Bitcoin price action and CME gaps Review (30th October 2023) ?

Review of Bitcoin's Week and Potential Gaps to Fill , Analyst Kim & Crypto

Source Link: Bitcoin Chart Analysis

The past week has seen Bitcoin prices consolidate in a narrow range between solid support at $32,000-$33,000 and resistance around $38,000. After breaking above this range briefly on Sunday, bulls were unable to sustain momentum and prices retreated back down.

With the price now hovering in thin air once more, any move in the short term remains possible. However, analyzing recent price behavior and gaps left unfilled on major derivatives exchanges like CME can provide clues as to the most likely near-term path.

Source: Bitcoin Chart Analysis

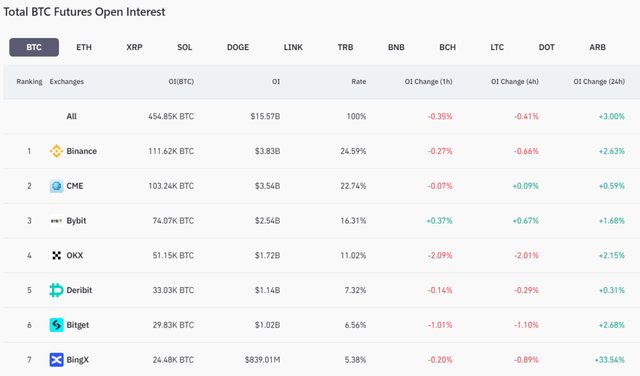

On Monday morning, eagle-eyed traders noticed a gap that had formed between Sunday's close on CME and Monday's open, with no trades filling the space between $33,350 and $33,650. For those unaware, CME trades more Bitcoin futures contracts than any other exchange, giving it outsized influence over market prices.

Gaps like this tend to either be filled by subsequent price action or act as movement accelerants if left unchallenged. With the price now fluctuating just below the lower bound of this CME gap, market participants will be watching closely to see if bears can drive it down to fill the void. A failure to reach the gap would signal continued buying pressure and potential for a retest of resistance up near $38k.

Source : CoinMarketcap

Of course, not all analysts give the same weight to gaps on derivatives exchanges when making predictions about spot prices. For some, what matters most is the behavior of prices on major spot exchanges like Coinbase, Binance, and Kraken that represent real Bitcoin changing hands. On these venues, solid demand for Bitcoin remains evident near current support levels, lessening the chances of a breakdown below $32k in the near-term.

Adding to bullish considerations, data from Glassnode shows a continued outflow of coins from exchanges to non-exchange addresses, representing a transfer to long-term holders. This type of accumulation by strong hands has historically preceded upward price movements. Between supportive on-chain trends and solid foundations under spot prices, it may take more than an unfilled CME gap to derail Bitcoin's trajectory higher in the weeks ahead.

No matter one's short-term price outlook, there are bigger developments to consider as well. Regulatory clarity continues increasing around the world, with both Brazil and South Korea taking steps to legally recognize cryptocurrencies like Bitcoin in recent months. Growing infrastructure like ETFs and futures bring in ever larger pools of institutional capital.

Ultimately, the long-term bull case for adoption and integration of blockchain technology into our global economic system remains robust. Short-term price fluctuations will likely continue to whipsaw some traders' emotions, yet those maintaining a wider view stand ready to accumulate at present levels. For long-term investors, periods like this represent opportunities rather than reasons to panic.

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Upvoted! Thank you for supporting witness @jswit.