Bitcoin Price Takes a Dive After £30m Tether Hack Exposed

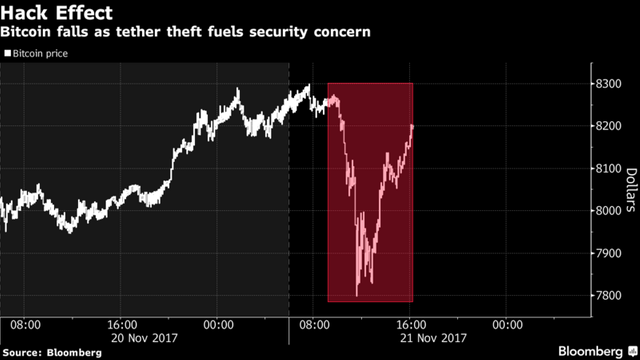

Bitcoin slipped from a record after the $31 million robbery of a cryptographic money peer restored worry about the security of computerized coins.

Bitcoin has been unequaled high amid the previous couple of weeks, above $8000 is something unimaginable for a computerized cash. In any case, as of late, Tether—an organization which offers benefits in trading fiat money into token—said today that programmers scratched around $31 million.

A year back crypto trade Bitfinex a Tether's accomplice lost 119,756 bitcoins which worth $72 million around then and esteemed $950 million today.

More than $400 was wiped from the estimation of the digital money which dropped five for each penny over night after Tether, a trade where cryptographic forms of money are pegged to customary monetary standards, said it had found the security defect and burglary.

The organization behind tie, a digital currency utilized by bitcoin trades to encourage exchanges with fiat monetary forms, declared the burglary on Tuesday. It said in an announcement that a "malignant" aggressor expelled tokens from the Tether Treasury wallet on Nov. 19 and sent them to an unapproved bitcoin address. The organization said it's endeavoring to keep the stolen coins from being utilized.

Bitcoin was influenced when the news began coasting on the web. Bitcoin dropped as much as 5.4 percent to $7,798.72, before paring decreases to 0.7 percent at 9:20 a.m. in London. In any case, later bitcoin recouped rapidly. Bitcoin presently remains at $8137.15 at the season of composing.

The occurrence is the most recent in an extensive rundown of hacks that have scratched trust in the security of digital currencies. It's probably going to fuel the civil argument on Wall Street about whether advanced coins are sufficiently secure to enter the standard of fund.

Tie, with a market capitalization of $676 million, is the world's nineteenth most-important virtual money, as indicated by information on Coinmarketcap.com. The tokens are pegged to fiat monetary standards, enabling clients to store and exchange all around and in a flash, as indicated by the site. The organization behind tie has said that the tokens are 100 percent upheld by fiat monetary forms.

Tie has moved toward becoming piece of the bitcoin biological community since it enables trades to encourage exchanges against monetary standards like the dollar, euro and yen, as per Arthur Hayes, CEO of BitMEX, a cryptographic money subsidiaries scene in Hong Kong. Hostile to illegal tax avoidance and know-your-client rules have kept numerous bitcoin trades from opening financial balances expected to hold fiat monetary standards.

The burglary has recharged worries over tie's suitability. Distrust had just been working after the organization behind the tokens said in April that every single global wire had been hindered by its Taiwanese banks. That energized theory about whether the tokens were completely upheld back fiat monetary forms.

Tie's clients are probably not going to forsake it as long as it's upheld by trades and no other dependable pegged token shows up, as per Zhou Shuoji, an establishing accomplice at FBG Capital, a Singapore-based cryptographic money speculation organization. That view may clarify why bitcoin recouped some of its underlying misfortunes.

Follow us and please Upvote!!