Detroitcoin: Bitcoin is the new vehicle currency— Why we should make Detroit into a Bitcoin hub.

Detroit can serve as a key for those looking to unlock the code of American economic history. Its pivotal role in the economy, its sensitivity to Federal policy, and its saliency as a symbol make it the perfect tool for combustion analysis.

I was born in Detroit and raised in Detroit. I graduated from a school named Renaissance. Our mascot was the Phoenix. Detroit’s motto is Speramus Meliora; Resurget Cineribus — ‘We hope for better things; it will rise from the ashes’. For the past century the internal combustion engine has been the beating and erstwhile ailing heart of the City. The mere mention of Detroit brings to mind images of industry, factories, and of course cars. This might lead many people to think that lifeblood of the City is oil. But another lubricant — fiat money — has at least as legitimate a claim.

This might lead many people to think that lifeblood of the City is oil. But another lubricant — fiat money — has at least as legitimate a claim.

In 1913, Woodrow Wilson signed the Federal Reserve Act into law. The Act was in some ways a response to the Panic of 1907, an aftershock of the San Francisco Earthquake of 1906. It established the central bank of the United States with the goal of promoting economic growth & stability and thwarting systemic crises. Chicago won out over Detroit as one of the new system’s regional seats.

Credit, is often given to mass production for making durable goods such as automobiles and radios affordable for the masses. But this is only part of the story. The importance of consumer financing cannot be overemphasized. Following WWI, low interest rates fomented the expansion of credit. And new institutions like General Motors Acceptance Corporation (GMAC) (founded in 1919) funded a ballooning of durable goods purchases. The age’s greatest industrial genius, Henry Ford, was hapless against the financial innovations of General Motor’s chief Alfred Sloan. By 1940 Ford’s US market share had fallen by two-thirds while GM’s had almost quadrupled, making it the greatest private industrial institution in global history. The expansion of credit through the Federal Reserve’s low interest rates made it cheaper and cheaper for consumers to borrow money to purchase durable goods like cars. This led to a boom for the auto industry and a boon for autoworkers who went on to do things like fill the nation’s theaters, buy more cars, radios & other durable goods, and funnel more money back into the system. Over the 1920’s the City’s population nearly doubled, bringing immigrants from Europe and the American South to work in auto plants. Low interest rates also helped to fund the construction boom in Detroit’s downtown, with most of the City’s gems hailing from this period. Detroit’s engines were roaring.

The initial result of an expansion of the money supply is increased expenditures, but eventually, with more and more money chasing the same number of goods, prices begin to rise. As prices rise so do business costs, and as business costs rise, profits fall. Investments made based on artificial liquidity signals begin to go sour, stock prices propped up by artificial demand and artificial profits plummet. Wealth, which seemingly appeared from thin air, disappears just as quickly. As more and more of the phantom cash which funded consumer expenditures (on cars for example) disappears, economic activity declines in a vicious autocatalytic cycle. History books are chocked full of stories and images of traders in New York losing their shirts in the stock market Crash of 1929. But the Depression hit harder in Detroit. After the waves of the crash reverberated through the economy, the auto industry employed a fraction of the workforce at a fraction of the wage that had previously attracted so many to the City. The Federal Reserve’s monetary policies had caused the bubbles and busts that it had been created to prevent. The auto industry was built largely on the flow of cheap credit of the 1920s. When that flow collapsed, the industry and the City built on it nearly did as well.

With another, and in this case unprecedented, economic crisis playing itself out on the great American stage, the Federal Government once again answered the resounding call for dramatic action. With riots and strikes breaking out across the country, and one particularly bloody one at Ford’s River Rouge plant in 1932, the government needed an antidote for Red Revolution and perhaps the most definitive restructuring of American society to date proved to be the potion. Hoping that giving people a greater stake in their society by encouraging property ownership would placate the masses, the Federal government, as a part of FDR’s New Deal implemented the federal programs most responsible for the current structure of American society. The programs were made possible in part by the creation of now notorious institutions like Fannie Mae, and the Federal Reserve’s once again low, low interest rates.

The global social crisis which grew in part out of America’s financial crisis created conditions perfect for the rise of fascism. Europeans demanded dramatic action and received some of the most horrifying performances in human history. This indirect product of monetary mayhem pushed Detroit to the top of the largest industrial operation in world history. The automotive industry survived until the trickle of money from consumers turned into a flood from the government with Detroit serving as the ‘Arsenal of Democracy’ and the workhorse of the Allied war effort. The city’s factories were once again brimming with activity, though this time they were rolling out matériel for war and not the luxury cars of the boom years. The Guardian Building, an Art Deco masterpiece in the City’s center served as the command and control center for US wartime production. The nation’s first freeway was constructed to ensure good contact between inner Detroit and outer ring factories. The uptick in production and the development of infrastructure to support it was funded by the largest ever expansion of the national debt, which in turn the Federal Reserve helped to monetize by expanding the supply of money through the purchase of government bonds.

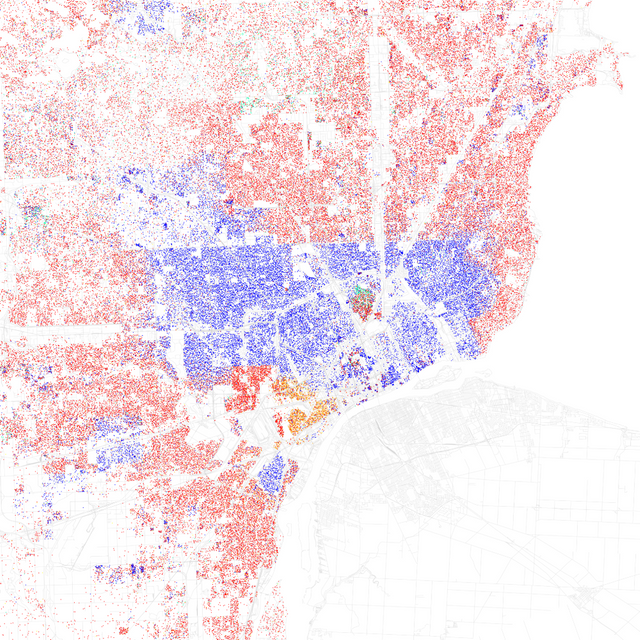

With the close of the war, the historical stage was set for another post-war boom era. Luxury cars again began rolling off the factory floors and the City reached its peak population of almost 2 million. The transformations in real-estate finance of the 1930s and the buildup of infrastructure of the 1940s sowed the seeds of a new social structure and a new American Dream that began to come to fruition in the 1950s: a suburban detached home, owned by (mortgaged to) the occupier, with, of course, a two car garage. This brought about a demographic transformation as dramatic as the one the City underwent in the first half of the 20th century. The structure of the City was gradually completely remade, ostensibly along the lines of credit-worthiness, in fact along lines of race. Blacks were not offered their piece of the property pie and were forced to remain renters in the inner-city while whites formed an ever receding ring around the City’s center. Tensions between the two groups grew until the expression of grievances by the City’s African American population took a violent turn in July of 1967. The riots helped to complete what the freeways had started. Whites began leaving the City in droves, with their tax dollars, for a piece of the suburban pie. Inflation in the 1970s, exacerbated by OPEC price fixing, further damaged the competitiveness of Detroit’s auto industry. These forces worked together to give us the City as we know it today, with an anemic economy and a population divided by color and credit.

These forces worked together to give us the City as we know it today, with an anemic economy and a population divided by color and credit.

In 2008, all of these century-long trends reached a head. Efforts to expand home-ownership to finally include disenfranchised groups, the availability of easy money for home financing led to unprecedentedly irresponsible borrowing and lending. The securitization of mortgages ensured that the toxic assets spread throughout the financial system. With the fountain of fantasy finance running dry, consumers were once again unable to secure auto loans. The auto industry nearly went belly-up. Detroit was once again ground-zero. Droves of neighborhoods were emptied, and the City’s tax base was decimated with finality.

I graduated from Renaissance in the Summer of 2008, my family’s home was foreclosed on like so many others. The neighborhood I grew up in was left sparsely populated. I left for West Africa and returned to a research internship at a wealth management firm. The complexity of the crisis was dizzying, but through my research I think I gained at least one insight. A lot of people point a lot of fingers. They blame institutions, regulators, greedy bankers, subprime borrowers and whoever else looks like a good target. But no one looks down, at the foundation. Maybe the money itself is the problem? Amid this storm something incredible happened. Satoshi Nakomoto published his now iconic white paper describing an innovation that could be as disruptive as the automobile: bitcoin.

Bitcoin is the new vehicle currency. Or at least, it could be. For those of you who don’t know, bitcoin is the digital currency that’s changing the meaning of money. What is a vehicle currency? A vehicle currency is a currency used as an intermediary for exchange. The Dollar is THE vehicle currency. Half the reason (some would say the whole reason) it has value is that you need it to get other things. Not the obvious things you buy at the store, but things like oil (PetroDollar) and lots of other special and necessary commodities. Most oil transactions are made in U.S. dollars. This means that if you want to buy a barrel of oil anywhere in the world, you have to pay for it with U.S. dollars and if you do not have U.S. dollars, you have to get them somehow. Because of this anyone engaging in international trade has to hold large reserves of dollars. This makes the dollar a convenient passthrough or vehicle for currency exchange: A Mexican with pesos looking to get Thai baht will have an easier time first finding someone who has dollars and wants pesos and then finding someone who has baht and wants dollars than finding someone who has baht and wants pesos. This creates consistent demand for dollars which for a time benefited American quality of life by allowing Americans to trade worthless pieces of paper for the wealth of the world.

There’s a myriad of reasons why we should make Detroit a bitcoin hub. For one, it’s got nothing to lose. By now Detroiters should be sick of being pumped and dumped by the financial system. Detroit desperately needs to diversify its economy. It is no coincidence that the largest municipal bankruptcy in US history quickly followed the [largest industrial bankruptcy in US history](largest industrial bankruptcy in US history) and that they came from institutions whose headquarters are just feet away from each other. Detroit and its neighbor, Windsor, form North America’s largest cross-border conurbation. It’s the ideal location for taking advantage of bitcoin’s frictionless, cross border transactions. Assets are selling like hotcakes in Detroit and lower costs mean less risk for the kind of entrepreneurs that are already starting to turn Detroit into a lab for innovation. Detroit is already the birthplace of (two bitcoin exchanges)[http://inbitbox.com]. Coincidence? No. The solutions come from the people with the pain.

Debtors are immobilized, just as much of the world would be without Detroit’s innovations. The mistake is thinking that mobility is about cars. It’s really about freedom. In order for Detroit to reclaim its role as the leader in the mobility movement it has to realize that fact. Detroiters have to realize that fact. Bitcoin is a revolutionary tool for moving value. It could also represent an opportunity for Detroit to take control of its destiny by getting people moving again in a new way. The combustion engine and the automobile built around it were revolutionary tools that enabled people to dramatically increase the flow of value. Becoming a bitcoin hub would more than get the City’s wheels turning again.

We will be living in a Tokenized world soon

It's coming.... !

When?

The ecosystem is already exploding in growth, I expect it to continue. We need to win over the hearts and minds of everyday people and inspire them to think deeper about the nature of money and value transmission.

Are you kidding me? Detroit coin? This is great! I was born in Detroit and now live in the suburbs. I will definitely look into this.

I had to upvote and resteem this for my hometown!

Always willing to give an upvote to a fellow Detroiter

Thanks! Are you on the Detroit Blockchainers slack?

Nay, just hang out here, sometimes on steemit chat

You should come to the next Detroit Cryptocurrency Exchange Meetup:

Today at 6:30pm in Capital Park:

https://www.facebook.com/events/1938212199783887/

You should come to the Detroit Cryptocurrency Exchange Meetup: https://www.facebook.com/events/219452335226076/

Kinnard! I'm so glad you've posted this wonderful article on the Steem blockchain, to be forever immortalized!

Thank you for this article- it is a timely piece and is exactly the reason we are building @agoric.systems. Detroit is a place in need of this movement; we just have to start it!

Can't wait to see what you guys build. Thanks @robrigo! Looking forward to putting Detroit on the Blockchain together.

Thanks @kinnard, lets do this thing!

A little late now I suppose, but I did find this article posted here https://medium.com/@InBitBox/detroitcoin-bitcoin-is-the-new-vehicle-currency-cd6c4afd625a

Hopefully you are the original author @kinnard

I can confirm, he's the original author and CEO of In BitBox. Looks like @steemcleaners falsely flagged him though. I hope they fix it before the payout window is up... within the next 3 hours.

Looks like they werent able to remove the flag but instead upvoted a comment for more than the post was making, not the ideal situation but at least he gets a few extra dollars out of it.

I can see why it happened, his only 2 posts are both taken from different medium blogs, extremely well done, bound to look a little suspicious without any intro or linking to the originals that came out years ago.

Great read, Yes a good plan, the Techno City has to become the Techno City.

Thanks. You in Detroit? Wanna help out?

I'm in London but I am interested in sustainable projects for cities... especially stuff like this... https://steemit.com/steemit/@chaugiang/brooklyn-s-latest-craze-making-your-own-electric-grid-using-the-same-technology-that-makes-bitcoin-possible-neighbors-are-buying

very nice

Tremendous piece! Upvoted and Highly rEsteemed!

Thank you for pointing out the obvious course of action.

SteemON!

In case anyone was wondering if I am the real Kinnard: https://twitter.com/Kinnardian/status/880113357579317251

Disclaimer: I am just a bot trying to be helpful.

@steemcleaners identity verification here!

Sorry your post was downvoted but the massive influx of plagiarism and identity theft lately leaves everyone thinking the worst of people.

Glad to see you got your comment upvoted at least for an extra 40 bucks on top of what the post was making.

bitcoin rocks!!

Sounds awesome!