How To Evaluate Something About ICO?

Since the Chinese government has banned ICO in the country, the topic of ICO has become a hot spot in social media now. Various variations of warnings about ICO have been issued in each country. Not least on Facebook coin.my's own page which is a battleground on this hot topic. At the request of many, this post is the author to discuss the issues we need to analyze about ICO before making a decision to buy the token offered.

For those who are still less knowledgeable about ICO or Initial Coin Offering, you can refer to the post about ICO here: What is Initial Coin Offering? Did you read? Well, for starters, we must know that the purpose of the ICO is to raise funds for a project, while at the same time offers some benefits to the buyer of the purchased tokens, in particular the return on investment as well as the increased value of the tokens in the future.

This means, it is basically difficult for us to evaluate without an in-depth analysis, whether the ICO is simply a pawn schemes based solely on a fraudulent project. In fact, the extent to which we analyze any project will not promise that the project will succeed in the future. Agree or not? So here, the penis will try to give step-by-step guidance on how to assess ICO.

1.View the ICO listing or visit the forum

Typically popular sites like coindesk or cointelegraph will announce new ICO on their press release tags. This announcement is a paid advertisement and does not indicate they support the ICO. Similarly, coin.my, our review of the ongoing ICO is aimed at providing information, and does not mean that coin.my has interests in the ICO.

Now, there are many websites that are listing and evaluating ICOs that are launched. For example, tokenmarket orcoinschedule to get the latest ICO list including the relevant ICO information. Such sites and icobench make ratings and ratings for ICO. Additionally, ICO will typically be announced on the ANN thread at BitcoinTalk.org, and here you can read the public comments on the post. Many questions that may arise in your mind are being asked by other members, and you can find your answer there.

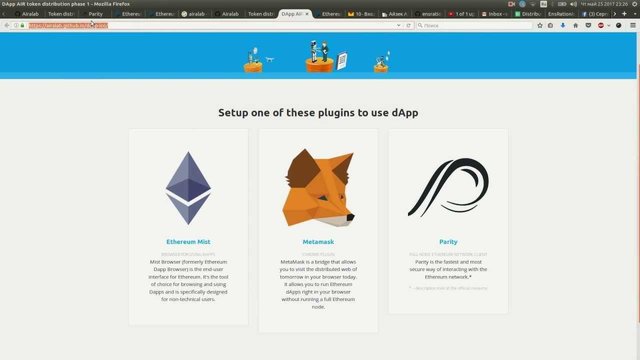

Visit the ICO website

The website is a platform to get all information about the ICO project. Here you can find more information about the ICO project, the developer team behind the project, as well as the background of the company itself. This is your first picture of assessing something ICO. If the site does not have much information or like copying other website content, this is like the first red flag about the authenticity of the ICO project.Whitepaper content

In a world of uncertain cryptic currency and at the same time unimaginable potential, the whitepaper becomes a piece of wood for a project. Many of the whitepapers that are available are highly technical and elusive for the public, and many whitepapers are more for the business plan. But the purpose of the whitepaper is the same: explaining the project to be funded and the direction of the project. Some of the things you should look for in a whitepaper are as below:

Products offered

The first thing is to look at the products offered. Is it a software for users like Ethereum? Or is it a user platform like LBRY or Steemit?

There are various types of projects in different types of sectors that you can imagine. Finance, education, media, real estate, infrastructure, health and more. Choose the project you support or feel you have great potential in the long run.

Token offered

Is the token offered related to the product? What is the token function? As Ether needs to use the Ethereum platform. Or it's just a by-product like Ripple, or the token itself is a product, like DOGECoin, Dash or Litecoin.

What about the token value itself? What will cause the token to increase (other than the ICO itself)? Will the token be used to buy other products or items, or can only be sold at a different krypto currency?

How to get the token? Is it only by purchasing it or can it be through mining activities? Usually tokens inventors will be pre-mine tokens (10-20%) and offer mining months after ICO. If 50 percent or more are already pre-mined by the token creator, this means that the market capital will be mastered by the token creator instead of the user.

Number of tokens

If the token is offered has no unlimited limit, it means your token does not have an incremental value because technically the demand for it decreases (as there is another supply) even though the demand for the token increases. For example, the successful ICO Bancor quotes over USD $ 150 million. From the perspective of investors, they do not benefit from that amount because the token offered has no production limit. Or the best examples of Bitcoin are getting value as the supplies are getting smaller.

Problems and solutions

This is a fairly common theme in the ICO project. Certainly with the development of new technology such as blockchain technology, we can solve many problems in this world. So, look carefully at what problems you want to solve and what solutions are offered. Is it something that is needed in the world, is it realistic? More important, is this project the only project that wants to solve the problem, or offer a unique solution from another project? Here you can evaluate the potential of a project to succeed in the long run.

Potential tokens

Perhaps the most important issue, especially for investors who want to profit. What is the potential token in the near future? Will the token holders get returns from the project, or other advantages? Is it possible to sell immediately after buying, or need to be stored? All this depends on the token function offered.

Project roadmap

This is also a very important issue as it makes it easier for us to make budgeting about the potential of the project. Will the project be launched at once, or in phase? Does the project offer other products such as wallet or exchanger? What about their long-term plans?

Developers and core teams

Many consider the background of the team behind the project very important. From there we can assess whether they are committed to their projects and what experiences they have. It does not mean that we do not know who runs the project shows that the project has no potential.

And from this information, you can also see the code behind the token offered. Most tokens codes are open and will be displayed in GitHub and where you can assess whether the code used for the token is of high quality or non-security, transaction speed and functionality.

Not necessarily all whitepapers will have the above information, and there may be other information not described above. The above list is just as a guide, and what the writers feel is very important for authors in evaluating whitepapers. You may have your own opinion, and you may ask the author to be added in this article.

4.Media social

Apart from websites and whitepapers, social media also plays an important role. Almost half of the world's population has internet access and almost all of them have Facebook, Twitter, Tumblr accounts and others. Including the team behind the ICO project. You can search their LinkedIn information and follow their Facebook or Twitter. That's where you can get the latest information and reviews about their projects. Be sure to open the forum on Redditatau BitcoinTalk for additional information.

5.Lock and common sense

Finally, this point is most important in this guide. We can hear the call of friends around to participate or see positive comments about the profits that can be obtained from the investment, but are still in doubt about the project. This may be your instincts or more precisely, your common sense that says do not invest in the token. Do not be easily influenced by other people's opinions without making your own analysis. Examine as best you can about each project that interests you, the risks you have, and if you decide to invest, invest it wisely.

Source: http://coin.my

Hi, great post, worth a follow. Looking forward to some more of your stuff.

At this time, you need to carefully buy coins and choose a good project for a long time. In my opinion, you can invest in Tokengo, since the project passed all my checks on the quality of the product.

Congratulations @luckm4nn! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

To support your work, I also upvoted your post!

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last announcement from @steemitboard!