Bitcoin Slandered By Poland, JPMorgan Funding Swiss "Stable" Crypto, Dutch Court Confirms Bitcoin Technically Not A Tulip

Western Europe is turning more and more crypto-friendly. Except for Poland.

Just this week, private Swiss foundation received $30 million in seed funding to begin development of a "non-volatile, complementary global currency." I find this to be a dubious endeavor, though I will wait and see what will happen. "Stability" cannot generally be enforced in a free market, and the company this new project (called "Saga") is keeping leaves much to be desired (they are financed by JPMorgan Chase and a former governor of the Bank of Israel.)

Somehow, I doubt those two parties have the best interests of the common man at heart. However, they will certainly claim to - all Saga purchaes "will require owners to pass anti-money laundering checks and allow national authorities to check the identity of a Saga holder when required."

Be still, my heart - there's still a chance to sink all my dough into this totallynotterrible plan!

By the way, I wasn't just taking a cheap shot at the Polish above. Their government really is being a little crybaby.

Per Zero Hedge: "The social media campaign against crypto was carried out by Central Bank of Poland in conjunction with Polish Youtube partner network Gamellon, Google Ireland Limited, and Facebook Ireland Limited, allocating about 91,000 zloty (around $27,000) for producing anti-crypto content."

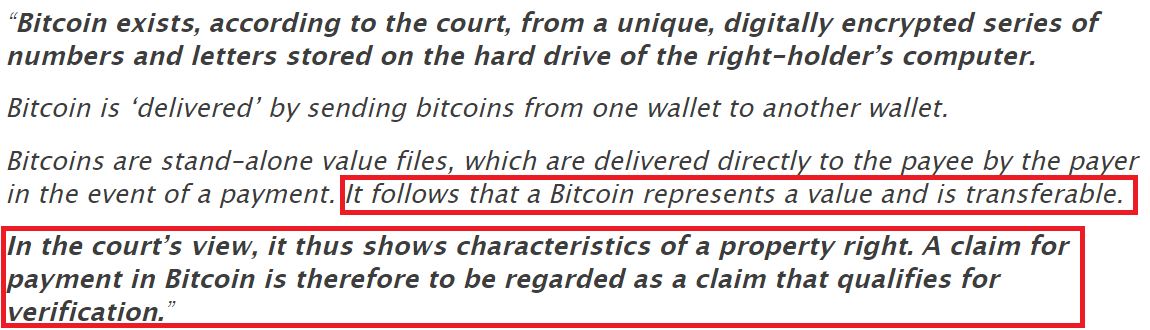

In news that excites me personally, (partially owing to the future comedy potential here,) a Dutch court has declared Bitcoin to be a legitimate legal store of value after ruling in favor of a plaintiff who was reportedly owed "owed 0.591 Bitcoin" in a civil contract dispute.

The logic required to make this ruling (shown below) wasn't exactly groundbreaking, but it is reassuring to see it asserted in a court of law. It would have been more reassuring if it wasn't a Dutch court of law, but we'll have to take what we can get.

In a final, bonus story, President Trump recently issued an arguably unusual executive order "banning purchases of Venezuela's cryptocurrency", the "Petro". Now, you should probably stay away from this currency anyway, as holding the financial bags of profligate-spender, crony-socialist nations is almost always a bad idea. However, this move by Trump is likely to have more to do with Geopolitics and wishing to continue isolating Venezuela from the financial spigot (of printing, borrowing, or issuing) than any real malice towards cryptocurrency.

I wouldn't make much of it, general crypto-sphere wise.

We also have a Radio Station! (click me)

...and a 10,000+ active user Discord Chat Server! (click me)

Sources: Google, CoinTelegraph, Bloomberg, ZH

Copyright: CoinTelegraph, CoinTelegraph (again)

great news for all steem community

its a nice post. great information for the steemit community

You got a 93.89% upvote!

Please delegate us Steem Power & get 97% daily rewards share!

20 SP, 50, 75, 100, 150, 200, 300, 500, 1000 or Fill in any amount of SP.

Click For details | Discord server

wow 93% upvote thats insane!!!!!

indeed it is

shame @thbot is not on steembottracker.com

have you ever used @thebot yourself?

no but i delegate to them

would you be so kind and tell me how does it work?

is it worth financially or are you doing it mostly to help new members? Im myself quite new here and Im still learning. Would appreciate your reply

Cheers, Piotr

I’m never going to visit poland again :)

That's good. Today I woke up to the green market and nothing can make you more happy now a days except a green market :p

I am sure this bear market is just for the moment, once we see lightning network deployed and SMT's launched on steemit, it is going to be a fun year.

I am agree with your opinion-the bear market is really for the moment. Hope its now going uptrend. Now I am buying different altcoins and enjoying my life and travelling where green scenery available. Because I know this moment investment will enrich me very well. Hhahha. I like "GREEN"

Crypto will go bigger this year than we will ever imagine! :)

I quit agree with yours

Goods news for all crypto investors

It's just the beginning of the great news! Wait for Juni :)

Its a amazing post, and i learns lot of things about cryptocurrency, well thanks for sharing it, keep it up, and i will waiting for your next post, Thanks.

HOW TO PREPARE YOUR CRYPTO HOLDINGS FOR BIG GAINS

Cryptos are ending the week a bit flat. It looks like there may have just been a bit of a bounce, but it will probably just be back to where we were a few days ago. Although the news is a bit more optimistic, we don't expect much activity over the weekend.

Many of you have asked about allocation of your crypto holdings. Today we just want to give a few different ideas to consider...

1.) Buy only the top market cap cryptos and hold. Some just hold BTC, ETH, and nothing more. Others only hold the top 5 by market cap. For us, we have some of these that we got in quite early on and do plan to simply hold for the 2-5 year range, but we don't put 100% of our holdings in these. One reason is because other cryptos may have more potential room to grow than these that already have huge market caps. If you do this, you don't have to check prices much and can pretty much snooze through these ups and downs.

2.) Put your holdings into the top 20-30 cryptos by market cap. We see a lot of people doing this. However, it's not good to do it just based on popularity. It is good to have cryptos and projects that have real concepts, products, services, and ideas that can be executed on in the marketplace. We have seen scammy ones like BitConnect, with a bug market cap...crash. We do think only 20-30 may survive, but that doesn't mean it will simply be the current top cryptos. Other new ones may come along.

3.) Watch CoinMarketCap for the coins with the most recent big percent gains. We don't do this and would suggest not doing it. Simply looking at growth means almost nothing.

4.) Focus on high risk high reward small coins, ICO's, etc. We do allot a portion of our crypto holdings to new projects with a lot of room to grow. In fact some of our best gains have been from this, but also, the risk is much higher.

5.) Trade in and out and don't give much attention to the type of coin. We do like to trade in and out of some coins, but only to generate funds for putting in longer term holds.

Summary: We have things split into 4 "pools." We like to have some cryptos that will just sit there like investing in a startup and that money is effectively "gone." It maybe will go close to $0 or pay off well in 2-5 years and we won't take it out for any reason unless there are substantial gains. These are the "Big 3," BTC, ETH, and LTC. Then, we have some in smaller cryptos. Ones that have really good potential and fundamentals, we will hold, but trade in and out of portions of the holdings. For example, if one "moons" we may take profit on 30-50% and then reinvest on a dip. Then, we have higher risk new projects, ICO's, etc, that we do not put big amounts into that can pay off big returns. And lastly, we trade in and out of coins (generally using Kraken) to try to grow funds to put into these other 3 "pools." We can't say how you should split them up, but ours are broken up close to evenly around 20-30% of total funds per pool.

We hope this helps you see how you can play with these to profit in the crypto market. For example, right now the market is slow, but perhaps you can take some from pool 2 and put it in a trading pool to trade bounces, and so forth.

We are going to have more information next week about different ways to profit in the crypto-markets.

Poland will never be crypto-friendly, cause of stupid government. People here are really blind and they are voting for other stupid people.

I agree. Our goverment is not going to embrace crypto :/

True :(

I guess the "saga" continues ! Good information mixed with some humor as well. I laughed a bunch but also understand the concerns that are raised from the "bitcoin-ski" situation taking place in Poland. :-)

Great news and great post ! good informations for the steemit community