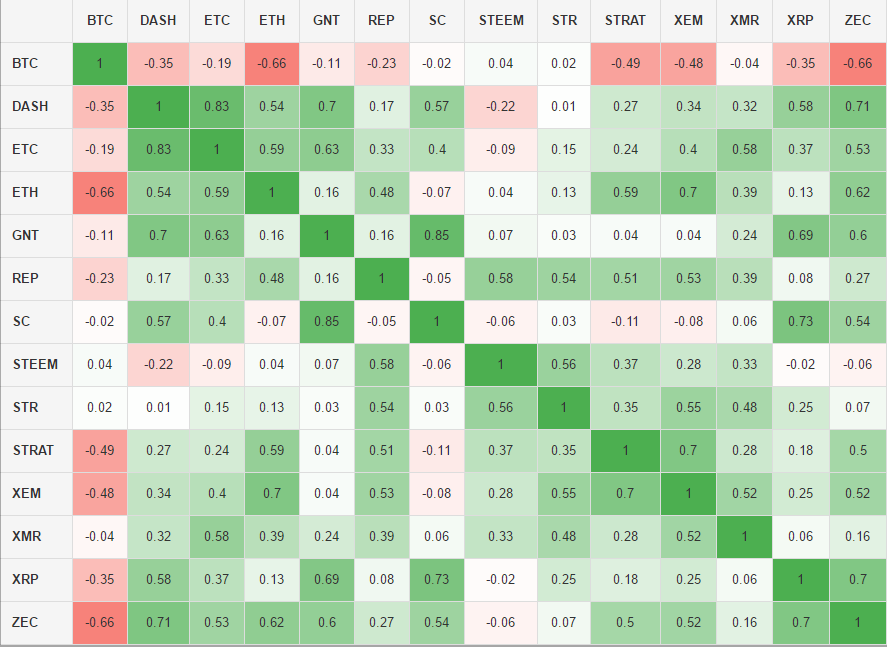

Correlation Coefficient between bitcoin and a bunch of altcoins

Explanation

The numbers in the matrix are correlation coefficients (What's that?). You have to read them in the following way:

The closer to 1, the more correlation (prices behave similar)

The closer to -1, the more inverse is the correlation (prices move in different directions)

Anything close to 0.0 – Either negative nor positive correlation (movements outweigh each other

This could be the start of a crypto index.

Curios but cool, could you please explain a little bit. May also follow @svtechnik

Explanation

The numbers in the matrix are correlation coefficients (What's that?). You have to read them in the following way:

The closer to 1, the more correlation (prices behave similar)

The closer to -1, the more inverse is the correlation (prices move in different directions)

Anything close to 0.0 – Either negative nor positive correlation (movements outweigh each other

Basically what it means that certain coins, the darker green ones, mimic bitcoin really well (go up when it goes up and go down when it goes down), some move opposite to bitcoin - those are the red ones which this data suggests will go down when bitcoin goes up and up when bitcoin goes down. Then you have the white-ish ones, those are "uncorrelated" to bitcoin meaning that it goes up and down independently from whatever bitcoin does.

Yea you got it all right.

thanks

Wonderful

Very cool, nice work! Can I ask where your data came from?

Very cool! Can you add Gridcoin?

Thanks for sharing this wonderful tool to help diversify our portfolio.