Bitcoin's Volume is Continuing to Decline at Major Exchanges

Bitcoin trading volume continued to slide on 26th January, as market sentiment showed signs it has yet to fully brush off the impact of new policies at major China-based exchanges.

Overall trading volume has declined substantially in the days since OKCoin, BTCC and Huobi began charging trading fees on 24th January, and there are signs that these exchanges are acknowledging what could be a continued issue.

Xu Qing, a spokesperson for Huobi, noted how these developments are impacting his exchange, telling CoinDesk: "The trading volume started plunging since we started charging trading fees."

In the face of this, sentiment is "bruised," according to Kong Gao, overseas marketing manager for over-the-counter trading desk Richfund.

He went so far as to claim that some market participants are beginning to look to other assets for improved returns, stating:

"I see many bitcoin traders going back to trading stocks."

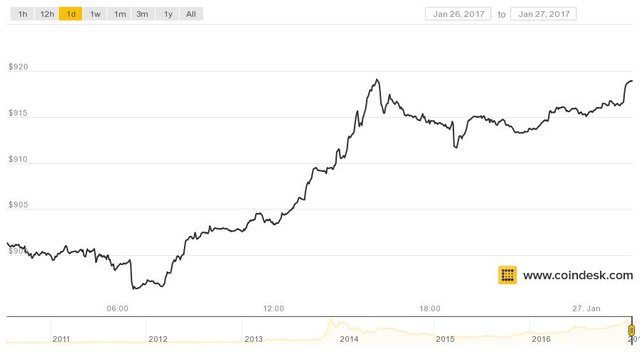

In spite of this lackluster sentiment and falling volumes, however, bitcoin prices did manage to notch some modest gains today, rising as much as 2.8% to $919.13.

The digital currency was slightly lower at $918 at the time of report.

China hit hard

While volumes were expected to decline on the first day of the change, what's notable is that this downtrend is showing no signs of stopping, data reveals.

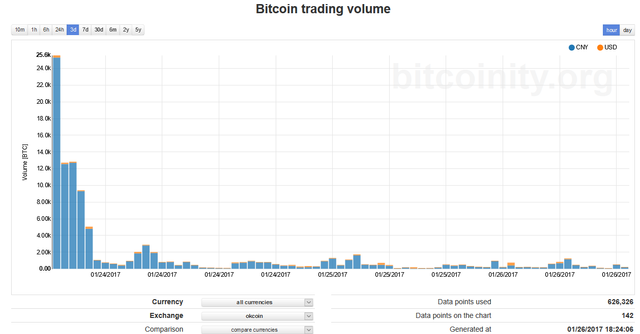

Market participants traded only 10,100 BTC through OKCoin, the leader in volumes in the 24 hours through 22:00 UTC on 26th January, Bitcoinity data shows.

This figure represents a mere fraction of the daily average of 23,000 BTC that the digital currency exchange saw over the last seven days. In addition, it represented a sharp decline when compared to trading volume over the last few days.

OKCoin’s 26th January figure, for example, was close to 30% lower than the 25th January figure of 13,900 BTC, and upwards of 90% below the 24th January total of 82,000 BTC, according to additional Bitcoinity data.

The chart below shows the declining transaction activity this exchange experienced over the last few days:

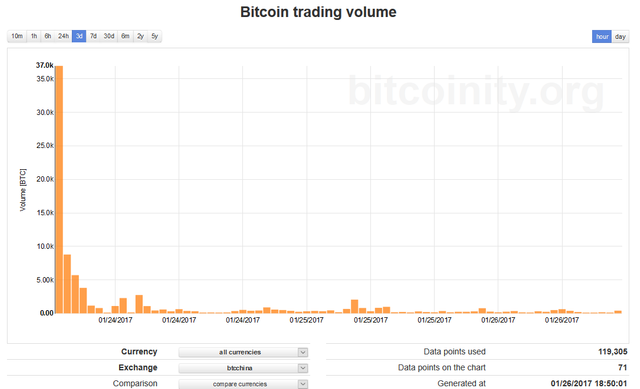

BTCC, the runner up in terms of market volume, encountered a similar situation, seeing only 7,100 BTC worth of trades during the 24 hours through 22:00 UTC on 26th January.

Today's session fell far short of the average daily volume of 160,000 that the exchange has enjoyed over the last week.

The graph below shows the sharp falloff that BTCC trading volume has seen:

International effect

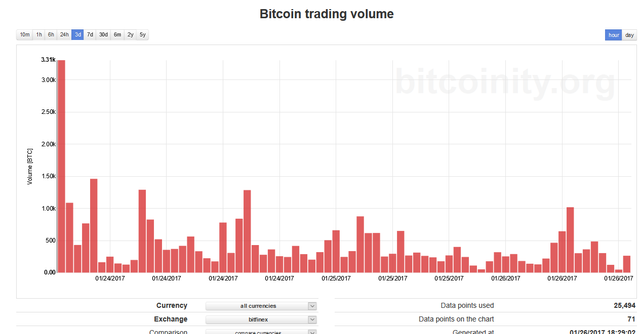

Even outside of China, Bitfinex, which is now in third place in terms of volume, also saw a notable decline in activity. Market participants traded only 7,000 BTC through the exchange during the 24 hours through 22:00 UTC.

This figure was more than 30% lower than the average over the last seven days, Bitcoinity data reveals.

But while Bitfinex has seen a decline in volume over the last few sessions, its drop has been far less severe than the decrease suffered by the major Chinese exchanges.

Bitfinex, based in Hong Kong, has not updated its policies in recent weeks.

Assessments vary

Analysts indicated that the decline may have been bigger than expected, a concern that is also contributing to depressed sentiment.

Petar Zivkovski, COO of leveraged bitcoin trading platform Whaleclub, spoke to this situation: "This has surprised many in the industry as the ‘real’ demand for bitcoin trading in China is much lower than what people expected," he said.

Yet, while several analysts emphasized the key role played by market sentiment, some pointed to the calendar as the chief contributor for the slump.

The Chinese New Year is only a few days away, noted Arthur Hayes, and as a result, "volumes are declining rapidly."

He added:

“Volumes and price action will be down for at least the next week.”

Tim Enneking, chairman of cryptocurrency hedge fund, voiced his doubts about this explanation, stating that while the Chinese New Year may be driving the recent decline in volume, he is "doubtful" this holiday is to blame.

Instead, he emphasized the lack of new macro events, which might otherwise prompt market participants to trade bitcoin.

Flat tire image via Shutterstock

Credits: http://www.coindesk.com/bitcoins-volume-continuing-decline-major-exchanges/