Aided By the EOS Bounce the Bottom is Likely Already In For the Current Short Term Bear Cycle - Although Future Lows Remain Possible in the Medium Term

During the last bear cycle, while many chartists were talking about 4,000 BTC, the last article on valuation published here, and based on fundamental mathematical methods, expressed then that the downcycle was already likely over. The comments on that thread still speaks for itself here:

Since then, as a computational exercise, we have improved the models even more with real time API calls, and real time calculations to see if it were possible to even capture the smaller time scale variations in modeled values with the fundamental variables we were tracking.

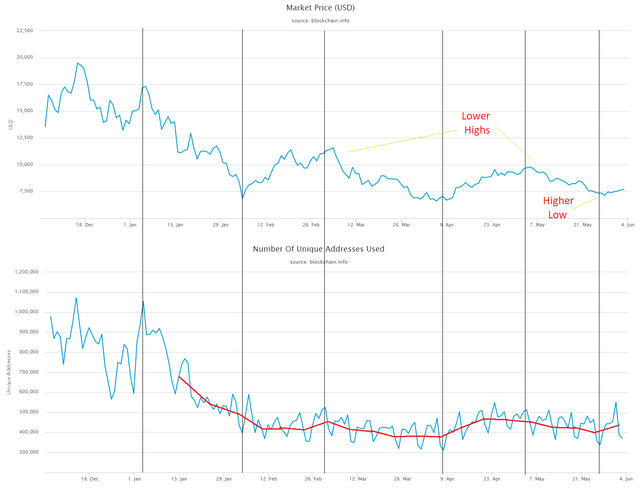

Here is what one of the longer time scale variables is showing. We see that the demand side has stopped falling since around 5/24. Other fundamental metrices that could drive values down further (see prior articles) remain stable. We also see an inexplicable bounce in DUA on 5/31/2018 that only likely points to TRX that day, and EOS release next day - which itself promptly saw a bounce. Let's remember that the a currently significant BTC (and ETH to a great extent) use case is as a medium of exchange to purchase other cryptocurrencies. In essence, you almost can not get EOS without first getting BTC or ETH (granted a few exchanges like Binance do now offer EOS/USD pairings.) The same is true of TRX. So in essence, activities and progress in other projects in the cryptocurrency space is pointing to an end to the recent cycles of higher lows and lower highs.

Source: blockchain.info.

However, using the data from blockchain.info means this plot is looking about 2 days back.

Looking at values from APIs down to the nearest hour, we do already see the slight uptick in demand continuing.

(For reference: It's 8:41pm Jun 5 2018, right now EST, and BTC is currently 7430 and just declined by about 200 points the last 24 hours. And the blockchain is immutable which is why this medium is the best for writing so edits can be verified with the times they are made.)

Overall, the lowest level in the current cycle is likely the roughly 7050 of around May 28th. However, we might also continue to see fluctuations but the base demand curve looks to have already turned back upwards. But please note that trading with this level of data is gambling rather than investing, as it is quite susceptible to news and events. The bigger picture is that the higher low of this cycle is likely already in.

Short Term

Looking at all the different projects releasing some test net or main net in June, and the uptick in demand around the EOS and TRX main net release would lead one to believe that medium term the current month might experience a net stable to higher value. Since Bitcoin tends to function as a gateway to all those other assets, demand for those will also mean some demand for the gateway or reserve asset. Some of those projects are compelling enough that their followers will likely pitch in more resources as those projects reveal some of their promised milestones.

Medium Term

Longer term the demand levels still remain very weak. Even after factoring in increased use of batching, and some more use of offchains and side chains for transaction, the current demand level will continue to put downward pressure on values until they increase. If the demand does not pick up, we could very well be looking at the rest of 2018 where bitcoin will not reach their ATH of nearly 20,000 that was reached late last year.

Other Articles by the Author

April 8 2018: Math-Based Fundamental Value Analysis Has Been Right About Bitcoin Bear Trend So Far - What Does it Tell Us About When Sustained Growth Will Return?

https://steemit.com/bitcoin/@kenraphael/math-based-fundamental-value-analysis-has-been-right-about-bitcoin-bear-trend-so-far-what-does-it-tell-us-about-when-sustained

Mar 17 2018: Lightning Was Released This Week – What Will be the Impact for the Bitcoin Network and the Cryptocurrency Market?

https://steemit.com/bitcoin/@kenraphael/lightning-was-released-today-what-will-be-the-impact-for-the-bitcoin-network-and-the-cryptocurrency-market

Mar 16 2018: Social Media Trading Analysts Are Likely Mostly Doing a Disservice to the Blockchain Community

https://steemit.com/bitcoin/@kenraphael/social-media-trading-analysts-are-likely-mostly-doing-a-disservice-to-the-blockchain-community

Mar 09 2018: Blockchain Technology Potential (Series 1) – A Review of a Recent PAYPAL CryptoCurrency Patent Filing and What It Means for the Future of the Technology

https://steemit.com/bitcoin/@kenraphael/blockchain-technology-potential-series-1-a-review-of-a-recent-paypal-cryptocurrency-patent-filing-and-what-it-means-for-the

Mar 07 2018: Audit the Teths – A Macro Case for Why Tethers Need to be Audited for Confidence to Return to the Market

https://steemit.com/bitcoin/@kenraphael/audit-the-teths-a-macro-case-for-why-tethers-need-to-be-audited-for-confidence-to-return-to-the-market

Feb 24 2018: A Review of a Few Fundamental Metrices that Drive Bitcoin Value and What They Currently Indicate

https://steemit.com/bitcoin/@kenraphael/a-review-of-a-few-fundamental-metrices-that-drive-bitcoin-value-and-what-they-currently-indicate

Feb 17 2018: Bitcoin Has Not Yet Fundamentally Recovered At This Time – A Mathematical Case

https://steemit.com/bitcoin/@kenraphael/bitcoins-have-not-yet-fundamentally-recovered-at-this-time-a-mathematical-case

Feb 12 2018: There is Little Chance Bitcoins can Sustain any Real Recovery Until This Fundamental Metric Begins to Turn Upwards Again

https://steemit.com/bitcoins/@kenraphael/there-is-little-chance-bitcoins-can-sustain-any-real-recovery-until-this-fundamental-metric-begins-to-turn-upwards-again

Feb 09 2018: This Single Metric Seems to Correlate More with CryptoAsset Values The Past Two Weeks Than Most Predictive Methods

https://steemit.com/cryptocurrencies/@kenraphael/this-single-metric-seems-to-correlate-more-with-cryptoasset-values-the-past-two-weeks-than-most-predictive-methods

About the Author

Ken has a doctorate in Engineering, and a master’s in Computer Aided Engineering, An IT professional, programmer and published researcher with over thirty publications in various fields of technology, including several peer reviewed journals and publications.

Legal Disclaimer: I am not a financial adviser and this is not financial advice. The information provided in this post and any other posts that I make and any accompanying material is for informational and educational purposes only. It should not be considered financial or investment advice at all. You should consult with a financial or investment professional to determine what may be best for your individual needs.

This is only opinion. It is not advice nor recommendation to either buy or sell anything! It's only meant for use as informative, educational, or entertainment purposes.

Upvote/Resteem/Comment. All comments are upvoted. Everyone that resteems gets a 100% upvote on comment here or their own blog. Let's start a conversation.

Glad I followed you. Continuing series of new and useful information.

You should be booking multiple $300 per day posts, instead of the TA chartist fraud we know and "love" as @haejin

Thanks Dave. While I will not comment on any specific chart analyst or method, beyond the general belief that most chart methods are not based on any fundamentals, I believe the track record of the articles here speaks for itself. Still is 100% so far. The current article is standing up very well right now when you look at BTC 2 days after this article; just like the last article, and the ones before.

It is a slow time for bitcoin. People are mostly waiting for the new hype, trading bots are amplifying dump from mt.Gox trustee fund and small day traders try to make some money with the relatively small price fluctuation. And weirdly enough people seem to be ignoring new information wether good or bad. At the moment it feels to me that everyone is waiting, but without knowing what we are waiting for.

Looks like overnight and over the early morning, as expected this has moved up some 200 units. More fluctuations can be expected along the way but the past few hours have been in line with the expectation laid out in the article that the low of this sub-cycle was already in. Currently sitting around 7590 at 1pm 06-05-2018 EST.

Hopefully some gambler (day trader) enjoyed reading this yesterday night and made some gains.

We all hoping EOS goes to the moon! Greetings from #EOSVenezuela @kenraphael

thanks for your information and more share with us

Amazing stuff

amazing post

Posted using Partiko Android

Very good application for checking cryptocurrency and receive notifications https://masscoinapp.com

Coins mentioned in post:

You got a 8.73% upvote from @postpromoter courtesy of @kenraphael!

Want to promote your posts too? Check out the Steem Bot Tracker website for more info. If you would like to support the development of @postpromoter and the bot tracker please vote for @yabapmatt for witness!