CME Bitcoin Futures Begin Trading (12/17/2017)

“Bitcoin futures (BTC) are live at CME. Now you can hedge Bitcoin exposure or harness its performance with a futures product developed by the leading and largest derivatives marketplace: CME Group, where the world comes to manage risk.” – CME Group

The Chicago Mercantile Exchange, also known as CME, begins Bitcoin futures trading today. CBOE was the first institution to implement Bitcoin futures trading earlier this month.

CME is an American financial and commodity derivative exchange based in Chicago, and is the largest in the world. The Chicago Mercantile Exchange trades different types of financial instruments including currency, commodities, equities and now the cryptocurrency Bitcoin (BTC).

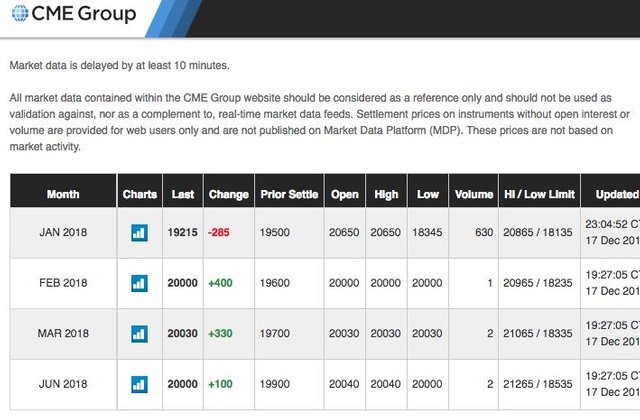

CME’s BTC futures opened at $20,650 and have traded in the range of $19,290 to $20,650. The reference price is where price limits are set and the reference price for February is $19,600. March is set slightly higher at $19,700 and June is even higher at $19,900. In comparison, the CBOE contract was most recently traded at $19,280.

Many people see the implementation of Bitcoin in major financial institution as an overall growing acceptance for the once taboo currency. It will surely be interesting to see how the futures contracts affect the Bitcoin price, demand and the crypto-sphere as a whole.

For more information visit:

- http://www.cmegroup.com/trading/bitcoin-futures.html

- http://www.cmegroup.com/trading/equity-index/us-index/bitcoin.html

Author’s note: Information from CME, Forbes and Bitcoin.com contributed to this article.