Bitconnect Ponzi Scheme - No Sympathy From Crypto Community

What looked pipe dream wound up being only that, as Bitconnect has everything except shut its entryways.

Since quite a while ago blamed for being a Ponzi-conspire, Bitconnect closed down its digital currency trade and loaning administration this week. As expressed on their site, Bitconnect had gotten stop this instant letters from two American securities controllers - prompting the conclusion of their loaning and trade stages. In any case, Bitconnect will keep on running its site and wallet benefit.

Scrappy 'Ponzi' offerings

Since its commencement in January 2017, many were incredulous about Bitconnect administrations. Fundamentally, one expected to send Bitconnect Bitcoin in return for Bitconnect Coin (BCC) on their trade.

When you had BCC, you were ensured "up to 120 percent return for each year." Users were told they were gaining enthusiasm by holding their coin "for keeping up the security of the system."

Lending platform

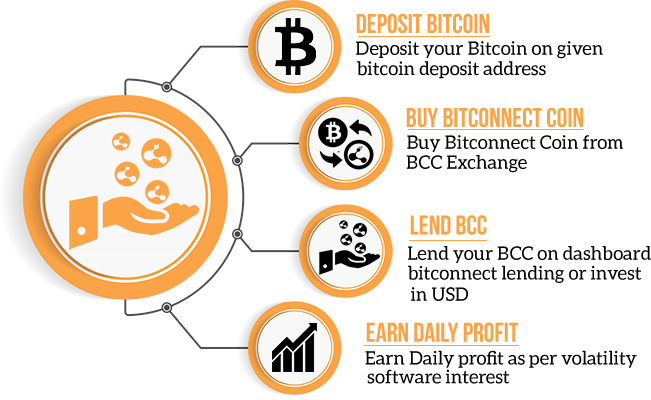

Bitconnect’s lending platform is what really led to accusations of a Ponzi scheme, as well as cease and desist orders from regulators.

As the above illustration explains, users bought BCC with Bitcoin and then lent out their BCC on the Bitconnect lending software.

Users would receive varying percentages of interest depending on the amount of BCC they had lent.

Add in the referral system seen in many other Ponzi schemes and the fact that the operation was run anonymously; it's hardly surprising that this whole endeavor has ended in tears.

The lending scheme was the main draw card of Bitconnect because of its huge promise of returns. In order to participate in the scheme, you had to buy BCC - which saw the token hit an all-time high of $437.31 per BCC before it plummeted in value following the closure this week.

That being said, the cryptocurrency is still alive and trading at around $35 at the time of writing.

Source: Thecointelegraph