Bitcoin’s Super BOOM Coming Soon

Bitcoin's price has fallen by 70% recently, and we are currently in an extended bear market, but the fundamentals are still very strong, and the adoption is growing gradually. We are very sure that Bitcoin will rise from the ashes and fly high. The next Bitcoin boom is most likely to happen due to the factors discussed in this article.

Bear Market

The overall marketcap of all the cryptocurrencies have fallen by 65% from approximately $800 billion in January to the current marketcap of $260 billion at the time of writing. Many media outlets claim that Bitcoin and other cryptocurrencies are dead, and the bubble has burst, but the truth is that it has only begun and the tech is still in infancy, and more exponential growth is expected in the coming years. Bear markets come and go in this space, and those who learn the fundamentals and stay in this game are rewarded. The people who lose are those who want to follow the FOMO to become rich quick.

Bitcoin will Rise Again

The current bear market is only temporary, and once it is over, we will see another All-Time High Bitcoin Price. The Boom trend will start once again, and next time the price rise would be exponential. Even though the price of Bitcoin has fallen by 70%, the fundamentals are still very strong and sound. One should only follow the fundamentals and not the price. Below are some of the reasons for the next Bitcoin Boom.

Hash-Rate at All-Time High

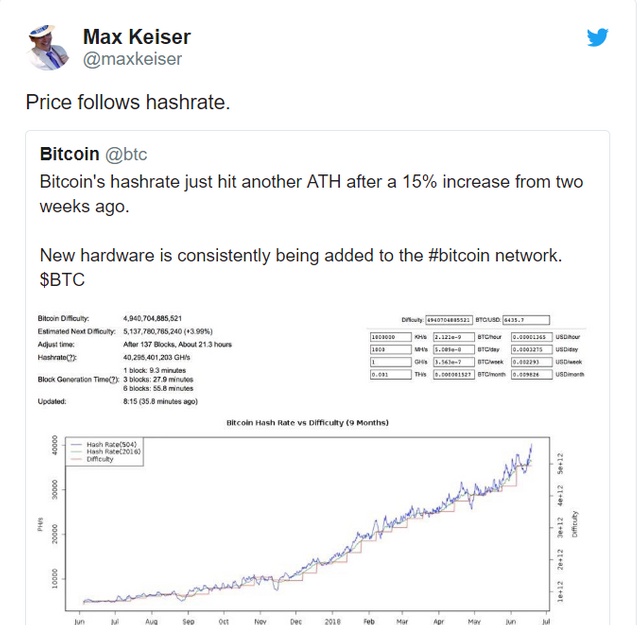

Bitcoin's Hash-Rate (amount of electricity spend to mine Bitcoin) is at an ATH. The Hash-Rate has risen by 50% in the last month alone. There is a belief that the "Price will follow Hash-Rate" (this has proved to be right in the past). The hash-rate is also exponential to the cost of hardware invested by the miners. So the investment is growing regarding mining for Bitcoin, which suggests the price will also follow soon.

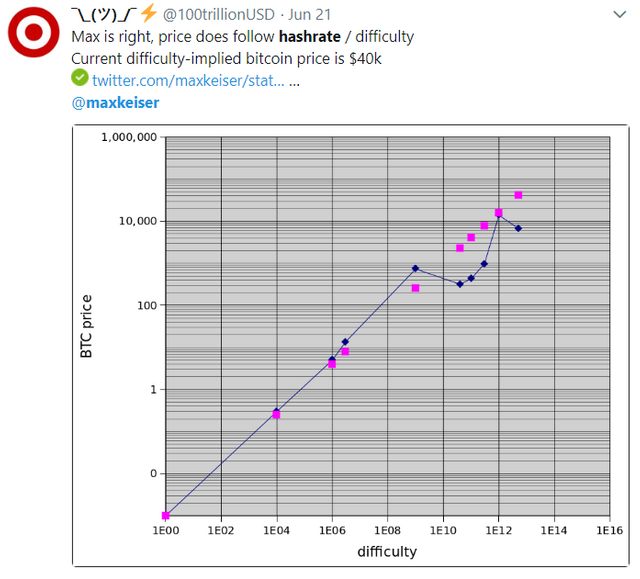

According to the current calculation on Hash-rate, the price will be around $40K. So we will soon see the price to grow to that level in the near future. The following tweet explains it clearly.

Below is the tweet from Max Keiser about the hashrate hitting its ATH with an increase of 15% in the last two weeks alone. New mining hardware is consistently being added to the Bitcoin network.

Below is the history of difficulty and hashrate changes in Bitcoin. You can see that the difficulty is currently at an all-time high with the hash-rate at 35,366,943,171 GH/s.

Supply vs. Demand

Bitcoin's total supply is only 21 million and of that 17 million is already mined. Only 4 million coins are yet to be mined, but the demand is growing exponentially. According to the Austrian School of Economics, the demand will overshoot the supply, and with more holders, we could see more uptrend in price action in the coming months.

Bitcoin Halving (an automated process in which the supply will be halved and rewards to the miners would be reduced) is only two years away and with the amount of adoption growing globally, we can see that the price will grow exponentially in the coming years. And with the supply reduced by half, we can say that the Bitcoin's price could go to the moon.

More Bullish Bitcoin Price Predictions - Here is Why

Exchanges and Point of Sale Increase

Last time, the bull market started only after extended three years of bear market. But this time the bear market would be short because the number of exchanges and Point of Sales for Bitcoin is more. Moreover, exchanges have started their operations in almost all the countries globally. Previously, we were short of exchanges, but now we have plenty of exchanges across the globe. The exchanges have grown big to compete with the banks, and they are expanding to many countries worldwide. There are also reports of exchange profits surpassing that of banks.

Exchanges were one point of failure in the past, but now they are more confident and bold. If they are not allowed in one country, they move their operations to another; for example, Binance was denied a license in Hong Kong, but they moved their operations to Malta (an island in European Union) which is more blockchain and crypto friendly. Moreover, we now have decentralized exchanges which are almost impossible to shut down.

Also, mobile payment apps like Robinhood, Abra, Square's Cash app and several others have started accepting cryptocurrencies, bringing in more retail investors. It is much easier to buy Bitcoin now than it was in previous years. Also, a large number of retails shops and vendors have started accepting Bitcoin and other cryptocurrencies worldwide, and they have this option in addition to credit cards and cash. We can see the "Bitcoin Accepted here" signboards in many shops worldwide now. The general public is coming to terms with the crypto boom, and the adoption is showing that the Bitcoin and crypto are here to stay and they will only become stronger day by day.

Institutional Investors Incoming

The institutional investors are yet to come, and they are waiting in the sideline for entering this new space to try their luck buying the new asset class. There are 15 million millionaires in the entire world, and the portfolio managers of each millionaire will advise their clients to have some exposure to the extent of 1-5% in crypto to hedge the global economic volatility. Cryptocurrencies are outside the global economy and is unaffected by the monetary policy of any country. So one can hedge the global economy by investing a small amount of their portfolio.

Last year, CBOE and CME introduced Bitcoin futures contracts. This year we may see the SEC clearing ETFs for Bitcoin and other cryptocurrencies like Ethereum. This is most likely to happen because recently the SEC has come out and said that Bitcoin and Ethereum are not securities. This was one of the main things stopping the SEC from granting a license to ETFs in the past. Also, since the SEC has clearly stated that Bitcoin and Ethereum are not securities, we might see more institutional investors pouring their money into cryptocurrencies. They were all waiting on the sidelines to get clearance from the SEC for them to be on the safer side.

Seven Network Effects of Bitcoin

For any technology to grow exponentially, it needs these seven network effects for wider adoption; and through this adoption, the price will grow exponentially. Below are the seven network effects of Bitcoin.

Speculation

Merchant Adoption

Consumer Adoption

Security

Active Development

Financialization

Status as "World Reserve Currency"

Lightening Network to come up

Last but not the least, the most bullish scenario for Bitcoin in the next few months would be because of Lightening Network. "Lightening Network" is the second layer solution for Bitcoin. Once this is ready, we will see "Near-Zero" transaction fees and it will help in major adoption worldwide. Lightening network will allow Internet ads to be replaced with Bitcoin payment using the Lightening wallet since you can make very minute transactions with negligible fees.

For example, a website can charge its customers for reading an article in micropayments using the Lightening Network rather than complex credit card or debit card payments, which require you to provide your card details that can be quite risky. By using the Lightening network, you remain anonymous, and also your funds are safe. And, you can instantly pay in small amounts with near-zero fees. There are many other use cases for Lightening network, and some are listed below

In App Stores

Payment for Content Seeding and Torrents

Online Advertising (Getting Paid for watching ads)

Micro-Payments for reading articles, watching videos and other digital content

Lightening network is in active development, and the nodes are growing exponentially with 2529 active nodes and 7819 channels at the time of writing. The nodes and channels are an integral part of the Lightening network through which people can transact using Bitcoin. If there is a channel created between two nodes than they both can transact with each other using Lightening Network and the final settlement can be done on the Bitcoin blockchain. This will also help in the faster transactions and will significantly reduce the network traffic on the main blockchain.

The full article is in the below link

https://cryptocoremedia.com/bitcoin-super-boom-coming-soon/

https://steemit.com/free/@bible.com/4qcr2i

Cool, thanks for sharing.