Bitcoin Network Uses 0.5% of the World's Electricity

Bitcoin has boomed over the past 2 year, with December 2017 seeing the largest increase in value. Bitcoin's value isn't the only thing booming. The power consumption of Bitcoin mining increases as more Bitcoin mining farms are created to process the cryptographic calculating requirements of the digital ledger.

Source

To estimate how much electricity is being used for entire Bitcoin network, a peer-reviewed article has been published on May 16th 2018 in the journal Joule. The estimates Alex de Vries came up with are that the current minimum usage of the BItcoin network is 2.55 gigawatts which is nearly the amount that Ireland uses.

Each single transaction is estimated to use the same amount of electricity that an average home uses per month in the Netherlands. By the end of 2018, the estimated power could be as much as 7.8 gigawatts. This would be about what Austria uses. It's also representative of 0.5% percent of the worlds total consumption of electricity.

Think about that. One network using half a percent of the power of the world in order to make it run. This is such a huge waste of electricity when it's not even required. It's not helping reduce the need for power in the world.

Additionally, this adds more argument in disfavor of Bitcoin or by association other cryptocurrencies compared to the traditional financial system, even though other cryptos are much more power efficient by not requiring useless hash calculations in Proof of Work (POW). With an continual increase in the value of Bitcoin, the network could reach 5% of the world's electricity, according to de Vries.

The more people get in trying to mine Bitcoin, the more power will be used and wasted. Not everyone who tries to mine gets to do so and claim the reward of 12.5 BTC. Miners compete for the chance to mine. Those who don't win still consume power with the computations they engage in. To increase the chance of winning the mining round, you need to increase your computing power. This incentives greater processing hardware and mining farms to be made.

Eventually the cost of hardwarer and electricity for mining will equalize with the value of Bitcoin. de Vries has looked at the cost of the mining hardware to estimate how much the cost is from hardware and how much from power consumption, but many manufacturers are secretive about their hardware. He has to rely on imprecise data for some of his estimation. He says his estimates look forward into cryptocurrencies and how sustainable they are, allowing policies to be made to restrict mining for cryptos like Bitcoin. Some U.S. states have already applied restrictions for Bitcoin mining.

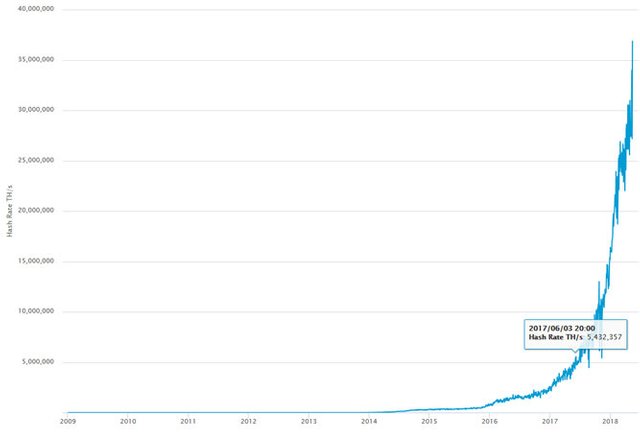

The Estimated Number of Terahashes per Second (Trillions of Hashes per Second) Performed by the Bitcoin Network

Source

I don't like this factor of the Bitcoin network using so much power wastefully. I suppose it will stick with mining coins to make it competitive until the cost of mining is greater than the BTC rewarded for mining. Another cryptocurrency can do better as the "king of crypto" if Bitcoin is locked in its ways and unwilling or unable to change how it functions. Maybe STEEM can take over someday? :P

References:

Too bad this estimate wasn't very good.

Worse, they are not comparing it to anything comparable.

Why not compare it to CERN. Which is just wasting energy. The theories have already been disproven... unless they are trying to do something else like punching holes in the universe. Uses much more energy.

Why not compare it to the SWIFT system? The banking system currently uses much more energy.

Why not compare it to cars sitting in gridlock traffic? Wasting much more energy.

Further, bitcoin miners are located in areas with very cheap electricity. Mostly this is due to their being a natural energy generator there. Like hydorelectric or geothermal.

Well you're right about the banking system, seems it's about 5x more energy use. His comparison is off indeed :/

How much money is bitcoin handeling. Large ammounts, but not near to global levels. Is it used in day to day transfers? No.

Is it already using a lot of power? yes.

Will the trend of power usage rising continue? yes.

It doesn't take a statistician to realize its not sustainable.

PoW work is never wasted, it adds to the security of the network. The flaw in my opinion is not pow mining, it is that given the rise of bitcoin price there is already too much security. The mining rewards should have fallen of faster than they do and we now are in a strange situation where the price is high even though adoption is still low and huge rewards are set out to support the network.

This design in bitcoin was designed to support the early growth when success of the technology was anything but clear. Now it is a big waste and I am looking forward to the next block-reward halvings that will help but that come a bit too late down the road.

I see, makes sense. They are getting a lot of rewards for mining that's for sure :/ Very lucrative to do mining farms.

Many times we don't think about the consequences that the BTC may have in the future, it has been a great revolution, that has kept with great expectations to the market of the economy, that in great part has placed all its hopes in it, but if we analyze these data that generate an alarm could generate great concerns, I don't manage the reliable data, but it is said that in my country there is a great boom with the history of the Btc, the mining has become the most sought after business, as a way out of the great crisis we are going through and the devaluation of our currency, what keeps many families afloat is the exchange of other currencies, including crypto, but there are already regions with serious electricity problems due to mining and the poor maintenance of power plants due to the poor performance of government agencies, in short, already the havoc is being perceived, so they spend long days without electricity, it would be great if the steem becomes the successor currency to the btc.

Excuse my English, I use a translator.

That's a good point, not right for big power consumption from mining to stress out the power grid and prevent regular people who need to live from getting their electricity. That's not right at all.

Mining is not profitable. it takes 200 days according to some days to recuperate investment. Then of course your country's electricity needs to be cheap enough.

Crypto trading is much more reasonable. But it requires the necessary skill sets.

Crazy

I have an investment in a company called HIVE. It's a brilliant idea. They listed on the Toronto stock exchange because this is the worlds market for mining stocks and speculations and has an entire financial industry build to support the industry.

They had their IPO and raised cash, then Geneses Mining, the worlds largest crypto miner bought 30%. They subsequently had two massive private placements that raised $80M and then $115M. They bought property in Iceland where it's cool and paid Genesis to build their first mining capacity. Then they pay Genesis to operate the facility. The power is some of the cheapest in the world. It is geothermal and excess power available. They expanded to Switzerland and did the same, but this time with all hydro power. So they are only using renewable energy.

They just purchased 160acre land parcel in Switzerland and have a commitment for up to 1GW of hydro power that is available to continue to build out their mining business. My point is that if you use renewable power, I see no issue with the using power for this new business.

As a side note, they will have installed 44.2MW of equivalent mining power by September. At this rate, they have projected annual revenue of $150M at greater than 90% profit and will hold the coins to ride their value up in the market and continue to grow. It seems like the perfect business.

I just read that solar is becoming the lowest cost and most abundant energy source in the world. They only need battery technology to store the massive amount that's being generated to use when the sun isn't shining. California is generating so much solar power they are at risk of blowing up their grid. So they pay Arizona to take the excess.

I have another investment called MGX Minerals. They are another tiny company but one of the most incredible I've ever seen. To stay on topic, I'll only talk about one technology they have. It's a battery technology called ZincNyx. They use zinc particles as the fuel and air in a fuel cell technology. It's completely scaleable by increasing the fuel tank (zinc particle tank size and the number of fuel cells). They just announced this week they effectively increased it's capacity by 300% in the latest version they will start offering the market. It's main use will be for power storage of renewable energy. This business has such massive opportunity they are shortly going to spin it off into its own public company.

To run a mining farm, 50% of the cost is electricity and 40% of this is the energy required to cool the computers. I own an incredible investment in a company called Smart Cool. They have a technology that can reduce the amount of energy required to cool. They are aggressively going after mushroom farms, data centers and crypto mining.

My point in this "comment" is only that technology coupled with capitalism will create solutions to many of the worlds problems. And companies like the three I'm invested in are at the forefront of helping responsibly manage the worlds use of energy...

Sounds like you are doing a good job picking them ;)

I work hard at it. As my hobby I spend about 30 hours a week and expect it one day to allow me to have my own businesses instead of working for someone else. I can't wait for my investments to pay off. My crypto portfolio on it's own is set up for pretty awesome future...

Green energy is the only method. Traditional energy is simply too expensive. And of course there a lot more support for green energy these days.

i believe after bitcoins market dominance drops below 33% it will have less sway on the direction of the market as other more utilitarian blockchains begin taking shape.

we still have a while to go but maybe steem will make it to the top 5 at least!

Maybe eh ;)

steem's the blockchain tech I've used the most actively (directly at least)

One of the reasons for this is that they make it as easy to participate as possible. There are no barriers of entry and everyone is welcome to participate.

I think we should switch to proof of stake.

2017 will definitely be not the highest value. Let's give it a year or two then we might see at least triple of what was in 2017!

Probably ;) 30k seems to be the estimate for end of 2018.

This seems like exaggeration. I dont know where the error in math is but it doesnt seem right. Also future is PoS. Once we have that, it will be faster and much less energy intensive.

that's a lot of electricity for just one entity. A new school idea running on old school energy. WOW. I have often thought that Bitcoin would not make the final cut in the beta testing of crypto currencies. This is just another reason. Thanks @krnel.

Maybe not in the end, but for now it will likely be the top for a while.