Hard stats on the global nature of blockchain/ crypto usage and FACTS you should know!

One of the core tenants that underpin the support and growth of bitcoin and now subsequently blockchain technology is in its decentralized nature. We are so used to being caught in a monetary system which is country based (excluding zones such as the Euro) it is hard to bend our heads around an idea that is technology has no borders, and in such lies it’s strength.

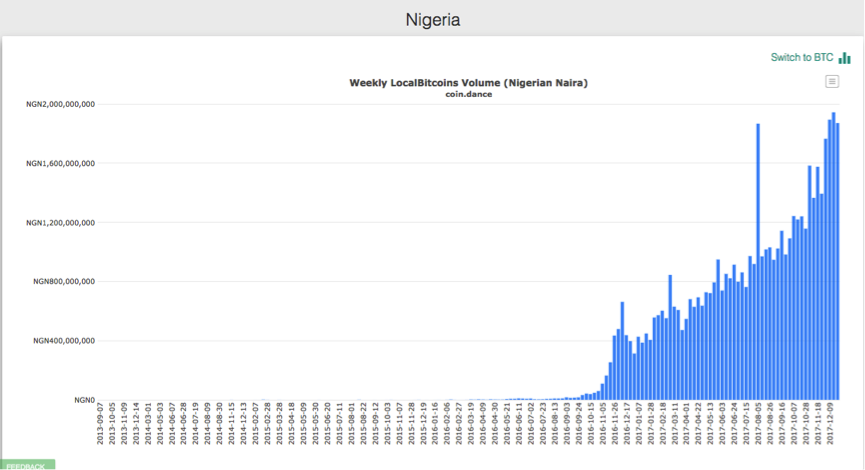

If you are keen to stay up to date with Bitcoin volume by country, statistical facts are lied out clearly on Coin Dance https://coin.dance/volume/localbitcoins

The clearest things that you notice from the outset is that:

- The market it global and well diversified

- Major volume and adoption is coming from counties that you may not otherwise anticipate - notable counties include Venezuela, Argentina, Hungary and Nigeria!

- Adoption is growing across all charts. This is further confirmation that this system is bigger than the usual forces that stop good ideas, namely; localized media, country to country politics and national laws.

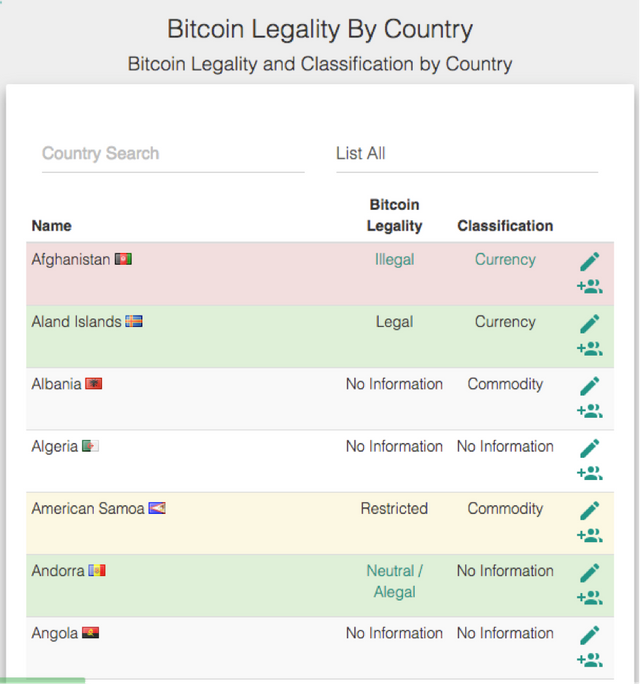

Another very interesting chart is the legality/ illegality of bitcoin/ blockchain country to country. This table is an up to date list of how governments are lining up in this market.

https://coin.dance/poli

As is clearly outlined in the table is the vast majority of governments in the world are either, supportive or neutral to the market. Enabling their citizens to onboard and freely participate in blockchain technologies.

The cross boarder diversity is also an interesting phenomenon when it comes to the question that is often asked ‘what is backing bitcoin/ the blockchain? Simply put, bitcoin and blockchain technology is backed by actual currency.

Not just one - MANY!

So the risk is spread. This is not to mention the tangible assets such as gold, energy and other commodities that backs various specific tokens concurrently.

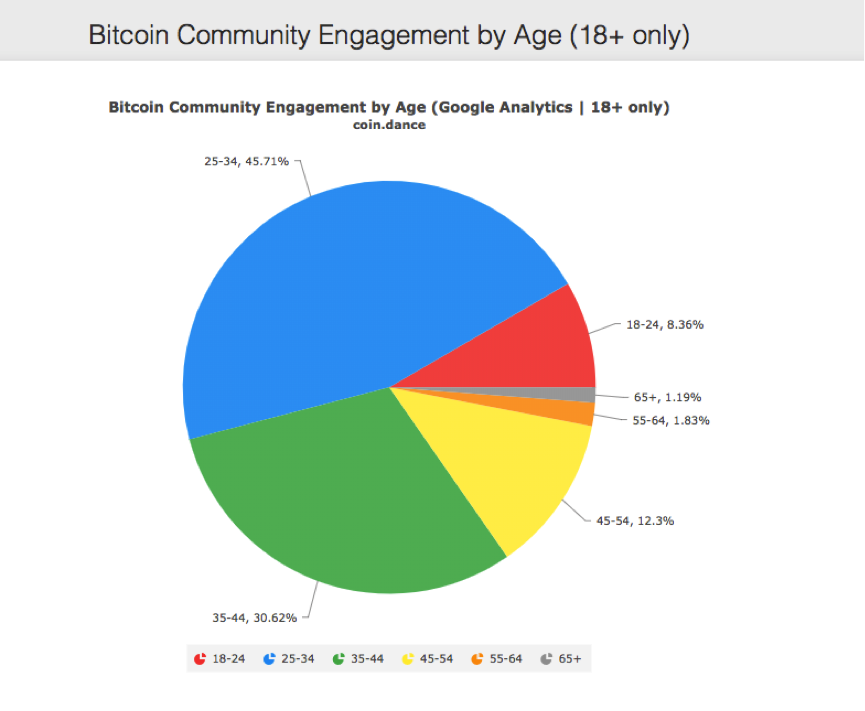

As we dig further into the Coin Dance website we also tap into more interesting facts. This graph which overviews bitcoin community participation by age is also telling. Historically the 'holy grail' for consumer companies has always been tapping the youth market. It is clear to see that Bitcoin is certainly cracking this code with over 45% of interest in the space coming from the age group of 24-34 year olds. Unfortunately this graph does not show actual investment figures and we would assert that there would be more invested in by older age groups than perhaps the younger market on a % basis.

In summary we are excited to be part of this global adoption. This monetary and cryptographic system shows many characteristics similar to the internet. Blockchain tech does not discriminate between borders, people’s, religions or races. It it impervious to politicians and existing controlling mechanisms.

It is of the people, for the people and controlled by the people - the closest thing to a true democracy existing in our time and age.