Current State of the Bitcoin ETF

Bitcoin ETF - Boom or Bust?

(Credit https://foto.wuestenigel.com/etf-and-silver-bitcoin/)

What is the Bitcoin ETF?

Anyone involved in cryptocurrencies for longer than a few months has heard to the upcoming Bitcoin ETF. Over ten different companies made multiple applications to comply with regulatory hurdles only to face denial each time. There is public demand though it may still be months away from becoming a reality. But what is an ETF, and why is it so difficult to create one for Bitcoin?

The Crypto 101 Podcast has covered the ETF topic in the past so we will recap in brief.

The first US Electronically Traded Fund (ETF) went on the market in 1993. An ETF consist of a collection of securities, or stocks, that trade as a single asset on an exchange. As Investopedia explains, "The best example is the S&P 500, which tracks the S&P 500 Index.” ETFs can hold stocks in a particular asset class, like oil, or specialize in a range of stocks and bonds designed to deliver growth over time. There are ETFs specific to telecoms, precious metals, and most recently, blockchain companies. Including many companies in a single ETF allows investors to gain exposure to an entire sector by buying a unique financial product. Previously, investors would have to buy each stock for their portfolio. ETF’s have been popular in the last 25 years. Unlike stocks, they can trade throughout the day, including after hours. This increased trading time results in ETFs trading at higher volumes than their stock counterparts. Of the 3,000 stocks listed on American stock exchanges, 10% are held in ETFs. This flexibility gives them tremendous influence over the economy as a whole.

How would the Bitcoin ETF Work?

There have been a variety of submitted applications for the Bitcoin ETF dating back to 2013, the details of which vary. The most recent and famous has been the VanEck SolidX ETF. VanEck’s Director of Digital Asset Strategy, Gabor Gurbacs, spoke to CNBC South Africa about the proposal in 2018.

"What sets it apart is it's physical, so it stays true to Bitcoin. You own the underlying (asset). It's fully insured, so if there is any theft, hacks, or losses, then the insurance covers it. The pricing that we use comes from our indexing subsidiary, which is a regulated entity and provided the first standard and regulated indices. The ETF is institutionally oriented, so 25 Bitcoins per basket, and we are just trying to do the right thing fitting into the US capital markets."

The SolidX ETF would allow shares to sell in "baskets," each basket backed by 25 Bitcoins. All Bitcoins would be held by VanEck, acting as the custodian of the funds. A single share would sell for $200,000, positioning it for the institutional market as opposed to retail investors. Because each share is backed by actual Bitcoin (physical Bitcoin), in this proposal, VanEck would need to buy the real cryptocurrency.

Many think that this will occur on the open market, but VanEcks submitted proposal states that they would use OTC (Over the Counter) exchanges. Using the OTC markets will allow VanEck to buy a large amount of Bitcoin without moving the price. A significant amount of coins would still be removed from the open market, reducing the circulating supply. Current estimates put the remaining circulating supply of Bitcoin from 5-10 million coins.

In a Twitter DM exchange, the question of initially available ETF shares was posed to Gabor. He was gracious in his response, noting that these kinds of details are challenging to finalize as they are still subject to legal review and approval. However, determining the number of available shares will be made after the ETFs approval by the SEC, but before the fund is available to purchase. Demand and available capital will ultimately justify the available shares. Bitcoin ETF shares will not be redeemable for actual Bitcoin. This does not rule out the possibility of a different, future ETF willing to make this accommodation.

The VanEck ETF will hold insurance for $125 million worth of Bitcoin. It has also secured additional insurance options should if necessary. The price of Bitcoin and the number of coins held will ultimately determine the size of that fund. In total, the amount is enough to cover over 14,000 Bitcoins.

Who will buy Bitcoin ETF?

A Bitcoin ETF would allow almost anyone in the world to invest in Bitcoin without going through the arduous task of buying Bitcoin direct. Acquiring Bitcoin is an intimidating multi-step process for the average consumer. Currently, customers sign up for an exchange, send personal identification, buy the Bitcoin, and then transfer them to a wallet they manage. This technology has been available for years, but the perceived hassle is overwhelming to the general public. The ETF would make purchasing Bitcoin as simple as buying Apple or, due to its high price, Berkshire Hathaway stock. Since ETFs make up a large portion of both retirement accounts and pensions, this allows Bitcoin investors to take advantage of the deferred tax benefits of a 401k. As money grows in a 401k, these gains are not taxed until the funds are removed. This low barrier to entry and long-term mentality has many crypto enthusiasts excited about the possibility of a Bitcoin ETF. It would allow traditional investors like grandmas and companies alike to invest in the speculative cryptocurrency. While Grandma may choose to invest only a few thousand dollars, large companies and institutions can afford to spend significantly more. The Vanguard Target Retirement fund for 2040 manages $27.9 billion in ETFs. If this single fund invested 0.1% of its value in Bitcoin ($27,900,000), it would create a sizeable upward buy pressure on Bitcoin and price spike. At the time of writing, this would be enough to push Bitcoin from $8,700 to $10,000, based on the Coinbase Pro order book. While financial markets are seldom this simple, and the Bitcoin would likely be bought on the OTC market, this example gives an idea to how much influence Institutional Investors like Vanguard hold. For comparison, the five largest financial advisory firms in the US handle, conservatively, $14.3 trillion as of 2018.

How will this affect the price of Bitcoin?

The media anticipates a mostly positive move for the price of Bitcoin following the ETF. Predictions range from $10k to $200k by the end of 2020. Since this is the first cryptocurrency ETF, it is impossible to draw from history for price comparisons. But it is possible to compare Bitcoin to its physical analog: Gold. Gold has been long compared to Bitcoin as the two are both viewed as a store of value and are in limited supply. Both appeal to the same mindset of low time preference, or delayed gratification. When SPDR issued its gold ETF (GLD) in November 2004, gold bullion was trading at roughly $440 per ounce. Like the Bitcoin ETF, GLD holds its value in the underlying asset, gold bars. Though SPDR holds the physical gold, GLD holders cannot redeem their shares for it. There are few gold ETFs that allow users to exchange their certificate for physical gold; one is VanEcks OUNZ ETF. In the years following the GLD market debut, the price of physical gold reached a peak price of $1,825, a 4.1X increase. The GLD ETF saw a similar increase from $42 up to $180, the same 4.1X increase over time.

(Credit https://www.macrotrends.net/1333/historical-gold-prices-100-year-chart)

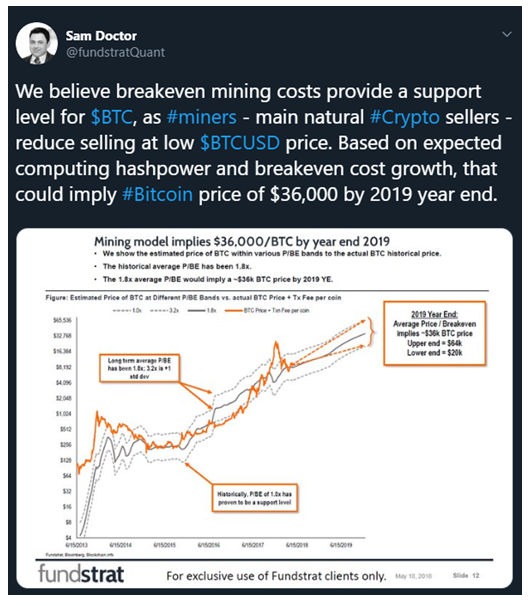

Following this example, it is possible to chart a Bitcoins price from $8700 today and apply the same 4.1X multiplier. This gives us a target of $35,670 sometime in 2020. As mentioned, this is an oversimplification of the financial market and should not be considered financial advice. But it does seem achievable when looking at Bitcoins previous price volatility; more significant swings have happened. This prediction seems to match up with Sam Doctor at the Market Strategy firm, Fundstrat. Sam uses Bitcoin mining costs to arrive at a similar conclusion.

(Credit https://twitter.com/fundstratQuant/status/994608007865565185?s=20)

“I do believe that America wants a Bitcoin ETF and at this point, the world wants an ETF… We have quite a job to do here” – Gabor Gurbacs

The SEC postponed their decision on the Bitcoin ETF in late May of 2019, setting a new deadline of August 19, 2019. This 90 day period is to give the SEC time to gather public opinion on the proposed ETF. The recorded public comments are found here along with instructions to submit additional views. As a regulatory body, the SEC's concern is on price manipulation and current custody solutions. The cryptocurrency industry has noted these concerns. Both Coinbase and Fidelity offer custodial solutions to large holders of cryptocurrency, like hedge funds and family offices.

While regulators are taking their time, the SEC Commissioner, Hester Peirce, thinks there is no need for further delay. From a recent Bloomberg article, she states, "If I had my way, we would have already had one, and maybe we would have had more." Hester's impatience is understandable. The US has an opportunity to establish a model for other countries in creating a favorable regulatory environment for Bitcoin and cryptocurrencies. While it may be months away from fruition, the VanEck Bitcoin ETF could be the catalyst needed for future growth.

-Kaltoro