Tl;dr: Bitcoin (and cryptocurrencies in general) will survive and thrive to be the default currency, within a decade.

The past few weeks have been a crazy ride, with Bitcoin and all other cryptocurrencies soaring as if there’s no tomorrow. But tomorrow did arrive, in the form of 24th of May, when the price per Bitcoin started falling from a peak of close to $2800 and touched $1900. It has gained value since then. So we know tht the market is volatile. But is it a market purely driven by the speculations of people, driven by hype and greed, trying to make a quick buck? Or is it more than all of that? Let’s find out.

Let’s take a step back and try looking at the bigger picture here. Actually, the picture to look at is too big and we might require a lot of step-backs. But let’s start with a few baby steps.

So, all that hype in the news, on the internet, who are all these people talking about it? Do you know someone personally? Is it just your thirteen year old geeky nephew, or your friend college? What do you call something that so many people around the globe are talking about and acting upon? Does it qualify to be called a global event?

Let’s consider those words separately.

Global

To qualify for the world Global this event must affect and be affected by a large number of people all across the globe. What tales do the numbers tell?

The live map for Global Bitcoin Nodes Distribution can be tracked at https://bitnodes.21.co

This picture only shows the number of nodes and not the actual number of people involved in bitcoin trading from those countries. Estimates put the total number of people currently trading Bitcoin between 5-10 million. What’s more interesting to see is the number of countries participating in this event. This map shows data from 91 countries. Does that make this event truly global? You do the maths.

Event

So events are nothing but occurrences, things that happen over a certain period of time. By that logic, almost anything happening over the passage of time can be classified as an event. The duration of time doesn’t matter, as long as it is not zero, i.e. time is stagnant. And if we know anything about time, we know that it’s always moving forward, or is at least perceived to do so. By this logic, the trading of Bitcoin does get to be called an event. In fact each transaction could be an individual event. And we have already established how these events are part of something truly global.

OK. It might be a global event, but how does it concern me?

When you ask how an event concerns you, you are assuming two key things:

- You have some ability to affect your immediate surrounding by your action.

- Your immediate surrounding has some ability to affect you.

If that’s not the case, then congratulations, you have just attained nirvana. Now’s the best time to claim your title for the next Dalai Lama.

For the rest of us who haven’t achieved nirvana yet, think how much you can insulate yourself from your surroundings. Think about how many people do you bump into every day, how many people do you hang out with every day, how many people have you spoken to today, even if it was nothing more than a mere “excuse me” to move ahead in a crowded street.

Each one of these points in time where two or more people have interacted can be categorised as an event. They might not be of any meaning to you. That guy you glanced at for a split-second while crossing the street; that doesn’t count, does it? Sure, there was no tangible outcome for either of you, but that thing did happen. And that, in itself makes it an event.

Now, imagine looking at two people meeting on the street. How would that event go? Those two people might talk, or they might just glance over each other and walk off. They might be friends, or may be strangers. They might share a joke or have an argument. There are infinite permutations to that scenario’s outcome. Happy, ugly, boring, eccentric; the prediction for the outcome to such an event would be impossible to deduce, especially for you, an unknown third party who’s just witnessing the event in real time. But there’s one thing that even you can be sure of. Because this is a civilized society and you live in this city, you know to a certain degree of accuracy that the event wouldn’t end in a bloodbath. You know that two perfect strangers walking down the street wouldn’t just stab each other the moment they some to face-to-face on a boring Wednesday afternoon. But how do you know that? Have you always known that? Have we, as a species always known to be this kind and benevolent?

The other tribe

It has been an inherent quest for humans, to find the optimum solution to any given problem. If the solution’s tough, try for an easier one, unless someone else intervenes and takes away all your “resources”. We tend do that as a species. It’s part of who we are. If you know of a better way to do something, you will do it. That’s the way you do it unless you have a different reason. You may call yourself an artist trying to make life deliberately harder and project it too. You could take the long way home to remember someone special. But that deviation has an alternate reason and you choose not do it the usual way, which also happens to be the easiest or most optimum way you know of. Or, you could just be suffering from dementia, not having a clue about what you are doing. Otherwise, it’s just what has been hardwired into you. To find the best approach to a task and then stick to it. You even make a routine out of it. That is something we have in common with all other species; tasks, routines and behaviours. Tasks, done routinely enough, become a part of our behaviour. In case of species like ants or bees, these behaviour patterns are so deeply ingrained that each member behaves as if it were programmed to do a job.

But we are humans. We are not programmed. We have free will and use our heads to react in complex ways. Right? One of the problems that mankind (or man-womankind? Is it time yet?) faced quite early on was how to react when you meet someone you don’t identify with, in any way. Is he from the other tribe? Who’s coming down that weird huge boat thing? Its skin is so pale. Is it the spirit? I must pray to calm ‘em spirits down.

For most mammals, there are two ways an interaction of two individuals from different packs (or groups) can have, fight or flight. What if its two different flocks of pigeons you ask? Those bastards will just sit on the powerlines, waiting to shit on you.

What would two insects of same species, but different colonies do? Kill or be killed. The flight mode is off for them. It’s all for the betterment of the colony.

But what would humans do. Imagine two humans from the stone-age people, but, from opposite tribes. What if they suddenly meet each other, on the banks of a river? Humans are mammals after all. Humans have the fight-flight response too. Right? Right! And boy do they fight! Do we fight! Right from pre-historic time to this day, we haven’t stopped fighting. But did also manage to find a way to bypass the flight-fight syndrome. Humans went a step ahead to save itself from fight-flight syndrome every time it discovers someone different. It found a symbiotic relationship where both the guys were happy. So were both the villages. So were the nations. Humans found a way around. Humans found the power of exchange. Humans found trade.

Trade

Trade started as barter. We have been at it for 150,000 years now, right from pre-historic times.

Once we discovered it, there was no turning back. Humans have travelled to every nook and corner of the world, trading obsidian, metal, spice, cloth and what not. Those places that became the centres of trade, those hubs, ports and harbours turned into places where people came to, from all directions. They came for prosperity. This pull of incentive gives people from far and wide the intention to migrate, concentrating humans at such places, giving rise to larger establishments. These places went on to become prosperous cities in the history of mankind. Guangzhou(China), Canopus (Egypt), Piraeus (Greece), Lothal (India) and Baghdad (Iraq) were some of these cities.

These are societies which could take care of the baser needs and flourished enough to stimulate their creativity, giving rise to art, artisans and artists. Science and literature too found their way in. That’s how it’s been happening repeatedly all over the world since centuries. But how can trade have such profound change to society as a whole?

Because trade is the amalgamation of intent and incentive.

Trade is the most benevolent way two people from opposite tribes can interact and get something of tangible value. On a larger scale it gives mankind an incentive to interact with each other, take to the high seas, and seek people to trade with, which eventually leads to further development of humanity as a whole. Every time two sides met to exchange goods, they ended up exchanging ideas too. This is the direction societies take when times are good. They come together for trade and not for war.

But as economies grew bigger, problems aroused; you can’t barter with everyone you meet. How do you know how much to give? How much wood does one barter for a goat? How does the king pay all his soldiers? Sacks of grains? Could there be something convenient with tangible value that everyone could relate to? Wait a minute what’s this shiny, malleable, and durable thing I have now? Metal! Make it flat and symmetrical, with enough space to have my face on it. No, wait! Have all my faces on it.

Currency

The creation of currency, pulled economies even further. Gold and silver became our go-to metals for currency. Kingdoms exchanged gold while trading. Everyone knew gold is precious and everyone trusted it. Humanity created a sort of de facto gold standard. Other metals came into the picture too. Coins of silver, copper and alloys like electrum were produced. But these were mostly used within state or kingdom. Gold was still the most preferred way of trade between two kingdoms, or states. Even when kingdoms and countries came up with banks and currency notes to replace coins, they could issue them to their citizens only. They couldn’t offer these currency notes to each other. Gold was still the de facto standard for all trades outside the state. This was because everyone trusted the gold standard.

But all this changed in 1971 when the US abandoned the gold exchange standard completely and moved to a fiat currency system. What this meant was that the Dollar was no longer backed by a stable precious commodity like gold anymore. There was no need to have a fixed amount of gold reserve to print money. It was completely upon the whims of the banks to print currency and put it into circulation. Many other countries followed suit and abandoned their gold standards. But how has it affected the American economy since then?

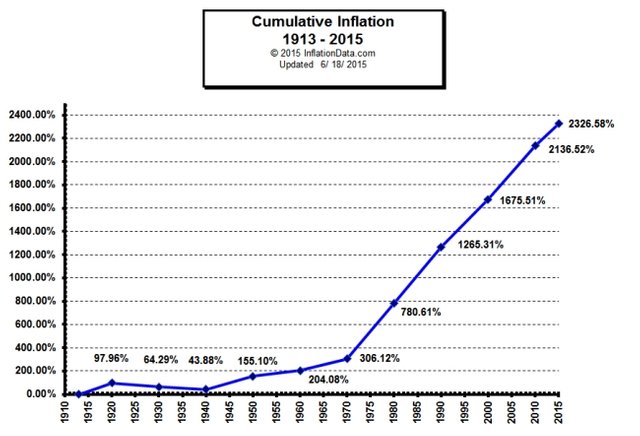

Like looking at charts? Here are a couple more for you

That doesn’t look very good, now does it?

When buying power of a currency reduces, it makes stuff costlier. It doesn’t matter how the economy is performing. This is the global age. If your country doesn’t produce a product you need, you can buy it from somewhere else. But how do you afford it, when your buying power keeps falling for decades? The gold standard doesn’t seem like a bad idea, now does it? What if we could have the gold standard back again? What if, somehow, we could all trade in gold, like in the old days? What if we could bypass the whole system of fiat currency, banks, artificially manufactured inflation and financial crisis? Could there be a way?

Gold in your pockets

Everything mentioned in this article till now has been in the public domain for a long time. People have known about the impending financial crisis for decades. That’s why as always, some people have been trying to create a solution to it.

In 1998, Wei Dai published a description of "b-money", an anonymous, distributed electronic cash system. Shortly thereafter, Nick Szabo created "Bit Gold". Like bitcoin and other cryptocurrencies that would follow it, Bit Gold was an electronic currency system which required users to complete a proof of work function with solutions being cryptographically put together and published. A currency system based on a reusable proof of work was later created by Hal Finney who followed the work of Dai and Szabo.

These are all precursors to Bitcoin. Bitcoin is an online currency that behaves exactly like gold and is hence, akin to the gold standard. How is that even possible?

It’s because new bitcoins are generated by a competitive and decentralized process called mining. This process involves that individuals are rewarded by the network for their services. Bitcoin miners are processing transactions and securing the network using specialized hardware and are collecting new bitcoins in exchange.

This means that in theory, Bitcoin is like any other precious metal (read: gold). You need to spend your resources to make it. Hence it comes at a cost. Also, the more bitcoins are mined, the harder it gets to mine them, very much like in real world mines. Add to that, the total number of Bitcoins that can be mined is a finite number, i.e. 21 million. It means there’s no arbitrary authority like a government or bank which can make endless Bitcoins, like they print money.

Speaking of government and banks, Bitcoin removes the requirement of both in an economy as it is completely decentralised.

It is possible due to the Blockchain technology. A blockchain is a public ledger of all Bitcoin transactions that have ever been executed. It is constantly growing as 'completed' blocks are added to it with a new set of recordings. The blocks are added to the blockchain in a linear, chronological order. Each Bitcoin knows its place in the system and also knows the place of all the connected Bitcoins. It’s simply not possible for anyone to destroy a Bitcoin in any way.

I won’t go into the maths behind the technology. That’s beyond the scope of this already-too-long article. But you are welcome research and refute it, if you are up for the task.

Alright! It’s gold. But so is my Candy Crush gold bar. They are all passing internet fads.

Umm. No.

The internet technology and the smartphone revolution are not passing fads. They have been pioneered by scientists, engineers and coders to solve real problems faced by real people. The problems of this century are global problems. These problems down affect a family, a village or a town, they affect billions of people worldwide and Bitcoin does exactly that.

According to the THE GLOBAL FINDEX DATABASE 2014, 38 percent of adults in the world don’t have any bank accounts. These are people with no access to financial services. They have a need for this online gold. And they are getting it too. With internet and mobile penetration skyrocketing in these places, online currency has come in like magic bullet to alleviate. Them from poverty. In fact Africa comes at the top in terms of Google searches on Bitcoin and in terms of adaptation too. The Africans seem to have understood the potential of cryptocurrency better than other parts of the developing world, while people in the developed parts are trying to determine how different a Bitcoin is from a Candy Crush gold bar and which one deserves more of their ever-depreciating currency.

The first wave has already hit

What we don’t seem to understand is that we are at a very unique time and space, as far as the journey of humanity is concerned. The past decade saw the tools of information and communication reaching billions of people around the globe in terms of internet and smartphone. What this has done is effectively decentralisation of information.

Think of the revolution after the invention of printing press. That was the first step towards decentralisation of information. Anyone could express an idea and it spread to hundreds of people. That very step seeded the ideas of equality, which in turn gave ideas of democracy and took the power away from central authorities of the day.

Internet and social media has done exactly the same in this age. They have spread information and ideas at an unmatched rate. Remember the recent US elections? Both the top parties had one candidate each who were being propelled by social media and being underplayed by the traditional mainstream media. One of them was successfully cut to size by the establishment while the other went on to become the President. We can chose to shut our eyes for as long as we want to but the truth is that social media has overtaken the mainstream media quite a while ago. If you don’t believe that, look from your mobile and look at other people around you. What are they looking at?

So, is the decentralisation of information a stand-alone phenomenon? Or is there more to it? We will have to wait and watch. But if the past events like the Arab spring and protests at the Wall Street are considered then we know how much they were fuelled by the decentralisation of information. And if that’s the case then who’s to stop future events that will be caused due to this free exchange of ideas?

My personal theory is that this was the first wave, in a series of many more, which would push towards more decentralisation, in all walks of life. Now that humanity has access to free flowing information, how long will it take to create free flowing value? If the last decade was all about decentralising information, which area will the next wave of decentralisation affect? What is it that will change the most in this decade? Take your guess (hint: it starts with “Eco” and ends with “nomy”). My money’s on Bitcoin. The market may dance like a devil. But it’s only trying to find stable ground, testing the new found currency (read: hope), trying to determine it’s real value, asking itself “have I really found gold?”

It is natural we need a global currency that is not centralized and from which all could benefit from. Blockchain is the ultimate solution. As soon as it gets stable we could expcect great things to happen.

Hopefully we should see that happening within 5-10 years.

maybe even sooner

totally agree with you and also we must remember that the cryptocurrency market is just in it's beginning..as you mentioned here above there are about 10 to 5 million people that own Bitcoins - in a market like so small it is very easy to generate panic and to drive prices up and down (it is also NOT illegal to do so , not as in other markets and much less expensive)

the falling of the prices yesterday gave (me at least) an awesome opportunity to buy some more coins at awesome prices

I am sure that if you will look at today's prices of various coins that everyone say that are bobbled - only in a couple of month time you will see that all is much more expensive