Cryptocurrency & Blockchain Project Breakdown #1.0 - Bitcoin (BTC)

This will be my first in a series of breaking down a project based on its history, development, and potential future. It is important to note that the historic or current value of a projects coin or token is of no importance, this series will attempt to solely concentrate on the substance of each project.

Disclaimer: I do not own any BTC and although many may suspect, nor have I ever owned any BCH, BAB, or BSV.

As the best known and very first blockchain project, Bitcoin (BTC) is the obvious first project to cover.

Birth of Bitcoin

Bitcoin was birthed through the publishing of the Bitcoin whitepaper (PDF) titled Bitcoin: A Peer-to-Peer Electronic Cash System in October 2008. Although this was not the first digital currency or cryptocurrency, it was the first to propose a trustless blockchain and resolved many of the problems present in its predecessors.

The persona and author behind the Bitcoin whitepaper was Satoshi Nakamoto. Nakamoto's identity remains a mystery although there are several people suspected to be the genius behind Bitcoin. It is also suspected that due to the advanced level of the code written for Bitcoin that Nakamoto is actually a group of persons.

After publishing the Bitcoin white paper, Nakamoto went on to release Version 0.1 of the Bitcoin software in January 2009 and the genesis block was mined. The genesis block of Bitcoin is unique in that it cannot contain the hash of a previous block and thus required special programming by Nakamoto.

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.

The text embedded in the transaction of the genesis block is a reference to a headline published in The Times on the same date the genesis block was mined and is widely considered as a negative comment towards the current banking system.

The Fracture of a Community

Prior to the handing over of the Bitcoin project, Nakamoto had done all modifications to the Bitcoin code repository personally. In mid-2010, Nakamoto handed control of the source code repository to Gavin Andresen and transferred domains such as bitcoin.org to members and contributors of the Bitcoin community. Nakamoto disappeared soon after, his identity remains a mystery and all involvement in the project has ceased.

To prevent frivolous data causing throughput issues on the network, Nakamoto had added a 1MB block size limit as a temporary anti-spam measure before his departure. Prior to this restriction, block size limit was technically 32MB, which made it possible to maliciously send large amounts of frivolous data to increase processing times of blocks.

In discussions over how to resolve this restriction, it was not long before fractures in the community over the development of Bitcoin occurred.

As there were communities created after Nakamoto's departure, like the /r/bitcoin subreddit on Reddit, as well as the ownerships of different communities and websites handed over by Nakamoto, a lot of control over these communities ended up actually being in the hands of a select few groups people.

Many of the most popular communities were in control of someone known by the username Theymos. Blockstream, a blockchain development company, also heavily supported Theymos. The main team behind the current development of Bitcoin renamed itself Bitcoin Core and is also aligned with this camp of Bitcoin development.

A tumultuous period of censorship as well as the purging of moderators and community members came to the forefront in 2015.

In controlling the narrative of the discussion over how to resolve the block size limit issue of Bitcoin, they were effectively controlling the direction of development instead of relying on the community and an actual consensus. The reasons for this are most likely financial as Theymos' financial links to Blockstream were discovered.

In defense of this censorship, much of the claims were that the suggested solutions to the block size limit restrictions required a hard fork, which meant these projects were no longer Bitcoin. This is an indefensible position as for example of the SegWit2x fork which was discussed and its plan executed, although it ultimately failed.

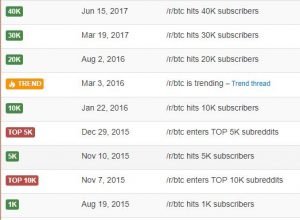

Instead of a single community discussing the potential solutions and development of Bitcoin, it had fractured. As users were purged and news came to light, there were small migrations of users from their communities, such as the /r/bitcoin subreddit to /r/btc that began in late-2015.

Source: http://redditmetrics.com/r/btc

Eventually, this fracture leads to the first notable hard fork of Bitcoin, Bitcoin Cash (BCH).

Many argue that Bitcoin (BTC) is the rightful successor of the Bitcoin named created by Sakamoto because it has consensus. The man Nakamoto handed the Bitcoin code repository to, Gavin Andresen has stated otherwise.

https://twitter.com/gavinandresen/status/929377620000681984?lang=en

Controversy in Bitcoin's Value

Much of Bitcoin's consensus was gained through well financed and heavily controlled marketing. All of the money involved in making this a reality is symbolic of all of those who have invested into the value of BTC.

Cue Bitfinex and Tether (USDT). Tether Ltd. is the company behind the Tether token which is what is considered a stablecoin because each token of USDT is supposed to be tied in a 1:1 ratio with USD fiat currency. Tether is the commonly used pair with BTC since it is easier to trade between the two tokens on crypto exchanges than it is to trade in fiat currency. As such the BTC/USDT pair is often used to determine the current comparative price of BTC in US Dollars.

On November 20th, 2018 the United States Department of Justice began a criminal probe into Tether and Bitfinex [Bloomberg] and the possibility that USDT was used to manipulate the price of Bitcoin during the price's meteoric rise in late-2017. This is following the subpoena received by both Tether Ltd. and Bitfinex from the U.S. Commodity Futures Trading Commission in January 2018.

Tether Ltd. and the Bitfinex exchange have a strange unconfirmed relationship which explains why both probes include both entities. The CFTC's subpoena is focusing on whether or not USDT is actually backed by USD as Tether Ltd. has failed to provide an audit of their finances, for which it has received a lot of negative feedback.

The Justice Department's probe is much more explosive. Following a paper issued in June 2013 coming out of the University of Texas at Austin by John M. Griffin and co-author Amin Shams [SSRN], there arose allegations that USDT was used to "provide price support and manipulate cryptocurrency prices."

The Justice Department's probe is now investigating further into these exact allegations of price manipulation. Due to the strange relationship between Tether Ltd. and Bitfinex, this could potentially explain why the highest value BTC hit was 19,891 USD in late 2017 on the Bitfinex exchange.

If USDT is not really tethered to USD and they are somehow partnered with the Bitfinex exchange, it could be stipulated that this manipulation was a concerted effort. The paper by Griffin claims that Tether was used consistently to manipulate Bitcoin's price and accounted for more than half of the 1,400 gains seen in late 2017.

Both Bitfinex and Tether Ltd. deny these allegations, however it is something to consider.

Cost of Production

It has been argued that one of the things that gives BTC value is the electricity cost to mine each block. There is an inherent flaw with this logic and that is the cost to mine can affect the profitability and value just as much as the value can affect the cost to mine. Thus the linkage of the cost of production to the value of BTC is not necessarily positive.

https://twitter.com/cnLedger/status/1064905224077291521

If the price is linked to the hashrate, we would not be seeing the dumping of miners on the street to be sold as scrap metal. The logic also fails to hold up when you understand the connections to hash rate and pricing. If less people are mining because the price is reduced, the remaining miners can now reduce the difficulty of their hashes and remain profitable. This means the cost of production has gone down and thus the price.

At the previous hash rates, profitability meant that BTC was worth approximately $6,000 USD. As of writing, cryptocurrencies as a whole have taken a battering in the last few days and BTC is currently valued at $3,984.14 (CMC). So although the two are linked, the price went below the value of the cost of production and as such will end up reducing the cost of production. The ability for each of these to drive the value of the other signals it does not represent a net positive for the value of Bitcoin.

Using the cost of production as a means to value Bitcoin is something I have disagreed with before. However it is something that needs to be addressed when discussing the value of Bitcoin as this fact is constantly used in support of BTC's value.

The Positive Value of Bitcoin

The consensus behind Bitcoin is a controversial topic to all except the supporters of BTC. Regardless of how this consensus was obtained, it means Bitcoin does have value due to this consensus.

It is from this consensus that Bitcoin has remained in the spotlight and top spot over all other cryptocurrencies. This has allowed Bitcoin to garner more attention from the public and has also attracted the most developers.

It has been oft repeated that the period after the cryptocurrency bubble of late 2017 would be followed by the inevitable collapse of many crypto projects. The projects which survive will be those who have an actual project or technology to support them. Although Bitcoin will also require this, it differs because of all the exposure and investment it receives.

Bitcoin's exposure to the public and thus its adoption remain the true driver of value in BTC. If Bitcoin is somehow able to continue its upward trend of adoption, it will still rely on a lot of faith from adopters. Although almost all the initial stages of adoption will only happen as long as BTC is paired to fiat currency and the value of that pair is stable.

Bitcoin ETF

Although it has yet to be approved, there are several organizations seeking approval from the U.S. Securities and Exchange Commission for a Bitcoin ETF. An ETF is an important vehicle for any cryptocurrency in that it generates a new avenue of investment. The appeal comes from the regulated nature of an ETF attracting investors that veer away from the risky nature of cryptocurrencies.

The SEC's reason for delaying or denying approvals of a Bitcoin ETF are due to the unregulated nature of cryptocurrency and the exchanges trading them. One of the warnings from the U.S. Commodity Futures Trading Commision for example, is that cryptocurrency exchanges are not regulated and can self-deal such as with the Bitfinex investigation.

Bitcoin's ETF is the type of partnership and adoption that have the potential to drive the value of BTC. A recent example at time of writing for large adoption of Bitcoin is the U.S. state of Ohio's accepting Bitcoin for the payment of taxes. The state is doing this through an intermediary which will immediately convert the Bitcoin into fiat currency.

These types of large adoptions may give Bitcoin value regardless of the technology. However, it is ultimately the technology itself which will drive that value upwards.

Lightning Network

The Lightning Network is Bitcoin Core's next big development. The purpose of this "second layer" sidechain is to address the scalability issues of Bitcoin without changing the blockchain size limit.

This is accomplished by performing the transaction via a smart contract on a sidechain prior to transmitting the transaction data to the main Bitcoin public blockchain. By offloading the transactions so they are occurring off the main blockchain, they are withdrawing from the original limitations of the BTC public blockchain's block size limit. The smart contracts would be enforced, but would require constant vigilance to monitor for fraud. As such, a "watchtower" program has been discussed where trusted sources will continually monitor the network for any fraudulent transactions.

It is argued by many contenders to Bitcoin that the Lightning Network means Bitcoin is no longer the peer-to-peer system envisioned in Nakamoto's white paper. This point could prove irrelevant if it enables a scalability to a product which can be taken to market and widely adopted.

Investment Potential

Bitcoin due to its adoption has strong investment potential. However, even as the oldest of the established cryptocurrencies, it is still in its infancy.

Warren Buffet is not a fan of Bitcoin and once said Bitcoin is "probably rat poison squared." at the Berkshire Hathaway 2018 annual shareholder meeting. I believe he says this with good reason. Bitcoin being in its infancy means it can still go in any direction.

It is also rare for the first of a nascent technology to lead the way and history tells us it is more likely a competitor project will eventually overtake Bitcoin's position. Consider technologies or services such as Friendster, Myspace, or Napster as examples of this.

As Bitcoin is currently the most valuable coin, there is potential in earnings by playing the markets. For long term investments, the value of BTC will be completely reliant on adoption. By having the most attention it also has the most developers working on solutions giving it the higher potential to make a breakthrough when comparing to other cryptocurrency projects.

It is important to note that competitor projects were able to use Bitcoin as an example when developing their own products. Due to this, they were also able to streamline their technology for very specific purposes. These projects all pose a risk to Bitcoin's dominance and The Flippening, the situation when an alternative cryptocurrency surpasses Bitcoin's value, could eventually occur.

Bitcoin's position as the top cryptocurrency at the time of writing continues to make it the most stable of all cryptocurrencies. Any rise and fall will be dependant on Bitcoin's own ability to make new technological breakthroughs and garner further adoption, but this will also be affected by other projects that may make similar breakthroughs if Bitcoin fails to rise to the challenge.

As always, only invest what you can afford. Do not take my word for it, but continue to do your own due diligence for any project.

Posted from my blog with SteemPress : https://leonox.me/2018-11-26/posts/cryptocurrency/cryptocurrency-blockchain-project-breakdown-1-0-bitcoin-btc/