CME Futures Traders Seem Bearish about the Bitcoin Price Curve for the Next Few Months

The order books of cryptocurrency exchanges around the world represent relatively thin markets, increasing the opportunities for price manipulation. One route for this manipulation involves taking certain related positions in the spot and in the futures markets. Influence can flow in both directions between the two markets, as everybody knows.

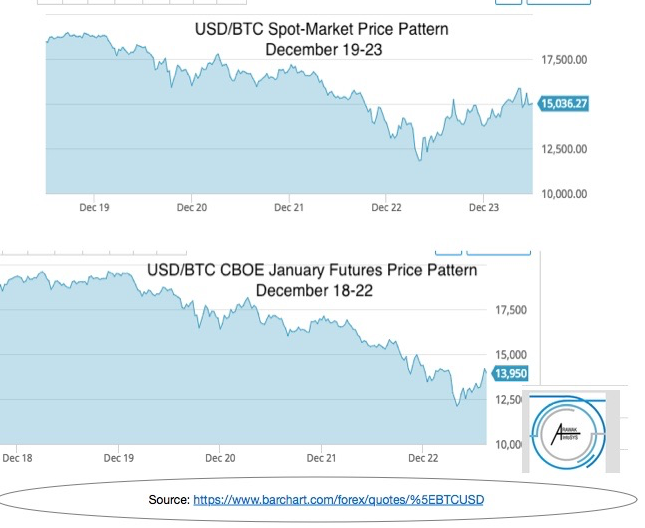

The chart which follows illustrates the usual similarity of the price tracks of the two markets. (Apologies for the unduly light blue colouring of the chart in the source document. Please focus on the curve at the top of the blue area.) Notice that the first date of the futures market chart is one day before the first date of the spot market chart.

Arbitrageurs are key players helping to maintain the said similarity. They will buy in one market and sell in the other to make small profits on unwarranted price divergences between the markets.

The abstracts and literature cited under two topics in the Arawak_InfoSYS “Knowledge Repository” comprise materials that you can use to get a quick overview of what is involved. The topics are: “Vulnerabilities arising from the multiplicity of small largely unregulated exchanges dispersed among many countries” and “How can the actions of futures traders affect the spot price of bitcoin?“

The influence of the futures-market trading on the spot market price pattern may be particularly interesting if it turns out that the “big” institutional money is going to participate in bitcoin trading largely via regulated derivative instruments. Some analysts have forecast this future development.

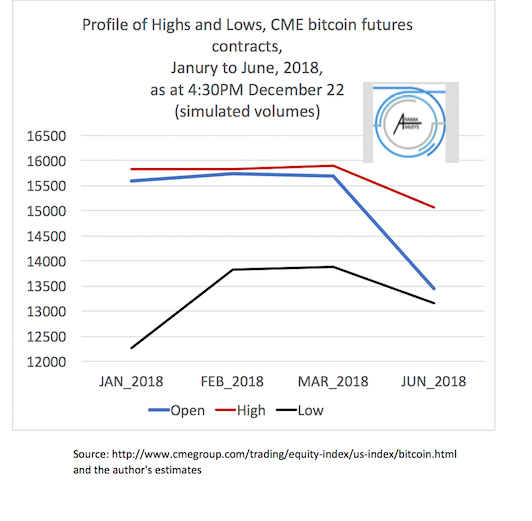

In the next chart, I have simulated what the price profile for the forward month prices of bitcoin futures at the CME (from January to June) would be, if the volume of contracts at each month was the same as for the January 2018 contract (roughly 2,400). Think of this simulation as giving you a rough estimate.

The chart is based on the actual midpoints between the High and the Low prices at each forward month. That is, the midpoints are computed from real data. The pattern formed by the curves does not suggest that these institutional traders are bullish for the next six months.

However, there are two cautions to note. The actual contract volume is very much larger for January (2,369) than for June (5), which means that the data provide a seriously inadequate sampling of sentiment across the months. Secondly, the pattern that is shown here is highly sensitive to disruption from the arrival of consequential news.

When I was actively trading stock options, I found statistical support for the hypothesis that the overnight futures price patterns provided good indications of how far (in percentage terms) and in what direction the relevant spot prices would change over the coming day of trading. This was for the broad stock indexes.

Despite the weaknesses in the data presented above, they suggest that the message in the futures price pattern deserves your consideration.

At the Arawak_InfoSYS “Knowledge Repository”, you will see abstracts from the best available texts and videos that provide basic education about the bitcoin futures. Beside the text of each abstract, a link takes you to the original source document.

The abstracts are classified under the following subject headings.

- Basic education about bitcoin futures contracts at the CME

- The relative frequency of selling versus buying futures contracts

- How can the actions of futures traders affect the spot price of bitcoin?

- Impact of futures trading on bitcoin’s price volatility

- Managing counter-party risk in bitcoin futures trading

- Vulnerabilities arising from the multiplicity of small largely unregulated exchanges dispersed among many countries

(“Look Grandma! No one-word tag names for topics. Instead, informative phrases to delight humans and make the bots angry.”)

So, Arawak_InfoSYS “Knowledge Repository” will be a “go to” place for those who wish to find a helpful assembly of abstracts and links to the most useful published thinking about key aspects of the impacts of bitcoin futures trading on the price pattern of the underlying bitcoin asset (the pattern of the so-called “spot price”).

P.S. This article is all “green content’. You will not find it anywhere on the Internet, except at Steemit. It would be nice to put the Arawak_InfoSYS “Knowledge Repository” right here inside Steemit; but it will disappear about 20 minutes after being uploaded and then almost nobody will know it was even uploaded to Steemit. Also, those who know it has been uploaded will have a very hard time finding it. Thus, for 99% of the Steemit sub-community that might find this piece useful, it never existed; unless (I have now learned from a Steemit veteran) I first spend 12 months selling myself and growing “5,000” followers. Great formula, gals and guys!

Resteemed your article. This article was resteemed because you are part of the New Steemians project. You can learn more about it here: https://steemit.com/introduceyourself/@gaman/new-steemians-project-launch

Thanks @gaman. I visited your site many weeks ago; but will do so again now in case there are new developments.

If understanding correctly, Arawak repository is yours?

Here's our suggestion for a next article:

What is the relative size of bitcoin volume on Coinbase vs the now short-history volumes on CME and CBOE? Think it would be VERY interesting to see if the futures (5 bitcoins per future x future volume ) volumes are gaining market share on the OTHER exchanges which allow large institutions to take custody of cryptos on behalf of their customers.

If you want help collaborating on a spreadsheet, aka gathering some daily data, we can offer SOME assistance.

Yours is a very encouraging response and thanks a lot @harpooninvestor. Yes, https://www.marketstatsanalytics.com is my website, recently converted from a 100% focus on the stock market to what is now a virtually 100% focus on the cryptos.

However, people visiting my site now get little indication of what is my niche — deep data mining and producing innovative statistics and analyses based on same. You do get a glimpse of this by going to my analysis of the August 2015 flash crash (https://www.marketstatsanalytics.com/marketspeaktrans.html) .

As time goes on my website will fill up with this kind of work, which will make it rather unique in the space. Your suggestion is very interesting as it ties in with my area of strength — deep data mining related programming work.

However, keeping in mind that the futures trading is going to be done only by Big Boys, we should expect big volumes there only when those with ability to print infinite amounts of fiat money (as well as absorb a paper loss of any size) start using the futures to try to manage the price of bitcoin. I'm sure you have read all about this expectation.

I am indeed seeking collaboration, so thanks. I will help with generating daily data; but I wish to say now that I would expect you to deal with publishing those data at your site (or posts), since that is not part of my niche.

I will use daily and intraday data to occasionally paint some broad picture that involves linking different variables and then writing an article about the messages in that picture. Most often, there would be a free version of the article at my website and a paid one at my e-commerce website. I may release two-paragraph summaries at Steemit (which is all we should try because stuff at Steemit gets lost so fast).

Cheers!

I forgot! Where should we exchange notes, data, etc., privately before you decide what you want to take public. Discord.app ? I already have a "server" there. Let me know if you would like us to use it. I have set up one channel for smart tokens, and we could set up a new one for futures-related stuff.

Is Discord.app a crypto site, or pre-crypto?

i gotta spend some time reading up on your web links above. will come back tomorrow.

Discord.app was created as a collection of sets of chat channels (each set is called a "server", and I have a server named Smart_Token, and I have not yet made any special channels inside it) to serve gaming communities! It has been so succesfsul that the owners have extended its reach to all kinds of communities.

It is free to join. When you do, visit the SteemitBC "server" to see a fleshed-out set of channels, one of which is crypto-trading, and another is crypto-taxation.

Stuff submitted to a channel can be seen by the public; but there ius a DM (Direct Message) service where private messaging happens.

Steemit set up a Steemit.chat service; but Discord is much more powerful. It even allows voice chatting.

Congratulations @lestatisticien! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!