BitMEX dumped their BCH and credited all users!

BitMEX is one of largest margin trading services with no ID verification that i have been trading and suggesting here since long time.

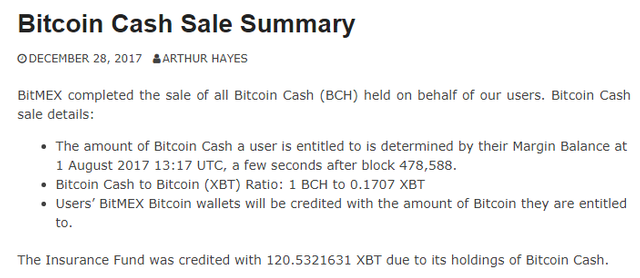

They said they dont honor any forks but due to BCH getting its place in crypto-sphere and good prices they did exception, took their stash, dumped and paid to users eligible today.

To verify if you got coins after logging in click "account". Then you will see it as "Transfer" from today.

BitMEX Markets

Keep in mind their competitor SimpleFX gave actually BCH away and you can deposits and withdrawal those too.

Follow, Resteem and VOTE UP @kingscrown creator of http://fuk.io blog for 0day cryptocurrency news and tips! |

|

|---|

@kingscrown - while given that BCH had considerably corrected in recent days, it was rather unethical of BitMex to sell off what their users held without their consent. I certainly would never trust an exchange like that which would take decisions without my consent.

I disagree. If the customer has the theoretical possibility to withdraw the BTC compensated and buy BCH for it, then the customer bears no harm for it. Except that the BCH/BTC-ratio may grow significantly during the time from the exchange starts dumping until the customer can withdraw BTC, and except that the costs and fees on moving the bitcoin funds and trading it on another exchange can be significant.

Anyway, the exchanges basically has five options on how to deal with forks:

The latter is the only truly unethical option, as I see it.

Certainly they didn't have the BCH to begin with because they didn't have all the BTC that they SOLD. (Fractional Reserve Crypto and part of their business plan - CoinBase too) They are exposed by their actions. It happens. When we are caught cheating our friends and clients we have egg on our face and it is embarrassing for everyone. The only thing to do at that point is admit it and try determinedly to earn their trust back.

Remember Hanlon's razor and all that ... but it's not even needed to include "stupidity" in the equation, it's perfectly reasonable that it takes time and resources to move tons of liquidity from cold storage to the exchanges.

Excellent point, and thanks for Hanlon's razor.

In this case, the most sensible thing for them would be to include BCH in their trading platform and yield the BCH to the customers there. Most likely many customers wouldn't withdraw it.

Seems equally valid.

The actual truth of the matter is beyond my pay grade. The only thing I might add is the observation that when, due to circumstances, we find we have neglected, shortchanged or actually cheated our friends and clients in the marketplace we have to earn their trust back one step at a time. But when we govern we are not usually held accountable for our actions and the neglect, injustice and hypocrisy can reach astronomical proportions. When corrected early by the Invisible Hand, a tiny spark cannot become a devastating blaze.

Coinbase did the same thing with BCH holding it for 6 months.

I think if BTC is going to become more useful, the name has to be taken away from the Bitcoin Foundation. Simply put: When you fork, keep calling yourself Bitcoin and let the world decide who is right. At the moment, miners have control due to fee structures and POW. That can change in a fork and improve on the structure to return power to the people.

I agree that the miners are the people, just not all of them. The other side of that is the users and HODLers. And the current structure of BTC mining gives an incentive to combine efforts into large, centralized mining pools which not only creates points of failure in the network but also gives undue power to a few people regarding what fees to accept when processing a block.

The miners are the people. Though some people can afford to mine more than others, the power is still in the people.

THE MINERS ARE THE PEOPLE!

Perhaps the market price of BCH will appreciate now that their sell-off is completed.

How would that lead to appreciation? Bittrex was holding that position. Now the users can dump BCH. Help me understand your take.

Bittrex users? Their BCH has already been dumped, and they have been credited with BTC equivalent of the value of BCH. That's fair game, one way out of four to handle such a fork (the other three being to ignore the fork, credit the user with their BCH and to sell the BCH without crediting the users. The latter can arguably be classified as "theft")

Many "smallblockers" were dumping their BCH right after the fork. Bittrex was holding quite much BCH and has been quite late in the game dumping it. Their dumping of BCH has for sure caused quite much supply of BCH in the market. Price goes down with supply and up with demand - if the demand is constant and Bittrex stops dumping BCH, of course that will push the price of the BCH upwards.

I'm fairly bad at predicting the future, of course there are many other things influencing the market price, of course the assumption that the demand will stay constant is just an assumption. I wouldn't be surprised if the price will continue slumping.

I half expect most of these places to shut down and steal all my money, so that's awesome

nice one! keep it up!

Ooops, never knew about this exchange. Glad i get to know about from you. Will surely check it out. Thanks for the info.

Good! more exchanges should follow this example!

Kraken is locked up tighter than a clam's asshole, no one is getting in, they are trying to storm the door holding wads of cash...

Lets have our exchange completely ignore the 4th largest cryptocurrency by market cap. Sounds like they run a real tight ship.

Very unprofessional of BitMEX to force this politically-motivated decision on their users. When did BitMEX management decide that every single client doesn't want their BCH coins?? Did they take a survey or what?

I'd say its a business descision if they dont anticipate a futures maket for Bitcoin cash right? has anyone created any Bitcoin Cash derivatives? and also who knows they havent been thinking about looking into Bitcoin cash derivatives in the future? What is the political motivation? Just trying to see both sides here.

I've always said that BCH is over hyped. If Bitcoin has a problem is leaving the family better than finding the problem of the root? They made a huge mistake and I see BCH plunging down into rivers soon if they don't attend to their mining issues.

I prefer BCH much more than BTC and I hope it will soon dethrone King Bitcoin as the principal crypto currency.

Over the weekend, I made 2 purchases, one with BTC and one with BCH. The Bitcoin transaction cost me $40.00+ in transaction fees and took 6 hours for confirmation. The BCH transaction cost me $0.03.

Enuff said.

Given enough time, BCH will have the same issue with blockk sizes filling up. Added to this, if you know how blockchains work well enough you will know that bigger block sizes lead to centralization with the people with the most powerful computer nodes having more control. BCH really did take the easier way out by increasing the block size. Look into segwit and segwit wallets, this should help you out with the transactions. Food for thought.

The hard coded block size limit is 32 MB in Bitcoin Cash. This may prove to be an issue at some point in the future - and exponential growth of the block chain may indeed become an issue. At the other hand, given enough time, there are lots of optimizations on the BCH roadmap reducing the implact of bigger blocks - and if Lightning really does prove to work out, there is no problem to roll it out on Bitcoin Cash, too.

what a pile of bullcrap.

https://www.reddit.com/r/Bitcoin/comments/6yofsq/blocksize_would_need_to_become_555_mb_in_size_for/

hahaha. Ignorance really is bliss. whatever makes you sleep at night my friend.

I am not even going to try to move my remaining BTC. I fear the last amounts of BTC that I have will become dust and will one day just be a way to get airdrops for new altcoins.

I wonder if these BCH lows are more sustainable being caused by real selling of BCH on to the market..

In general, if you have lots of "dust" in one wallet, it may be smart to try to consolidate it into one UTXO - that is, send everything in the wallet to yourself with the lowest possible fee.

If the wallet does not support transactions with artificially low transaction fees and RBF, it may be smart to export the wallet seed (or private keys) into a wallet supporting it, i.e. electrum. Try to send with 72 satoshi/byte in transaction fee - there is a non-zero chance that the transaction will go through during the weekend or the next.

You will not lose the "airdrop"-quality of bitcoins even if you have stuck unconfirmed transactions.

Yes, but fees are falling now. I think bitcoiners are more accepting of altcoins now. We can use the bitcoin blockchain for buying houses and new cars.

They Both as in, together eat away at central banking’s authority, right?

Cool, just checkin. 😉

The hard coded block size limit is 32 MB in Bitcoin Cash. This may prove to be an issue at some point in the future - and exponential growth of the block chain may indeed become an issue. At the other hand, given enough time, there are lots of optimizations on the BCH roadmap making the implact of bigger blocks - and if Lightning really does prove to work out, there is no problem to roll it out on Bitcoin Cash, too.

edit: sorry, this reply ended up on the wrong place in the thread. Will try to repost it.

Feel free to accidentally upvote me any time, looks just like a real one! Haha. Stop by, you might like what you see.

Right ✔

the problem with bitcoin-core is that it doesnt want to solve its problems. Raising the block size is something they could do at any moment... If they wanted to still go with lightning network, they could do both... But they dont.

Blockstream wants bitcoin core to be broken so they have an excuse to centralize it through lightning hubs.

Correct and Ripple will now eat their lunch. Beware of Banker takeover.

Its not decentralised, the banks can keep Ripple if it helps them sleep at night.

Do you mean you wouldn't mind if Ripple becomes the new Reserve Currency and The Gold to broken BTC's fools gold?

I'm saying that I don't care what happens to Ripple as it is not a decentralised currency nor is it actually crypto currency. Its just another gimmick that they can get excited about. Ripple labs own about 80% odd and can place into the market whenever they like.

Segwit 2x is a mojor challenge, politically (worth researching) and technically, not just as simple as changing "1" to "8" in the codebase, and 2x itself ain't good solution either (still back to the blocksize)

Both of the solutions come with challengers that really need careful consideration.

Not a good argument. It's not about finding solutions, it's about agreeing to theses solutions (temporary and permanent). Take for example, segwit 2X fork which almost happened. It was simply an upgrade to 2mb while the lighting network is being worked on. This the community could not agree on. Now Bitcoin fees are extremely high while other blockchains are scaling nicely.

Agreed! It was a huge fight over nothing. Would of been a short term solution till lightening

It was a huge (and successful) resistance for nothing, I'd say.

With SegWit2X activated, we probably wouldn't have had such congestion issues on the blockchain. Probably the average transaction fees for sending bitcoins would still have been a bit too high for coffee-sized-transactions, but it's a great difference between "high" and "insanely high". Probably there would have been sufficient idle capacity that "stuck transactions" wouldn't have been a problem. There would have been enough on-chain capacity to allow for lightning channels to be established and closed. And the roadmap would still be the same, with Lightning hailed as the scaling solution. Bitcoin would probably have remained strong, dominating the total crypto market cap (today it's below 40%). Had SegWit2X become reality, Bitcoin Cash would have gained much less traction.

Flipsides? I see two:

well written, good information. I recently posted a reply to someone who was complaining about the slow transaction fees, I asked him for the tx id, and what will i do with it, turns out they had no idea of the existance of the ledger and blockchain.info. I showed the details and the low fee they opted to pay. I didn't get as little as an upvote for providing some insight, but just more complaints about the fees in general. I am definately upvoting people with good information.

Good points!

I thought that Segwit 2X had already been passed. The lighting patch is still in test

I blogged about it earlier: https://steemit.com/bitcoin/@doctorvee/successful-lightning-bitcoin-transaction-test

Segwit was pushed through but segwit 2x was not

If you're not 100% sure about Segwit2x, I don't understand why you are 100% sure about the misguided conclusions in your original comment.

Segwit 2x recently just become a failed fork.