This is the early days of Cryptocurrency. We are still in the lunatic fringe, and it is time to dive in.

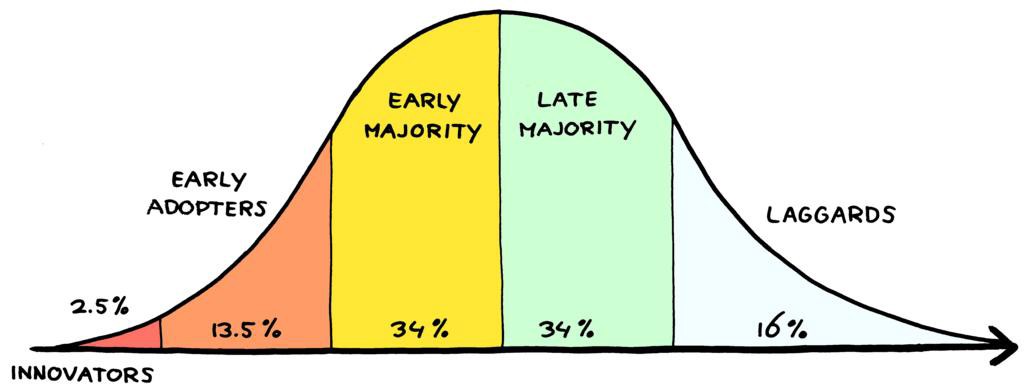

You may have seen this graphic before. It’s the technology adoption curve.

Technology adoption curve

New technology that eventually becomes successfully adopted generally follows this bell curve. With inventors and innovators starting the trend, early adopters following next. Then the early majority, late majority and finally the laggards are those who have to upgrade because the market no longer produces or sells what they used to have.

There is a missing piece here and it is within the 2.5% innovators slice. It is the lunatic fringe, the very first people to start using the new technology. The lunatic fringe is what gets the word out to the early adopters. The lunatics are ones that prove its use and can’t shut up about it (◕‿◕). And that is us, me writing this, you reading this.

The previous impactful major adoption

Tim Berners Lee

Tim Berners Lee worked on a project called the World Wide Web, with its first trial runs in CERN laboratories in Switzerland in December 1990. [1] In 1991 the browser and web server software had been created. AOL was one of the first companies launched that year. By the end of 1992, 26 websites had been created. In April of 1993 CERN directors declared that WWW technology would be free to be used by anyone, with no fees payable to CERN. Towards the end of 1994 there were a million browser copies in use.

Amazon was created in 1994 to just sell books. However, they saw that shopping online was going to be the way of the future. Soon after in the mid 90s search engines came about and Google soon followed. Adoption increase a thousand fold. When 1998 came around hundreds of thousands of commercial websites existed and the early adopters started to see how the internet was going to disrupt many existing industries. That was the year my favorite online game StarCraft was launched as well ♥. To put things in a fresher perspective, Facebook launched in 2004 and Snapchat in 2011.

All the adoption and commerce are impressive, but the real significant impact of the Internet was that it ushered in the age of information. For the first time in human history we could reach out and talk and see each other globally. All our knowledge could be stored online forever. People can easily access and learn new things everyday about every subject possible. Free speech could be broadcasted around the world and we could respond quicker to disasters and atrocities. Now, we collectively could not imagine a world without the Internet.

A new age is beginning

There is a massive mostly unseen tsunami of technological disruption forming at the moment, and it’s coming in the form of Cryptocurrencies with Bitcoin being the first. You can also call this new wave, the Internet of money.

Right now, we are kind of in the 1993–1994 creation period during the early Internet days. The Facebook and Twitter of Cryptocurrency are still a decade away. However, with the rate of innovation and adoption increasing, it is probably closer to 3–5 years away. Thousands of coins[2] and hundreds of new companies are being spawned all with different blockchains or tokens, working on solutions to solve new problems or bring current services into a brand new decentralized world.

We are nowhere near the early adoption majority phase of the curve yet. It is still really hard to use Cryptocurrency. If you currently have a diverse portfolio, the safest way to hold your assets are in multiple wallets, some web-based, some in desktop and mobile apps, and some even in hardware wallets. You have to secure many of them with 2-factor authentication, and remember to save your private keys and 24-word phrases in a safe yet easy to access location.

For a quick example, let’s take IOTA, which by the way is the only Cryptocurrency without a blockchain (it uses a technology/network called The Tangle to handle its transactions). In order to store IOTA you have to first download their wallet, then you have to find a safe to use seed generator, then download it (I used the JavaScript NPM version). Next you have to run a few commands in a terminal window to create your private seed. Now other digital wallets are a bit easier to use, but they all add to the complexity in investing in Cryptocurrencies.

When sending out the first emails back during the early Internet, you not only had to know a bit of code to create that email, but it then took about 10 minutes to send it. Now a tweet sent across the globe in an instant can start a revolution.

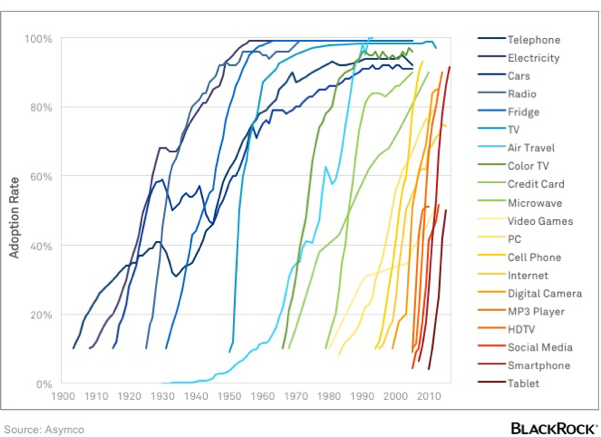

Here is another chart we should take a look at.

Above is the technology adoption rate graph, where we can see how long it took various technologies to get widely adopted. Electricity and the telephone took several decades before reaching 60% adoption. And as we near the digital age we see adoption skyrocket, especially with each generation getting up to speed faster than the last. Kids born now are digital era natives, these kids will be the first generation bringing ownership of automated cars into the majority. They will also be the first generation completely using cryptocurrencies.

The adoption rate of money.

Looking back at the previous revolutions in money, in the 16th century there was a radical proposal to replace gold with gold certificates written on paper. Andreas Antonopoulos (A technologist and Bitcoin Jesus) from this Bitcoin video here says,

“If you think people find Bitcoin weird, imagine a time when they told them gold is no longer the money, bits of paper are… they were like you gotta be kidding me. So that idea was so radical, it took 400 years before it became broadly deployed in mainstream society.” — Andreas Antonopoulus

However let’s go much further back than that. From about 100 thousand years ago to about 20 thousand years ago, there was no form of money. Anthropologists have shown that no tribe or civilization based their trade on barter. [3] Here is a great talk about money myths and bitcoin from Wences Casares (CEO of Xapo).

Early tribes relied on an inefficient subjective type of ledger. They needed to remember who owed them what. If you slayed a woolly mammoth and some of your friends asked for some meat, you’d need to remember how much meat you gave to who, so later you can could ask for similar favors. However, this was a system that worked for a very long time, longer than any other form of trade and commerce.

Eventually, certain persons in a tribe would come up with the idea of using objects such as shells, beads, stones as an objective ledger to keep track of debt within a tribe. Every tribe across the globe had their own objective ledgers. As human populations grew and created larger societies, they started to bump up next to each other and this system started to break down. Salt would work for one tribe, but not another. Shells would be meaningless to non-coastal peoples, etc. This is when humans had to find something in common to use as money.

“The anthropologist say that if you describe for them an environment in detail they can predict what is going to emerge as money, because it’s always something that has the 6 characteristics of money. Of which most important is something that is scarce, something divisible, transportable, durable, recognizable and fungible. For each early tribe, their form of money had to varying degrees all these qualities. And when this system broke down 5 thousands of years ago what emerged that had all these qualities, not for one particular tribe but universally was gold” — Wences Casares

A myth people believe about money is that because it is an asset it has intrinsic value. Money does not possess intrinsic value. Money is just a ledger to keep track of debt. Whatever form of money exists, we give it value because of its utility as a ledger. Gold does not have value because you can make a chair or jewelry out of it, the chair is valuable because it’s made out of gold which is scarce. Gold had been the “Gold standard” for the last 5 thousand years. And until Bitcoin and the blockchain, gold had made for the best form of a ledger we have found.

The 6 characteristics of money

Scarcity

Divisible

Transportable

Durable

Recognizable

Fungible

Bitcoin is orders of magnitude better and superior than Gold in every single characteristic of money. It is scarcer (Only 21 million will ever exist), divisible up to a 100th million, transportable like a digital file, and more durable since you cannot destroy a Bitcoin. It’s cryptographically recognizable and fungible.

The same characteristics exist for practically every cryptocurrency out there as well. Some are inflationary based like government issued fiat. Some are deflationary with a set amount. And a multitude of others have different attributes and use cases. With IOTA it’s for machine to machine transactions for the Internet of Things, Ethereum, NEO and Lisk are platforms for creating decentralized applications in this new space. ZCash and Monero have extreme privacy meant for dark web usage. District0x tokens are for voting and the list goes on.

All these cryptos have created a new asset class as well as usher in the new digital revolution of money. Each of these tokens and their blockchain ledgers have speculative value and it is time to jump in and join us in the lunatic fringe. It is a fun time now, right before the early adoption really starts. Welcome to the Internet of money.

http://www.nethistory.info/History%20of%20the%20Internet/web.html

https://coinmarketcap.com/

https://www.theatlantic.com/business/archive/2016/02/barter-society-myth/471051/

If you like Leon Gaban articles, you can donate with Ethereum: 0xC11f8E7C1dc8B69575661aF1b175803B5f775f5f

Thanks - Share, Like, Follow :P

Bitcoin: 1Tybeu8zKGMKUMKKgt3bNcowybpmA4PnH

Etherium: 0x6244DD89Fc5C73C8E165990f760034aaC80A94A2

Litecoin: LgRRGesDZNp4HD1SyzJPA9gAE6xtGcRFAP

Amazing posts...Thanks from Heart...

Thanks allot!

I love reading this sort of stuff. Crypto for life!

Thanks Allot!

Strong post. It's exciting to be apart of something in it's early years of it's life. Cryptocurrency has so much potential and is going to be of huge magnitude in years to come. I've created similar posts, would appreciate a read :)