Coinbase Sends American Client IRS Tax Form 1099-K.

Coinbase Sends American Clients IRS Tax Form 1099-K

If you are an American client of Coinbase and made plenty of transactions during 2017, you better check your email. The company sent out tax forms for 2017 to many clients who were not necessarily expecting it.

Also Read: Bitcoin Tax Reporting Software Developer Node40 Acquired for $8m

IRS Tax Form

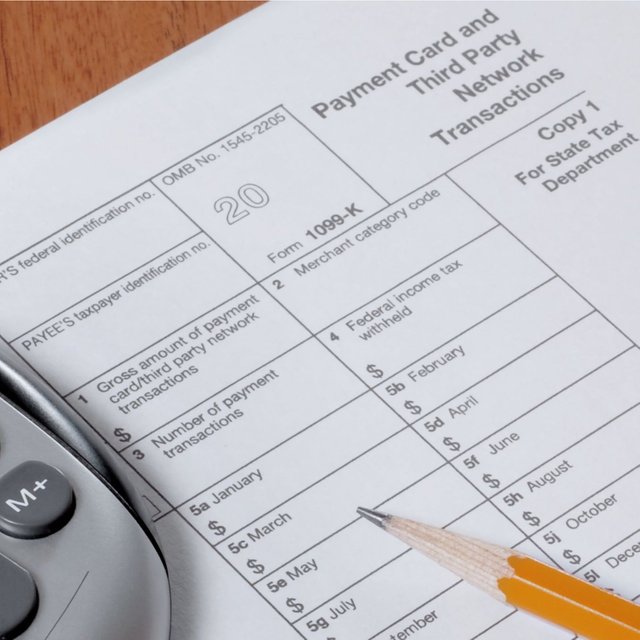

Coinbase Sends American Clients IRS Tax Form 1099-K on Jan 31San Francisco-based cryptocurrency exchange Coinbase has issued 1099-K tax forms for a certain segment of its clients in the US on January 31. The company explains that it files 1099-K for customers who have received cash above the required reporting threshold, which is more than 200 receipt transactions or greater than $20,000 during the year.

This also includes “business use” accounts, as well as GDAX accounts in which sales of cryptocurrency for cash have occurred that exceed the thresholds.

Business use is meant to apply only to those who received payments in exchange for the provision of goods or services, not mining proceeds or transfers from other wallets they hold. Coinbase states that: “We used the best data available to us to determine whether your account activity qualifies as Business Use, including but not limited to factors such as completion of a merchant profile or enabling merchant tools.” This is similar to Etsy sellers and Uber drivers who also file 1099-K forms.

What Can You Do?

Coinbase Sends American Clients IRS Tax Form 1099-K on Jan 31Over at the crypto community’s online forums and social media, complaints are already popping up from Coinbase clients upset about the move. Besides the obvious displeasure of learning that their transactions will be reported to the IRS, people are complaining about not being notified beforehand and above all about the figures being higher than what they expected.

If you believe Coinbase made errors in your form, you should send them the information regarding the transactions that were counted in error via their support email. Consulting with a tax professional is advised as well.

The fact that Coinbase would want to prevent more problems for itself with the IRS should not be surprising. Back in November a court ruled that the company had to report the personal data of 14,355 account holders who bought, sold, sent, or received more than $20,000 between 2013 and 2015.

How do you feel about exchanges reporting your bitcoin transactions to the taxman? Tell us in the comments section below

Source https://news.bitcoin.com/coinbase-sends-american-clients-irs-tax-form-1099-k/

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by komoniok from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.