Bubble or Disruption

Everybody from technology geeks to persons who never shows interest in technology these days are talking about Bitcoin. The interest is there because money is involved and a lot of money has been already made. Bitcoin is the world's first cryptocurrency. A cryptocurrency is a form of payment which is recorded on an encrypted distributed ledger. And in case of Bitcoin, the distribution is in the many nodes spread across the planet. This makes Bitcoin decentralised meaning, no one can suspend it, no one can ban it. The technology which makes Bitcoin possible is called 'Block-Chain'. Apart from currency application, Blockchain has many other applications like Smart-Contracts, Tokenization, automated governance, digital identity, data management, etc. Though, to understand what block-chain basically is and how it works in check out the below video:

[youtube

The Bubble

As the prices of cryptocurrencies increases, people are saying Bitcoin is a bubble. But what is a bubble or more specifically a financial bubble? A financial bubble is an economic cycle characterized by a rapid escalation of asset prices followed by a contraction. Basically, it means that prices of an asset will rise unreasonably and drop suddenly at a very high rate. The Bubble takes place when people rally around an asset to buy it at whatever irrational price assuming the prices will continue to grow and the prices too continue to grow much time at exponential rate, however, when there is no buyer who is willing to purchase that asset at a higher price, a massive sell-off occurs as the early buyers proceed to cash out causing panic in the market and causing a price free fall. This has happened multiple times in history like the 1980s real estate bubble in Japan, 2008 housing bubble in the USA, 2000s dot-com bubble in the USA, 1600s Tulip Mania, etc.

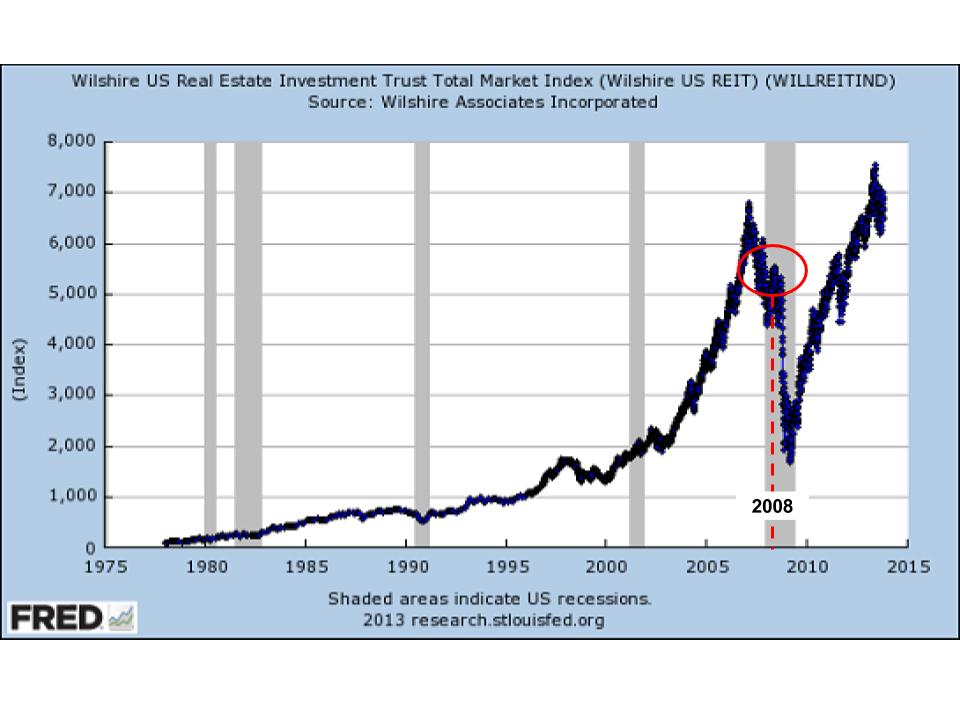

As in the above chart, the US Housing index increased at a rapid rate from 2003 this was due to lot of money flowing into the market (due to inflation), low-interest rates and tax free investment in houses, initially people started buying houses and later started taking mortgages on homes, however, when they did not pay back, in 2006, banks started collapsing one after another causing fall in housing prices. Later in 2008 when Lehman Brothers filed bankruptcy the housing prices went to a free fall causing the whole economy to collapse. In case of the housing bubble people believed the housing prices will continue to grow unreasonably, making the houses best possible investment, however, this bubble went bust.

The Disruption

Now moving to disruption, it is basically a new innovation in the business which creates very high value and therefore disrupts existing market causing the traditional or established businesses to go out of businesses. Mostly a disruption creates large amounts of wealth and is considered to be an advancement or progress for the civilization resulting in betterment of the lives of the people. Examples of disruption are the Internet, automobile, telephone, mobiles with digital camera, printer, air travel, Spaceships, satellites, computers, Artificial Intelligence, etc.

A company like Apple Incorporated has created many disruptions in the consumer electronics market giving them more value over any other competitors like Nokia, Blackberry, Sony, IBM, HP, etc. Below is the chart of the market capitalization of the Apple Incorporated. Since 1980 IPO value of $101 million the Apple is now worth close to $800 billion in 2017. However, that is quite a long period of 37 years.

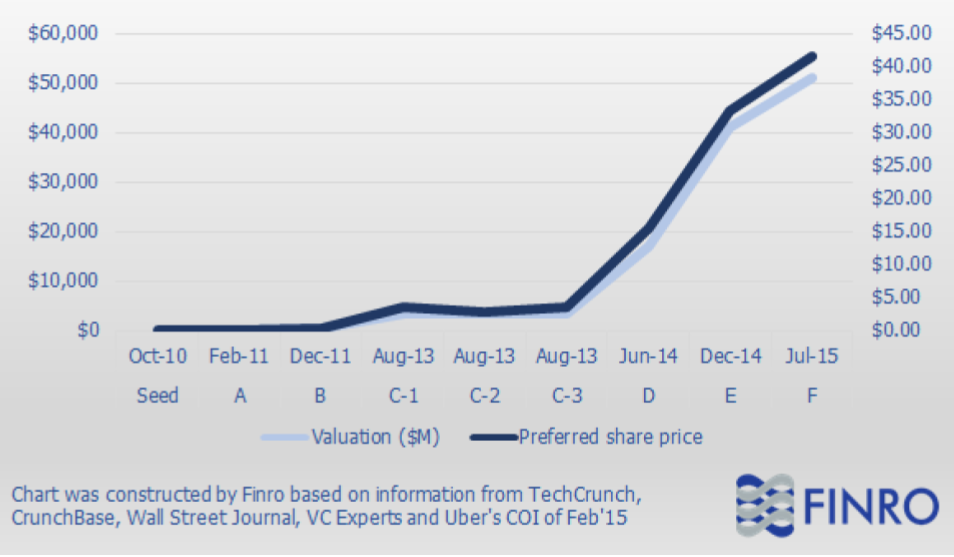

Now consider the example of Uber, ride-hailing service, since seed round in October 2010 with a valuation of some millions it reached a valuation more than $50 billion by July 2015. However, in case of Uber, this change has not happened in an open market but with very high due diligence by the VC firms.

So if a company is able to disrupt an industry it surely has a lot of value considering the future gains.

The Difference

The important parameter which differentiates a bubble and a disruption is the intrinsic value of the asset. Intrinsic value is the underlying worth of something 'essential to nature'. To understand what 'Essential to Nature' means you have to ask 'does it solve one or more natural problems? If yes to what scale? Higher the problem-solving ability means higher intrinsic value. E.g. Gold has many applications in terms of problem solving like it is very good conductor of electricity and hence it is used in electronic components or due to high reflectivity it is used in space suits and it's never vanishing shine makes it ideal for jewellery and to provide pleasing appearance, so it does has some intrinsic value but not enough to support its price. However, the shine of gold has always made humans to put higher price on gold, therefore, making it higher in market value. Another example can be land, if the land is fertile it'll have high value as it is able to yield crops or if a commercial complex can be built upon it, then it'll have an even higher price. However, if the land is valued more than it can yield then it can be considered as overvalued and the prices will drop when this is realized. But suppose it has been realized that a farmland has oil beneath it, the prices of the land will increase drastically. Similarly, if a product is used it'll have intrinsic value however if a product is disruptive it'll have exponential valuation growth.

What about Bitcoin?

Now we can analyse bitcoin with the above information. Below is the chart for Bitcoin prices from 2012 to today. It is seen that the prices have grown drastically over the period especially during the year 2014 and in 2017. During the year 2017, the Bitcoin prices went from less than $1000 in January to a $20000 in December 2017.

Is Bitcoin a bubble or it is a disruption? If we want to answer this question we need to find the incentric value of Bitcoin and have to ask the question 'What problems does Bitcoin solve?' Bitcoin is a form of currency so it can be used as a mode of payment. The proposed use cases for Bitcoin are efficient and fast cross-border payment and payment without much hassle. Does it solve this problem? We can compare Bitcoin with other services which solve similar problems, these are PayPal, Transferwise, Western Union, Nettler, etc. for cross-border payments and Paytm, PayU, Mobikwik, UPI, etc. for direct payments. There are other services like VISA which has both kinds of services via a card. All of the services have some market capitalization and some charges or fees. To have Bitcoin high intrinsic value it must have very low fees or low transaction time or low hassle or a combination of all of these.

To use PayPal, TransferWise, WU and Netteler, etc. the customer is required to provide extensive documentation and verification. These services charge a combination of fees based on percentage and a fixed charge. The percentage generally vary from 1% to 4%. Therefore if one sends ₹1,00,000/- the transaction charges would be ₹1000 to ₹4000 plus the forex conversion deductions. The time required for transfer over WU is can be in minutes or in a week, depending upon the type of service you choose.To send money via Bitcoin the challenge is the conversion from the domestic currency to Bitcoin. This conversion is done by exchanges. Availability of exchanges was very scarce a few years back which are now widely available. If you are using an exchange you will be doing KYC at their or you will send money with a bank or card transfer, therefore, creating the footprint of the money. Bitcoin is highly transparent you can check transactions processed and the balance of any wallet, however, it is very difficult to trace who owns the wallet. The Bitcoin has two types of fees on its network first is the general mining fee and another is the incentive fees. General mining fee is a reward for the miners (miners are the computers which process transaction, validate it and secure it) and the incentive is to conduct your transaction faster. The mining (also know as Network fees) have increased through the history of the Bitcoin. Following chart shows Bitcoin transaction fees.

From this chart it can be said, the fees grow from ₹0.01 in the year 2011 to ₹1700 by end of the year 2017. Like the price of Bitcoin the fees for Bitcoin also have grown from drastically and will continue to grow if the network continues to grow. The time required to transfer Bitcoins is some minutes to few hours. Like in the earlier case, if you want to send ₹1,00,000/- overseas the transaction fees will be near to ₹500 to ₹1800 depending upon traffic in the network. So it is still cheaper than some of the talked options, however, if the amount is even larger say, ₹1,00,00,000/- the transaction fees in the conventional money moving services will be much high, but in case of Bitcoin the fees are flat. However, if the fees in exchanges are percentage based it'll equivalent. Though the transactions are quicker. So it seems like the Bitcoin is comparatively cheaper and has potential to disrupt, however, don't jump to this conclusion yet.

If we consider, domestic payments, for most of the services like Paytm or UPI are almost free, however, in case of Bitcoin the fees are almost flat of around ₹500 to ₹1800, so if you want to pay say, ₹500 you will be paying a total of ₹500 + ₹500 i.e. a total of ₹1000/-. However this was not the situation some years back, for Bitcoin it was affordable to send ₹500 with a fee of few paise.

As said earlier the transaction fees for Bitcoin will increase with growth in the network (here network does not mean the number of users but the number of minning nodes/ computers) in future, therefore, it is possible that using Bitcoin won't be affordable to send money overseas in future which means future intrinsic value for Bitcoin is diminishing. Does this mean end of Bitcoin? Bitcoin's blockchain can be improved by adding features such as larger block size or SegWit2x. However, if not supported by the whole community these improvements create hard forks which results in completely different currency, therefore it is very difficult to improve Bitcoin and it might collapse.

The Real Disruptions

Collapse of Bitcoin does not mean the end of Blockchain technology. Great projects like Ethereum, Neo, Ripple, Steem, Cardano, IOTA, Telcoin, Golem, SingularityNet, etc. are the real disruption.

Ethereum is a system for decentralization and automation. Bitcoin is a decentralized service which enables transfer of money without any central authority like a bank or government, therefore, you do not have to depend upon and trust anyone to transfer your money, it'll work because it is coded to work. But, Bitcoin is a single application for decentralization, what Ethereum does is it provides tools to make any centralized service into a decentralized service. One can create services like decentralized cloud storage or trade digital assets like music or photos without a third party using Ethereum blockchain.

Ripple is working on transaction processing software for banks and similar clients. It has already partnered with banks like Standard Chartered and Axis Bank for faster and low-cost transaction processing and is funded by Investors likes of Google Ventures and Andreessen Horowitz.

Like Alibaba is Amazon and Baidu is Google of China, Neo is Ethereum of China and they have approval from the Chinese government. They are already coming up with blockchain projects with Chinese Government. Hopefully, I'll write a separate post on applications of blockchain in government.

Telcoin is another service, which is built upon blockchain. Telcoin is built for underbanked countries. Telcoin provides a better alternative to any remittance (especially international remittance) service through Telcom operators. Many Asian countries including India and many African countries use mobile money for payments. Telcoin will be partnering with existing telecom operators like Airtel, MTN, Etisalat, Jio, etc. and will provide this service. They have already made some partnerships with Telecom operators however the name is not disclosed yet.

Another is IOTA, IOT stands for Internet of Things. In an economy of automated system real-time data has high importance and to purchase and to get paid for this data seamlessly is the aim of the IOTA. Also, it does not use blockchain but a different kind of algorithm called Tangle or DAG (Directed Acyclic Graph) which enable it to do feeless transactions with possible nodes even on smartphones. This means one can send and receive data or money securely without any fees.

Cardano is similar to Ethereum, developed by IOHK, Emurgo and Cardano foundation. Cardano is working on blockchain infrastructure similar to Ethereum however, it is built on scientific philosophy and designed built by a global team of leading researchers. It ensures that the software is built flawless, ensuring maximum security and safety for the economy.

Golem is service for decentralized cloud computing. It let users rent their computers to compute to any client on peer to peer basis. They started out with cloud computing for CGI rendering. They have promised to deliver it in the first quarter of 2018.

SingularityNet is a decentralized marketplace for AI (Artificial Intelligence). They are working on a system for seamless integration of various AI APIs for development and implementation. SingularityNet allows the developers to collaborate and allows the robot to use the API in a better manner.

Conclusion

These are just a few examples on top of my head, there are many projects which will make world better. Whether Bitcoin is a bubble or disruption is up to you to decide, but it has started the blockchain revolution which will create true democracy by giving power back to people.

@curie Do check out my latest post

@cryptoriddler do checkout my latest post

@OriginalWorks do check my original work :)

Congratulations @kbad10, you have decided to take the next big step with your first post! The Steem Network Team wishes you a great time among this awesome community.

The proven road to boost your personal success in this amazing Steem Network

Do you already know that awesome content will get great profits by following these simple steps, that have been worked out by experts?