Start bitcoin mining???

Begin Mining

One of the first questions faced by those interested in crypto money mining is whether to do it alone or in a pool. There are dozens of arguments against mine pools and against them. But if the hash rate distribution throughout the Bitcoin network is adequate, most miners choose to join the pool. Things you should know are as follows.

Pros and Cons

If you are deciding whether or not to participate in a pool, you can think of it as a lottery draw. The pros and cons are identical. If you are mining by yourself, you do not have to share the prize, but at the same time you are less likely to catch the prize. If you are mining by pool, the prize will be shared among the people participating in the pool even though you have a much better chance of winning a prize and winning a prize.

So, joining a pool provides a steady income, even if you are uncomfortable when you unpack a block, compared to what you get.

There is a very important thing that a mine pool should actually have: The network hashing power of 51%. If one group tries to control more than 50% of the crypto money network, theoretically this could seriously destroy the entire network. This is called "51% Assignment". At the beginning of 2014, many expressed that the GHash.io Bitcoin mineral pool is about to reach this level of strength, and miners were asked to leave this pool.

Unit difficulty

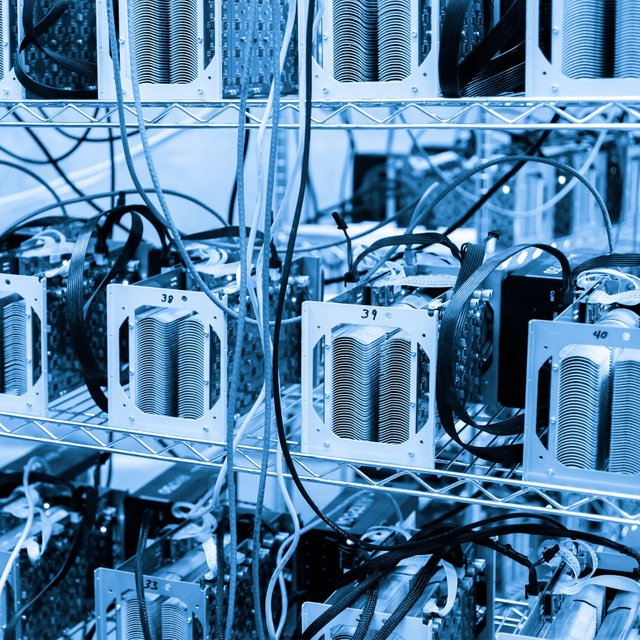

If you look at bitcoin, the current level of difficulty is so difficult that it is almost impossible for a single miner to earn money. Of course, if you have a room full of ASIC machines and you can keep them cool, that's the case. If you are naïve, joining a pool is the best way to earn a small prize in a short period of time. Pools encourage small-scale miners to continue to work.

What you can dig

There's no such thing as you just dig Bitcoin. It is quite easy to find a list of mineral pools for your desired crypto money. One of the mining methods facilitated by Bitcoin is "unified mining". In this way, you can use blocks in other crypto parcels (such as Namecoin) that use the same POW algorithm to solve blocks for Bitcoin. To roughly describe what '' unified mining '' is, you can think of writing the same number indexes in several different lotteries.

The novice miners who do not have a strong hardware should look for alternate crypto currencies - especially units that use Scrypt instead of SHA256 as the algorithm - instead of Bitcoin. This is because the difficulty of calculations in Bitcoin exceeds the capacity of ordinary computer processors.

If you can not decide on which unit to mining, there is a pool system called "Multipool" which automatically adjusts your mining equipment to the alternate crypto currency that makes the most profit. Multipool is updated every 30 minutes and you will see that in many alternative units over time, the look increases. If necessary, Multipool also allows you to fix a single alternative to your hardware.

But from Nu2Pools.com, Mark said:

"Loyal crypto money followers hate these pools because when the level of difficulty of a crypto dollar falls, the profitability increases. Then all the multiple pools flock to it, and in a matter of hours they are again annihilating the level of difficulty. This forces faithful crypto money followers to try to lower the level of difficulty with a very low profit. "

(Grasberg gold mine- Papua Indonesia)

Pool Awards

When deciding which pool to join, you should investigate how the different pools allocate the payments and, if so, how much they charge. There are many different ways that a pool can pay off. Most of these are determined by looking at the 'feelings' of a miner's contribution to the pool as a POW.

These 'feelings' are a bit hard to understand. There are two things to keep in mind: First, mining is the phase of decoding encrypted puzzles; Secondly, mining has a difficulty level. When a miner unblocks, there is a corresponding level of difficulty. Think of it as a quality measure. If the difficulty of the block solved by the miner is higher than the difficulty of the whole unit, that unit is added to the blockchain and the reward is awarded as crypto.

In addition, a mine pool sets a level between 1 and the difficulty level of the unit. If the miner transmits a level block between the pool and the level of difficulty of the unit, it is recorded as a block "share". These share blocks have no purpose of use. It is only shown as a proof of the fact that the miners have unlocked the blocks, that is, they are working. At the same time, they show how much work is done to the pool - the better the equipment, the more shares it creates.

The simplest version of payment distribution in this way is the "pay per share" (PPS) model. Changes in this system can change the rate paid per share. For example, equally shared maximum pay-per-share (ESMPPS), or shared maximum pay-per-share (SMPPS). The pools may or may not keep the pre-plan which miner previously added shares.

Another issue you need to consider is how much you will have to pay for your mining payments. In general, this ratio ranges from 1% to 10%, while some pools do not cut any money.

Thanks friends...