network flaws threaten trust.

Market Manipulation: Thin liquidity enables whales to sway prices. Suspicious trades on Binance raise red flags.

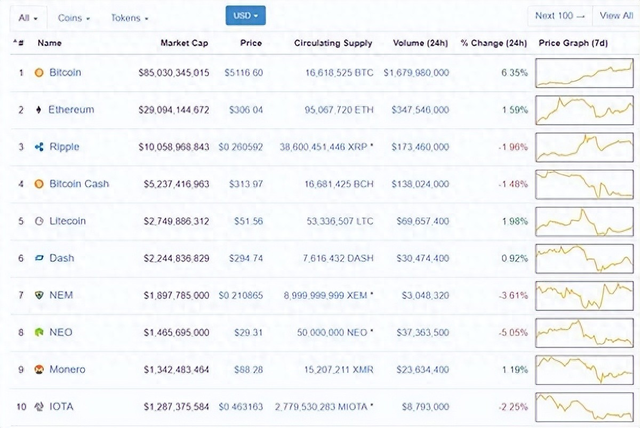

Competitor Threats: Rivals like Ethereum and Ripple divert capital, challenging Bitcoin's dominance.

Investment Advice and Risk Warnings

Bitcoin investing is a high-stakes gamble. Proceed with caution.

Volatility Risk: Past crashes (e.g., 2018's 80% plunge) illustrate the danger of buying at peaks.

Regulatory Uncertainty: Evolving policies could ban or restrict Bitcoin, impacting prices.

Asset Allocation: BlackRock advises capping Bitcoin exposure at 2% of portfolios. Avoid overconcentration.

Avoid Herd Mentality: Research thoroughly, resist FOMO, and stay disciplined.

Conclusion and Outlook

Whether Bitcoin hits $1 million remains debated. Bulls cite scarcity, institutions, and ETFs; bears warn of risks and competition. Regardless, Bitcoin has reshaped finance, sparking blockchain innovation. For investors, it offers opportunity—and peril. Approach with rigor, diversify, and stay informed. As the market matures, perhaps Bitcoin will stabilize, offering a clearer path to its million-dollar dream—or a reality check.